- +1-315-215-1633

- sales@thebrainyinsights.com

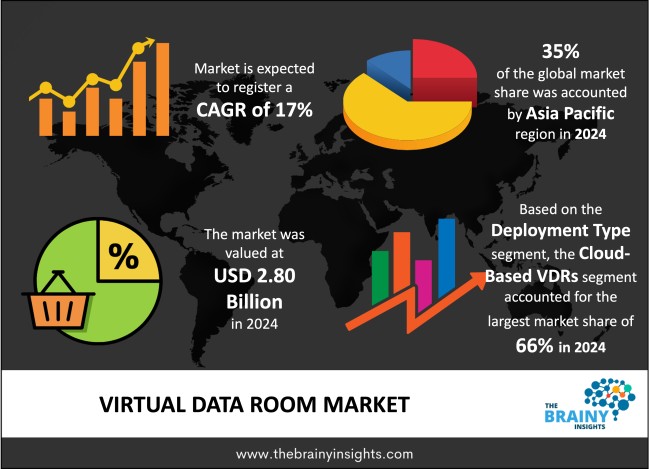

The global virtual data room market was valued at USD 2.80 billion in 2024 and grew at a CAGR of 17% from 2025 to 2034. The market is expected to reach USD 13.45 billion by 2034. The increasing prevalence of remote work culture will drive the growth of the global virtual data room market.

A Virtual Data Room (VDR) provides secure online access to sensitive documents as a central repository that mainly serves organizations in their business transactions, legal engagements and due diligence needs. Users who receive authorization are able to access sensitive or confidential documents. Mergers and acquisitions (M&A), financial transactions, fundraising and legal compliance activities depend on VDRs due to their essential need for confidentiality and speed of sharing information. A VDR system provides elevated security features to its users as its primary benefit. An important feature of VDRs is their implementation of encryption technology and multi-factor authentication systems. The combination of encryption protocols and authentication measures protects corporate-sensitive information including intellectual properties and financial documents and proprietary materials from unauthorized access and data leakages and breaches. The auditing system of VDRs generates logs which show who accessed documents together with their dates of access activities and document-related actions such as downloading, printing and forwarding. Advanced VDR systems provide two main supplementary features including watermark protection that stops document unauthorized distribution and team coordination tools for real-time work on shared docs. Organizations can tailor their VDR systems according to their exclusive requirements. Virtual data rooms find widespread adoption in finance, healthcare, legal and real estate sectors.

Get an overview of this study by requesting a free sample

The increasing demand for secure data management – Organizations experience high levels of concern regarding data breaches and intellectual property theft and cyber threats thereby leading to explosive market growth for secure data sharing platforms. The encryption methods coupled with multi-factor authentication and detailed access control systems of VDRs enables authorized users to access and modify documents. The security features especially benefits finance, healthcare, and legal businesses which require absolute data confidentiality. The rising merger and acquisition transactions drive the expansion of virtual data room solutions. As M&A transactions progress it becomes essential for multiple parties to exchange substantial amounts of confidential documents for their due diligence assessment. VDRs support safe document-sharing procedures while delivering efficient organization in addition to reducing dangers related to traditional approaches like physical data rooms. The growing M&A market worldwide creates rising demand for VDR solutions in the industry. The adoption of virtual data rooms receives increased momentum from escalating adoption of cloud-based solutions. The move towards cloud-based platforms increases because these solutions provide businesses with flexibility, remote data access alongside scalability advantages. The ability of cloud-based VDR to let businesses securely manage and share documents through remote servers without needing extensive on-site hardware infrastructure makes them valuable to companies operating abroad and having distributed workforces. Remote work requirements have increased the absolute necessity for effective teamwork platforms across businesses. Through VDRs companies gain secure remote collaboration tools which let their teams view and modify documents together while monitoring version changes simultaneously. Modern distributed work environments rely heavily on VDRs because these systems have become essential resources.

The high costs associated with virtual data room – Advanced security features of VDRs drives up their costs. Very few businesses can afford the pricing structure of VDRs because subscription fees and storage-based pricing escalations as well as customized solution premiums drive up expenses. VDR costs significantly outnumber what small and medium-sized enterprises can afford and these limitations make basic cloud storage alternatives much more cost-effective. The adoption of VDRs faces additional barriers because many organizations need to deal with difficulties when integrating their systems with these platforms. Organizations maintain old-fashioned IT infrastructure which does not integrate with current VDR technology standards. Competent workflow integration demands crucial IT support through specialized development or third-party interfaces that results in significant capital outlay and technological difficulty. Businesses avoid the transition to VDR platforms because legacy systems have poor compatibility with VDR products that results in operational inefficiencies. Implementation of VDRs requires advanced technological expertise together with dedicated training along with lengthy timeframes that creates adoption challenges for entities who lack experience working with these technologies.

Technological advancements – Businesses face significant pressure to protect sensitive data because GDPR and HIPAA along with multiple industry-specific regulations have become more stringent in the recent times. Organizations use VDRs to effectively fulfil regulatory needs through their secure data storage capabilities and detailed access management features and comprehensive tracking capabilities. Through these security features organizations can avoid legal punishments while significantly improving their capacity to show compliance when auditors inspect them. The rise in non-compliance penalties forces organizations to use VDRs. The advancement of technology has strongly contributed to VDR market expansion. The document storage platform evolved into advanced VDR solutions by adopting contemporary technologies which include artificial intelligence (AI) machine learning (ML) and blockchain. The incorporation of artificial intelligence search capabilities enables users to find appropriate documents in extensive repositories thus enhancing the operational speed. Machine learning algorithms enable security improvement through their ability to analyses user behaviours while monitoring both normal and abnormal activities. Collaboration with Customer Relationship Management and Enterprise Resource Planning software systems allows businesses to exchange data in real-time while maximizing contact between different divisions.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. Asia Pacific emerged as the most significant global virtual data room market, with a 35% market revenue share in 2024.

The Asia Pacific region has become the leading market player for global Virtual Data Room (VDR) services because of its fast economic expansion combined with digital transformation initiatives and heightened requirements for protected data storage solutions. The growth of digital economies in China and other Asian countries including India and Japan along with Southeast Asia has led to this regional dominance. Cloud-based solutions alongside digital technology adoption by businesses in these countries have caused the demand for VDRs to securely handle and distribute sensitive information to surge significantly. The fast-growing economic sectors in the region depend on VDRs for secure M&A activities and to maintain compliance and establish safe collaborative environments in their finance, real estate, healthcare and manufacturing markets. Organizations throughout Asia Pacific face developing regulatory requirements which push them toward secure solutions to fulfil strict data protection and privacy regulations. Governments of China and India have recently introduced data security and privacy laws similar to the GDPR in Europe thus elevating VDR market demand. Remote work adoption and cloud-based platforms rise continue driving the Asian-Pacific region to lead the Virtual Data Room market.

Asia Pacific Region Virtual Data Room Market Share in 2024 - 35%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The deployment type segment is divided into cloud-based VDRs and on-premise VDRs. The cloud-based VDRs segment dominated the market, with a market share of around 66% in 2024. Their dominance in the market is primarily attributed to scalability factors. The ability to adjust document hosting capacity automatically based on business requirements defines why cloud-based VDRs dominate traditional data management solutions because they eliminate the need for expensive physical infrastructure. Their dominance stems from their capability to remain accessible from anywhere. Modern business operations spanning global distances require remote document access since teams now work across time zones and different geographic areas. The cost-efficiency of cloud-based VDRs also contribute to its continued dominance in the market. Cloud-based VDR platforms allow businesses to evade costly expenses which come from running infrastructure hardware in house. They choose subscription payments that produce predictable expenses that are easy to handle. Cloud-based VDRs maintain data protection through their advanced security capabilities.

The end user industry segment is divided into finance and mergers & acquisitions (M&A), legal, real estate, healthcare, energy & utilities and others. The finance and mergers & acquisitions (M&A) segment dominated the market, with a market share of around 35% in 2024. M&A transactions specifically necessitate secure transfers of substantial amounts of sensitive financial and operational and legal documents between parties who work in multiple geographic regions. The secure sharing environment of VDRs protects data confidentiality by issuing access rights to authorized users and comes equipped with document protection features that enable watermarking and expiration dates with detailed tracking systems to prevent unapproved distribution. Structures of M&A deals require an efficient document management system that centralized the due diligence processes during their complex stages. VDRs make document sharing easy and provide collaboration tools alongside real-time updates that enable all stakeholders to obtain necessary information at any time with no delays. The security measures along with the modern user-friendly structure ensure both fast transaction processes and protected sensitive data throughout all steps. Other high-security uses of VDRs in the finance industry include IPOs and debt issuance as well as fundraising because these tasks demand absolute compliance and strict confidentiality regulations. Finance businesses adopt VDR systems because these platforms provide encryption measures and generate audit trails that ensure regulatory compliance standards. Efficient collaboration with confidentiality and compliance characteristics drives Finance and M&A to become the primary segment in the VDR market.

The organization size segment is divided into small and medium enterprises (SMEs) and large enterprises. The large enterprises segment dominated the market, with a market share of around 59% in 2024. The organizations maintaining vast amounts of sensitive information extend across multiple departments together with business units in addition to serving international locations. Large enterprises need highly secure scalable efficient platforms to manage essential documents because they perform M&A operations and legal compliance and corporate restructuring processes. Large enterprises need robust functionality for their operations which VDRs satisfy by providing encryption features as well as multi-factor authentication and real-time performance tracking capabilities. Large organizations need these security features to safeguard defensive intellectual property assets and financial and proprietary information because external collaboration with partners and stakeholders presents information security risks. Large enterprises need to maintain data privacy compliance with regulations and industry standards because of their stringent regulatory requirements.

The type of solution segment is divided into document management, collaboration and communication, workflow management, due diligence management, regulatory compliance solutions, contract lifecycle management (CLM), litigation support services, investor reporting solutions, intellectual property (IP) management, and others. The due diligence management segment dominated the market, with a market share of around 23% in 2024. Due Diligence Management’ dominates the market primarily owing to its key role in high-value business transactions in M&A, fundraising, and corporate restructuring. During all these activities, organizations have to check and deliver volumes of sensitive information to various stakeholders such as prospective investors, legal teams, and regulatory processes. Due diligence management solutions in a VDR ease this very complex process by providing a secure, organized, and easily accessible platform from which documents including financial statements, legal documents, and intellectual property and operational data can be reviewed.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2024 | USD 2.80 Billion |

| Market size value in 2034 | USD 13.45 Billion |

| CAGR (2025 to 2034) | 17% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Deployment Type, End User Industry, Organization Size and Type of Solution |

As per The Brainy Insights, the size of the global virtual data room market was valued at USD 2.80 billion in 2024 to USD 13.45 billion by 2034.

Global virtual data room market is growing at a CAGR of 17% during the forecast period 2025-2034.

The market's growth will be influenced by the increasing demand for secure data management.

The high costs associated with virtual data room could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global virtual data room market based on below mentioned segments:

Global Virtual Data Room Market by Deployment Type:

Global Virtual Data Room Market by End User Industry:

Global Virtual Data Room Market by Organization Size:

Global Virtual Data Room Market by Type of Solution:

Global Virtual Data Room Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date