- +1-315-215-1633

- sales@thebrainyinsights.com

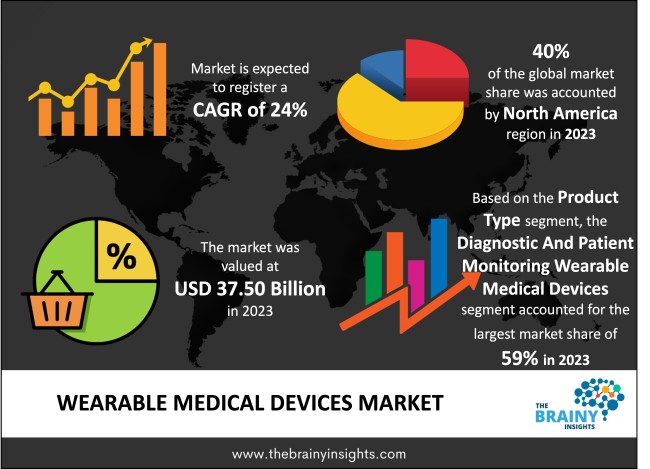

The global wearable medical devices market was valued at USD 37.50 billion in 2023 and grew at a CAGR of 24% from 2024 to 2033. The market is expected to reach USD 322.29 billion by 2033. The increasing incidence of chronic diseases globally will drive the growth of the global wearable medical devices market. Wearable Medical Devices allow remote monitoring, which is beneficial for both the doctor and the patient. Patients living in villages can get treatment from city doctors, and doctors can also study the functioning of the patient's body properly with the help of that device.

A medical device is an equipment, apparatus, machine or object used in healthcare or medicine. Medical devices are used for diagnosis or treatments. For instance, an ultrasound is used to examine internal body structures and identify if anything is amiss to make a diagnosis and prescribe treatment. Medical devices are also used for monitoring patients' vital signs, which helps in early diagnosis and prevention. Wearable medical devices are a niche category of devices the user can wear. It can be a wristwatch used by fitness enthusiasts to monitor their heart rate, oxygen saturation, steps taken and calories burned to monitor their health and overall progress. Smart jewellery, web-enabled eyewear, and Bluetooth headsets are other examples of modern wearable technology. Wearable medical devices are vital for patients suffering from chronic diseases as they enable real-time monitoring of their vitals and timely intervention in case of deviations. Real-time monitoring of patients enables physicians to remotely monitor their patients. This reduces unnecessary hospital trips, making them more efficient and productive towards delivering community healthcare. It reduces the cost of healthcare for the patients and encourages proactive health management. Wearable Medical Devices benefit the aged populations the most. They help doctors plan their future treatment. Also, with the help of Wearable Medical Devices, sports personalities and gym goers can enhance their performance, analyze their bodies' performance, and find areas and methods for improvement.

Get an overview of this study by requesting a free sample

The increasing incidence of chronic diseases – The sedentary lifestyle with poor and unhealthy eating habits has led to an increase in the incidence and prevalence of chronic diseases. Furthermore, the covid-19 pandemic has led many survivors with long covid, increasing the need for constant patient monitoring. For instance, there was an uptick in demand for pulse oximeters during the covid-19 pandemic for home healthcare purposes. The growing health-conscious has increased the population's adoption of an active lifestyle, driving the demand for smartwatches that track vital signs, which help monitor health and fitness progress. The growing emphasis on telehealth to improve the reach of medicine and healthcare services and the growing importance of mental wellness will also propel the growth of the global wearable medical devices market.

The high costs of wearable medical devices – Medical devices are sophisticated pieces of equipment and technology which cost significant capital to develop. Furthermore, it takes special manufacturing assembly and maintenance costs as well. These devices are patented, so retail prices are often high. The manufacturing and distribution are limited to certain geographical territories, which increases the costs in other areas, often the developing and under-developing regions, rendering the population helpless. Therefore, the high costs of wearable medical devices will limit the market's growth.

Product innovations – Technological advancements have improved novel innovations like artificial intelligence and IoT. Introducing and integrating these technologies in medical devices have improved their efficiency in identifying vitals and monitoring health. Such innovations show promising benefits in proactive health management, early diagnosis and prevention of diseases and deaths. Therefore, the growing product innovations will offer lucrative opportunities for the market players in the wearable medical devices market in the forecast period. Many hospitals are now choosing digital surgical instrument monitoring systems, like RFID-based ones, to enhance how surgical tools are controlled. By speeding up surgical procedures and ensuring the right equipment are accessible, these technologies can enhance patient safety and hospital efficiency.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most significant global wearable medical devices market, with a 40% market revenue share in 2023.

The increasing incidence of chronic diseases will increase the demand for wearable medical devices. Furthermore, significant regional manufacturers and distributors offer easy accessibility to these products for consumers. The increasing fiscal healthcare expenditure will also propel the market's growth. The well-established healthcare sector, extensive insurance coverage, and favourable healthcare initiatives will augment the market's growth. The increasing research and development expenditure has propelled product innovation, contributing to the regional market's growth.

North America Region Wearable Medical Devices Market Share in 2023 - 40%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The product type segment is divided into diagnostic and patient-monitoring wearable medical devices and therapeutic wearable medical devices. The diagnostic and patient monitoring wearable medical devices segment dominated the market, with a share of around 59% in 2023. Diagnostic and patient monitoring wearable devices allow real-time monitoring of patients' vitals like heart rate, oxygen saturation, sleep cycle, etc., which enables proactive health management. It leads to early diagnosis and timely intervention. Real-time and remote patient monitoring allows effective health management for hospitals as it reduces patient burden and overload on staff. It also reduces costs and saves time. Public healthcare systems increasingly use diagnostic and patient-monitoring wearable medical devices to further telemedicine and reach every corner of civilization. The use of smartwatches and pulse oximeters by the geriatric population and active individuals in fitness is driving the segment's growth.

The application segment is divided into sports and fitness, remote patient monitoring and home healthcare. The remote patient monitoring segment dominated the market, with a market share of around 43% in 2023. Using digital medical instruments like pulse oximeters, blood glucose metres, blood pressure monitors, and scales, healthcare providers can monitor patients remotely from hospitals or otherwise. Real-time monitoring enables physicians to prioritize cases and leads to effective health management. It also leads to early diagnosis and prevention. It minimizes hospital visits and hospitalization, reduces costs, saves time, and prevents patients from being exposed to germs. It leads to proactive healthcare management and overall improvement in community health indicators. Additionally, it is highly beneficial for patients suffering from chronic diseases, and the increasing incidence of chronic diseases will drive the segment's growth. The growing emphasis on telehealth will also contribute to the segment's growth.

The distribution channel segment is divided into online and offline. The online segment dominated the market, with a market share of around 53% in 2023. The trend of online shopping has gained traction over the years, given its convenience. A wide range of products from different brands within a range of prices, if offered online, gives consumers accessibility and affordability. The growth of the e-commerce industry has also augmented the online segment's growth.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2023 | USD 37.50 Billion |

| Market size value in 2033 | USD 322.29 Billion |

| CAGR (2024 to 2033) | 24% |

| Historical data | 2020-2022 |

| Base Year | 2023 |

| Forecast | 2024-2033 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East & Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Product Type, Application and Distribution Channel |

As per The Brainy Insights, the size of the global wearable medical devices market was valued at USD 37.50 billion in 2023 to USD 322.29 billion by 2033.

Global wearable medical devices market is growing at a CAGR of 24% during the forecast period 2024-2033.

The market's growth will be influenced by the increasing incidence of chronic diseases.

The high costs of wearable medical devices could hamper the market growth.

1. Introduction

1.1. Objectives of the Study

1.2. Market Definition

1.3. Research Scope

1.4. Currency

1.5. Key Target Audience

2. Research Methodology and Assumptions

3. Executive Summary

4. Premium Insights

4.1. Porter’s Five Forces Analysis

4.2. Value Chain Analysis

4.3. Top Investment Pockets

4.3.1. Market Attractiveness Analysis by Product Type

4.3.2. Market Attractiveness Analysis by Application

4.3.3. Market Attractiveness Analysis by Distribution Channel

4.3.4. Market Attractiveness Analysis by Region

4.4. Industry Trends

5. Market Dynamics

5.1. Market Evaluation

5.2. Drivers

5.2.1. The increasing incidence of chronic diseases

5.3. Restraints

5.3.1. The high costs of wearable medical devices

5.4. Opportunities

5.4.1. Product innovations

5.5. Challenges

5.5.1. The stringent government regulations

6. Global Wearable Medical Devices Market Analysis and Forecast, By Product Type

6.1. Segment Overview

6.2. Diagnostic and Patient Monitoring Wearable Medical Devices

6.3. Therapeutic Wearable Medical Devices

7. Global Wearable Medical Devices Market Analysis and Forecast, By Application

7.1. Segment Overview

7.2. Sports and Fitness

7.3. Remote Patient Monitoring

7.4. Home Healthcare

8. Global Wearable Medical Devices Market Analysis and Forecast, By Distribution Channel

8.1. Segment Overview

8.2. Online

8.3. Offline

9. Global Wearable Medical Devices Market Analysis and Forecast, By Regional Analysis

9.1. Segment Overview

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.2.3. Mexico

9.3. Europe

9.3.1. Germany

9.3.2. France

9.3.3. U.K.

9.3.4. Italy

9.3.5. Spain

9.4. Asia-Pacific

9.4.1. Japan

9.4.2. China

9.4.3. India

9.5. South America

9.5.1. Brazil

9.6. Middle East and Africa

9.6.1. UAE

9.6.2. South Africa

10. Global Wearable Medical Devices Market-Competitive Landscape

10.1. Overview

10.2. Market Share of Key Players in the Wearable Medical Devices Market

10.2.1. Global Company Market Share

10.2.2. North America Company Market Share

10.2.3. Europe Company Market Share

10.2.4. APAC Company Market Share

10.3. Competitive Situations and Trends

10.3.1. Product Launches and Developments

10.3.2. Partnerships, Collaborations, and Agreements

10.3.3. Mergers & Acquisitions

10.3.4. Expansions

11. Company Profiles

11.1. Apple Inc.

11.1.1. Business Overview

11.1.2. Company Snapshot

11.1.3. Company Market Share Analysis

11.1.4. Company Product Portfolio

11.1.5. Recent Developments

11.1.6. SWOT Analysis

11.2. Basis Science Inc.

11.2.1. Business Overview

11.2.2. Company Snapshot

11.2.3. Company Market Share Analysis

11.2.4. Company Product Portfolio

11.2.5. Recent Developments

11.2.6. SWOT Analysis

11.3. Fitbit

11.3.1. Business Overview

11.3.2. Company Snapshot

11.3.3. Company Market Share Analysis

11.3.4. Company Product Portfolio

11.3.5. Recent Developments

11.3.6. SWOT Analysis

11.4. Medtronic Plc

11.4.1. Business Overview

11.4.2. Company Snapshot

11.4.3. Company Market Share Analysis

11.4.4. Company Product Portfolio

11.4.5. Recent Developments

11.4.6. SWOT Analysis

11.5. Omron Corp.

11.5.1. Business Overview

11.5.2. Company Snapshot

11.5.3. Company Market Share Analysis

11.5.4. Company Product Portfolio

11.5.5. Recent Developments

11.5.6. SWOT Analysis

11.6. Philips Electronics

11.6.1. Business Overview

11.6.2. Company Snapshot

11.6.3. Company Market Share Analysis

11.6.4. Company Product Portfolio

11.6.5. Recent Developments

11.6.6. SWOT Analysis

11.7. Polar Electro

11.7.1. Business Overview

11.7.2. Company Snapshot

11.7.3. Company Market Share Analysis

11.7.4. Company Product Portfolio

11.7.5. Recent Developments

11.7.6. SWOT Analysis

11.8. Sotera Wireless

11.8.1. Business Overview

11.8.2. Company Snapshot

11.8.3. Company Market Share Analysis

11.8.4. Company Product Portfolio

11.8.5. Recent Developments

11.8.6. SWOT Analysis

11.9. Vital Connect

11.9.1. Business Overview

11.9.2. Company Snapshot

11.9.3. Company Market Share Analysis

11.9.4. Company Product Portfolio

11.9.5. Recent Developments

11.9.6. SWOT Analysis

11.10. Withings

11.10.1. Business Overview

11.10.2. Company Snapshot

11.10.3. Company Market Share Analysis

11.10.4. Company Product Portfolio

11.10.5. Recent Developments

11.10.6. SWOT Analysis

List of Table

1. Global Wearable Medical Devices Market, By Product Type, 2020-2033 (USD Billion)

2. Global Diagnostic and Patient Monitoring Wearable Medical Devices Wearable Medical Devices Wearable Medical Devices Market, By Region, 2020-2033 (USD Billion)

3. Global Therapeutic Wearable Medical Devices Wearable Medical Devices Wearable Medical Devices Market, By Region, 2020-2033 (USD Billion)

4. Global Wearable Medical Devices Market, By Application, 2020-2033 (USD Billion)

5. Global Sports and Fitness Wearable Medical Devices Wearable Medical Devices Market, By Region, 2020-2033 (USD Billion)

6. Global Remote Patient Monitoring Wearable Medical Devices Wearable Medical Devices Market, By Region, 2020-2033 (USD Billion)

7. Global Home Healthcare Wearable Medical Devices Wearable Medical Devices Market, By Region, 2020-2033 (USD Billion)

8. Global Wearable Medical Devices Market, By Distribution Channel, 2020-2033 (USD Billion)

9. Global Online Wearable Medical Devices Wearable Medical Devices Market, By Region, 2020-2033 (USD Billion)

10. Global Offline Wearable Medical Devices Wearable Medical Devices Market, By Region, 2020-2033 (USD Billion)

11. Global Wearable Medical Devices Market, By Region, 2020-2033 (USD Billion)

12. North America Wearable Medical Devices Market, By Product Type, 2020-2033 (USD Billion)

13. North America Wearable Medical Devices Market, By Application, 2020-2033 (USD Billion)

14. North America Wearable Medical Devices Market, By Distribution Channel, 2020-2033 (USD Billion)

15. U.S. Wearable Medical Devices Market, By Product Type, 2020-2033 (USD Billion)

16. U.S. Wearable Medical Devices Market, By Application, 2020-2033 (USD Billion)

17. U.S. Wearable Medical Devices Market, By Distribution Channel, 2020-2033 (USD Billion)

18. Canada Wearable Medical Devices Market, By Product Type, 2020-2033 (USD Billion)

19. Canada Wearable Medical Devices Market, By Application, 2020-2033 (USD Billion)

20. Canada Wearable Medical Devices Market, By Distribution Channel, 2020-2033 (USD Billion)

21. Mexico Wearable Medical Devices Market, By Product Type, 2020-2033 (USD Billion)

22. Mexico Wearable Medical Devices Market, By Application, 2020-2033 (USD Billion)

23. Mexico Wearable Medical Devices Market, By Distribution Channel, 2020-2033 (USD Billion)

24. Europe Wearable Medical Devices Market, By Product Type, 2020-2033 (USD Billion)

25. Europe Wearable Medical Devices Market, By Application, 2020-2033 (USD Billion)

26. Europe Wearable Medical Devices Market, By Distribution Channel, 2020-2033 (USD Billion)

27. Germany Wearable Medical Devices Market, By Product Type, 2020-2033 (USD Billion)

28. Germany Wearable Medical Devices Market, By Application, 2020-2033 (USD Billion)

29. Germany Wearable Medical Devices Market, By Distribution Channel, 2020-2033 (USD Billion)

30. France Wearable Medical Devices Market, By Product Type, 2020-2033 (USD Billion)

31. France Wearable Medical Devices Market, By Application, 2020-2033 (USD Billion)

32. France Wearable Medical Devices Market, By Distribution Channel, 2020-2033 (USD Billion)

33. U.K. Wearable Medical Devices Market, By Product Type, 2020-2033 (USD Billion)

34. U.K. Wearable Medical Devices Market, By Application, 2020-2033 (USD Billion)

35. U.K. Wearable Medical Devices Market, By Distribution Channel, 2020-2033 (USD Billion)

36. Italy Wearable Medical Devices Market, By Product Type, 2020-2033 (USD Billion)

37. Italy Wearable Medical Devices Market, By Application, 2020-2033 (USD Billion)

38. Italy Wearable Medical Devices Market, By Distribution Channel, 2020-2033 (USD Billion)

39. Spain Wearable Medical Devices Market, By Product Type, 2020-2033 (USD Billion)

40. Spain Wearable Medical Devices Market, By Application, 2020-2033 (USD Billion)

41. Spain Wearable Medical Devices Market, By Distribution Channel, 2020-2033 (USD Billion)

42. Asia Pacific Wearable Medical Devices Market, By Product Type, 2020-2033 (USD Billion)

43. Asia Pacific Wearable Medical Devices Market, By Application, 2020-2033 (USD Billion)

44. Asia Pacific Wearable Medical Devices Market, By Distribution Channel, 2020-2033 (USD Billion)

45. Japan Wearable Medical Devices Market, By Product Type, 2020-2033 (USD Billion)

46. Japan Wearable Medical Devices Market, By Application, 2020-2033 (USD Billion)

47. Japan Wearable Medical Devices Market, By Distribution Channel, 2020-2033 (USD Billion)

48. China Wearable Medical Devices Market, By Product Type, 2020-2033 (USD Billion)

49. China Wearable Medical Devices Market, By Application, 2020-2033 (USD Billion)

50. China Wearable Medical Devices Market, By Distribution Channel, 2020-2033 (USD Billion)

51. India Wearable Medical Devices Market, By Product Type, 2020-2033 (USD Billion)

52. India Wearable Medical Devices Market, By Application, 2020-2033 (USD Billion)

53. India Wearable Medical Devices Market, By Distribution Channel, 2020-2033 (USD Billion)

54. South America Wearable Medical Devices Market, By Product Type, 2020-2033 (USD Billion)

55. South America Wearable Medical Devices Market, By Application, 2020-2033 (USD Billion)

56. South America Wearable Medical Devices Market, By Distribution Channel, 2020-2033 (USD Billion)

57. Brazil Wearable Medical Devices Market, By Product Type, 2020-2033 (USD Billion)

58. Brazil Wearable Medical Devices Market, By Application, 2020-2033 (USD Billion)

59. Brazil Wearable Medical Devices Market, By Distribution Channel, 2020-2033 (USD Billion)

60. Middle East and Africa Wearable Medical Devices Market, By Product Type, 2020-2033 (USD Billion)

61. Middle East and Africa Wearable Medical Devices Market, By Application, 2020-2033 (USD Billion)

62. Middle East and Africa Wearable Medical Devices Market, By Distribution Channel, 2020-2033 (USD Billion)

63. UAE Wearable Medical Devices Market, By Product Type, 2020-2033 (USD Billion)

64. UAE Wearable Medical Devices Market, By Application, 2020-2033 (USD Billion)

65. UAE Wearable Medical Devices Market, By Distribution Channel, 2020-2033 (USD Billion)

66. South Africa Wearable Medical Devices Market, By Product Type, 2020-2033 (USD Billion)

67. South Africa Wearable Medical Devices Market, By Application, 2020-2033 (USD Billion)

68. South Africa Wearable Medical Devices Market, By Distribution Channel, 2020-2033 (USD Billion)

List of Figures

1. Global Wearable Medical Devices Market Segmentation

2. Wearable Medical Devices Market: Research Methodology

3. Market Size Estimation Methodology: Bottom-Up Approach

4. Market Size Estimation Methodology: Top-Down Approach

5. Data Triangulation

6. Porter’s Five Forces Analysis

7. Value Chain Analysis

8. Global Wearable Medical Devices Market Attractiveness Analysis by Product Type

9. Global Wearable Medical Devices Market Attractiveness Analysis by Application

10. Global Wearable Medical Devices Market Attractiveness Analysis by Distribution Channel

11. Global Wearable Medical Devices Market Attractiveness Analysis by Region

12. Global Wearable Medical Devices Market: Dynamics

13. Global Wearable Medical Devices Market Share by Product Type (2023 & 2033)

14. Global Wearable Medical Devices Market Share by Application (2023 & 2033)

15. Global Wearable Medical Devices Market Share by Distribution Channel (2023 & 2033)

16. Global Wearable Medical Devices Market Share by Regions (2023 & 2033)

17. Global Wearable Medical Devices Market Share by Company (2023)

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. The Brainy Insights has segmented the global wearable medical devices market based on below mentioned segments:

Global Wearable Medical Devices Market by Product Type:

Global Wearable Medical Devices Market by Application:

Global Wearable Medical Devices Market by Distribution Channel:

Global Wearable Medical Devices Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date