- +1-315-215-1633

- sales@thebrainyinsights.com

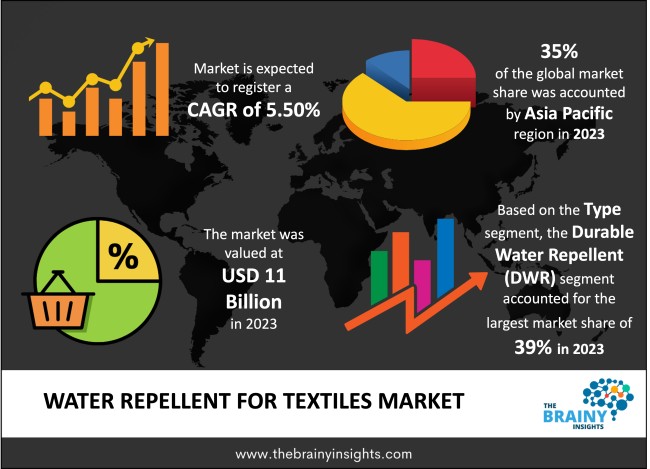

The global water repellent for textiles market was valued at USD 11 billion in 2023 and grew at a CAGR of 5.50% from 2024 to 2033. The market is expected to reach USD 18.78 billion by 2033. The increasing demand for sustainability will drive the growth of the global water repellent for textiles market.

Water repellent for textiles means processes that are used to coat or treat fabrics such that water cannot pass through while still allowing the fabrics to ‘breathe’. Whereas, waterproof textiles are completely impervious to water, water repellent fabrics only prevent the surface of the fabric from getting wet but allows the water drop to pass through it. These are commonly used in garments, apparel, furnishing, outdoor products and equipment, footwear and accessories where the material does not completely need to be waterproof as it affects breathability. The hydrophobicity is created by using the fluids which are characterized by low surface energy such as fluoropolymers, silicones or waxes. The most frequently used water repellent is Durable Water Repellent. There are also nanotechnology-based repellents. Automotive and aerospace industries apply water repellent fabrics in seating and other interior parts owing to durability and comfort in different climate conditions.

Get an overview of this study by requesting a free sample

The increasing demand for sports apparel – The use of water repellent fabrications in apparel meant for the outdoors or sports is seeing increased use not only due to higher participation in sports and other outdoor activities such as hiking, camping, etc, but primarily because these textiles provide protection against moisture while at the same time being very breathable fabrics. Consumers want to use clothes and other equipment that are both long-lasting and offer high performance. Thus jackets, shoes, and other equipment are designed to have water-repellent coating. Modern science has however progressed through discoveries in the likes of nanotechnology-based repellents making these treatments long lasting and effective. Furthermore, with increasing integration of sportswear into formal wear through the athleisure trend, there is an increasing need for multi-utility, water-resistant clothing. This is because, increasingly, customers are inclining more towards products which serve more than one use in their lives. Today’s consumers are searching for textiles that can both give style and utility; they look for garments and home textiles that are water repellent but offer fashion, style and comfort. all of these combined together will drive the demand for water repellent for textiles and contribute to the market’s growth.

High production costs and certain performance challenges – the high costs of production of advanced water-repellents, including nanotechnology or biodegradable applications, result in more expensive textiles. There is also the problem of degradation over time, meaning that the performance of these products is optimum at the start but degrades after several washings and uses. This decrease in long term performance lowers the demand for water repellent fabrics especially for individuals who want functional, little or no maintenance textiles with a longer life. The complicated treatments that have to be put on in order to waterproof fabrics make complex manufacturing processes and therefore add up to the costs of manufacturing. Therefore, high production costs, complex manufacturing processes and performance degradation over time will hamper the market’s growth.

The growing demand for sustainability across sectors – Growing concern over sustainable and environment friendly products has played a great role in the shift of consumers’ demand for water repellent fabrics. Customers are particularly aware of eco-toxins of traditional water-resistant treatments. As a result, there is a steady increase in the need for substitutes that are eco-friendly and sustainable. Furthermore, technological advancement in nanotechnology has seen an improvement in the quality of coatings for water repellents. For example, nanoparticles can be incorporated within fabric materials. This not only increases their utility but also their lifespan. Moreover, new technologies in manufacturing processes have lowered the amount of chemical and energy needed in the production process contributing towards reducing their carbon footprints. These advances are revolutionizing the market and driving its growth during the forecast period.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. Asia Pacific emerged as the most significant global water repellent for textiles market, with a 35% market revenue share in 2023.

Asia Pacific covers some of the biggest textile production centres, including China, India, and Bangladesh. With increasing global consumption of performance fabrics and water repellent fabrics, Asia-Pacific is uniquely positioned to cater to this increasing demand with its extensive and well-established manufacturing capabilities in these countries. Furthermore, as sustainability aspects are being embraced, the majority of Asian-Pacific manufacturers are incorporating environmentally sensitive water repellent technologies that are currently popular in this century. Moreover, the region’s cost advantage, flexibility, and option to work with leading innovative technologies guarantee its future dominance.

Asia Pacific Region Water Repellent for Textiles Market Share in 2023 - 35%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The type segment is divided into durable water repellent (DWR), fluorine-free repellents, silicone-based repellents, wax-based repellents, and nanotechnology-based repellent. The durable water repellent (DWR) segment dominated the market, with a market share of around 39% in 2023. Water repellent coatings referred to as Durable Water Repellent (DWR) finishes enjoy wide use in the water-repellent textiles due to their efficiency and applicability in multiple uses. DWR treatments offer a durable water resistance shield and simultaneously enable breathability. DWR coatings can be pre-applied to almost any sort of synthetic material like polyester or nylon used in jackets, tents, and even footwear. This compatibility with the widely used fabric forms increases the demand of DWR treatments since they can be incorporated easily into products in the market. The continuous evolution of athleisure meaning the use of functional outdoor wear in regular life has also contribute to the demand for DWR treated apparel. Additionally, new generations of DWR and the appearance of environmentally friendly products that conform to environmental standards have supported the prolongation of DWR’s market leadership.

The fabric type segment is divided into synthetic textiles, natural fibres and blended fabrics. The synthetic textiles segment dominated the market, with a market share of around 42% in 2023. Synthetic textiles have captured the largest share in the water-repellent textiles mainly because of their performance characteristics, versatility, and affordable price standards. Polyester, nylon and polypropylene are mostly used for water repellent application due to their low moisture uptake characteristic specific to their inherent nature which can be further improved with the application of water repellent treatments. These synthetic fibres can be tailored to exhibit specific performance characteristics necessary for manufacturing high quality, light weight, durable, and ventilative fabrics as used in apparels well suited for outdoor activities and sports. This is supplemented by the fact that synthetic textiles are used in different end use segments such as apparel, outdoor products, sportswear and industrial uses. Additionally, owing to low cost of manufacturing, synthetic textiles are preferable than natural fibres in the global market.

The end use industry segment is divided into outdoor and sports apparel, home textiles, automotive and transportation, industrial textiles, fashion and casual wear, and others. The outdoor and sports apparel segment dominated the market, with a market share of around 36% in 2023. The largest application area of water-repellent textiles is outdoor and sports apparel as the consumer shifts more towards outdoor activities and an active lifestyle. Such activities include hiking, camping, skiing, cycling, etc., which means that there is a need to develop and wear apparels that are suitably designed to wear outside during different kinds of weathers. This segment requires the use of coatings that will offer protection from water in form of rain or snow and also allow sweat to evaporate during warm weather. Consumers who participate in outdoor sports have different requirements from their clothing and their paramount concerns are functionality and resilience, which means that water resistance is an important criterion for consumers. Hiking jackets, pants or appropriate footwear with fabrics that does not soak up water aids the users in keeping dry and comfortable throughout. Also, the shift towards more widespread wear of something between sportswear and leisure clothing has fuelled the desire for fashionably effective outdoor wear. Due to growing consumer preferences aiming at stylish products that could be used in active outdoor activities in combination with daily wear, brands include water-proof elements to their products. Thus, the intersection of functionality, aesthetics, and performance guarantees that outdoor and sportswear retains the largest market share in the market.

The technology segment is divided into coating-based repellents, finish-based repellents and lamination. The coating-based repellents segment dominated the market, with a market share of around 45% in 2023. These coatings are applied in the outer layers of fabrics so as to produce an anti-moisture surface which does not interfere with the inherent properties of the material used. This method is used in many areas of applications such as outdoor wear, footwear and home textiles. Coating-based repellents are highly suitable since they produce a very long-lasting waterproofing layer that does not encroach on the fabric’s ability to allow air to pass through. These remarks are especially significant for creating outerwear and athletic wear since moisture management plays a primary role in wear comfort. Coatings-based repellents can be developed according to the kind of fabric it will be applied on, as well as the intended use of that fabric making the repellents versatile. The process of applying is also simple.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2023 | USD 11 Billion |

| Market size value in 2033 | USD 18.78 Billion |

| CAGR (2024 to 2033) | 5.50% |

| Historical data | 2020-2022 |

| Base Year | 2023 |

| Forecast | 2024-2033 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Type, Fabric Type, End Use Industry and Technology |

As per The Brainy Insights, the size of the global water repellent for textiles market was valued at USD 11 billion in 2023 to USD 18.78 billion by 2033.

Global water repellent for textiles market is growing at a CAGR of 5.50% during the forecast period 2024-2033.

The market's growth will be influenced by the increasing demand for sports apparel.

High production costs and certain performance challenges could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. The Brainy Insights has segmented the global water repellent for textiles market based on below mentioned segments:

Global Water Repellent for Textiles Market by Type:

Global Water Repellent for Textiles Market by Fabric Type:

Global Water Repellent for Textiles Market by End Use Industry:

Global Water Repellent for Textiles Market by Technology:

Global Water Repellent for Textiles Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date