- +1-315-215-1633

- sales@thebrainyinsights.com

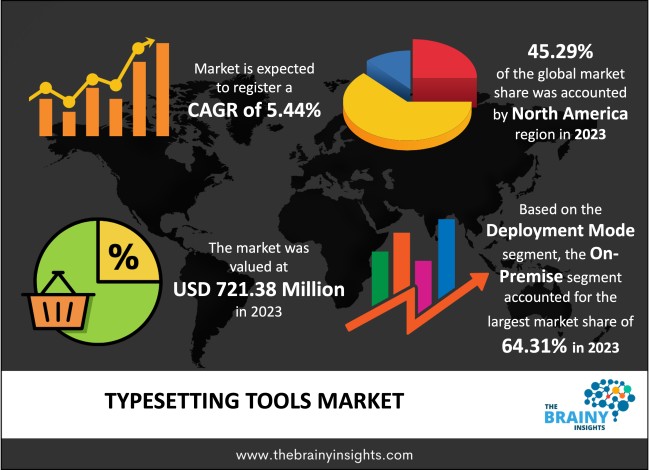

The global Typesetting Tools market generated USD 721.38 Million revenue in 2023 and is projected to grow at a CAGR of 5.44% from 2024 to 2033. The market is expected to reach USD 1225.23 Million by 2033. There is a huge demand for typesetting tools for better qualitative publications worldwide, especially in the publishing, advertising, and designing industries. Typesetting tools help ensure that a publication is laid out correctly and has a good visual aesthetic regarding lettering style.

Typesetting or typographical tools involve tools or applications that enable a user to present formatted messages, text or images in printed and digital media. All these tools provide users with several techniques and abilities that allow them to manage typography, layout, and design most efficiently. These allow users to choose the sort of font, the size of the font, the spacing of the lines and the alignment, all aiming to produce quality and readable work. Furthermore, typesetting tools allow users to create physical layouts of the required pages and set margin options and columns meant for putting text alongside or below pictures and other forms of media contained in the document. Another function of typesetting tools is to provide for the overall consistency and cohesion in the layout of printed materials. It allows users to put the styles and templates to have consistency throughout the document through a format surrounding the headings, sub-headings, body and other sections. Moreover, there are specials which are a part of the typesetting tools, which are used to deal with more number of problems related to text extremely easily and are called pre-servers, which is also important in case of conducting various types of extreme text dealing operations and the types of operations involve, hyphenation, justification and also kerning and many more. In general, typesetting tools are one of the important elements of publishing and designing products. Using these tools, people can produce high-quality documents and focus on specific organizations, resulting in better readability and aesthetics.

Get an overview of this study by requesting a free sample

Technological Innovations — The fundamental driver to the market growth is the evolution of new and innovative typesetting tools, such as creating new typography software and even automated formats. These advancements also mean the typesetting process can be done much more rapidly, and the manual labour required is significantly lower.

Growth in Self-Publishing — There is continuous growth in self-publishing companies, authors, indie-scribes, self-producers, and even "subliminal" producers, thus increasing the need for typesetting tools. The former allows authors and publishers to apply the best formatting to enhance the appearance of books, magazines, and other products without necessarily needing the support of the big publishing firms.

Globalization and Multilingual Publishing — Another area seeing increased action is the globalization of business management to encompass multilingual publishing, which requires this type of typesetting tool. This aspect fuels the need for typesetting software that should address all possible alphabet demands, not just the Latin-based ones and languages with pleonastic writing systems.

High Initial Investment — The hefty initial investment in typesetting tools hinders the growth and development of this market. This factor can disadvantage small and medium-sized publishers or independent authors since they may need more capital to operate costly typesetting machines.

Sensitivity — Technical tools for typesetting can be sensitive, requiring much attention in handling. Like any tool, mastery of these tools may take time, and this may be an issue for individuals or organizations that have never typed before or have little practice in typesetting. This can be an issue since for one to type, it may require one to take his or her time to learn how to use the tools that are provided.

Emerging Markets — Penetration into emerging markets is among the opportunities to attract or benefit typesetting tool vendors. Since the populations of emerging markets are increasingly starting new businesses, adopting the Internet, and embracing self-publishing, there is a need for entry-level practical typesetting platforms that can assist them.

Integration with Publishing Platforms — There are possibilities for the typesetting tools to work harmoniously with the most famous self-publishing providers, such as Amazon KDP and IngramSpark. For authors and publishers interested in repurposing their work and sharing content on these platforms, amplifying their reach and visibility and using typesetting tools that offer integration features for formatting and uploading content to such platforms can be valuable.

Determined Market Structure — The typesetting tools market is characterized by a highly diverse market of numerous players offering similar products and services. These prerequisites have created a rather complex environment for vendors, and the task of positioning and the need to set their value propositions apart from a plethora of similar solutions is especially daunting for SMEs.

User Interface Complexity — Despite being powerful, typesetting tools have complicated interfaces that inexperienced people cannot operate. Reducing the level of complexity in the user interface and the typesetting tools that a vendor provides can be as challenging as increasing the versatility of the product as it is up to this point that a new set of user targets, such as those who may have little or no experience with graphical design or software programming will be reached.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most prominent global Typesetting Tools market, with a 45.29% market revenue share in 2023.

North America is one of the world's leading technological innovation and software development locations, focusing on the USA. Currently, there are several primary global typesetting tool outlet suppliers; Adobe Systems is a North American Company that developed Adobe InDesign, while Quark Inc. is also a North American company that developed QuarkXPress. The presence of such a large number of innovative organizations encourages the advancement of more groundbreaking typesetting solutions and tools, fostering the addition of value to North America-based vendors within the global context. Additionally, North America has a well-developed industry of publishing houses and companies dealing with bookselling, magazine selling, advertising, and web-based products. Some of the leading publishing centers include New York City, and these are major business corridors comprising numerous publishing houses, designing agencies, media firms and others, which largely rely on typesetting tools in their operations. Many typesetting tools in North America's publishing industry extend their influence in the market. It has a higher demand for typesetting tools than in other regions. Another factor is the extraordinary vantages of North American geography in supplying a vast and various customer base for typesetting tools among publishing specialists, graphic designers, advertising agencies, schools and universities, and self-publishing writers. Therefore, the huge and well-established market in the North American region guarantees steady streams of demand for typesetting software and solutions, increasing overall revenues for vendors based in the region. More so, North America has a high bar for printing and design, which is why most of the publishers and designers there emphasize the quality and professionalism of their work. Software with these qualities and additional options for further typesetting, typography layout, and design is in high demand in the North American region. This aspect contributes to regional-specific preferences, and those vendors that offer products within such specific preferences are likely to thrive in the region.

North America Region Typesetting Tools Market Share in 2023 - 45.29%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The deployment mode segment is divided into on-premise and cloud-based. The on-premise segment dominated the market with a share of around 64.31% in 2023. The on-premise typesetting tools allow for increased data and content management as all the processing and storage are done on a user’s server system or infrastructure. Such an extent of control is essential in industries under strict regulatory standards concerning data retention, including finance, health, and government, as more sensitive information cannot be shared with strangers or third parties. Secondly, on-premise typesetting tools offer ample customization and flexibility compared to Cloud or SaaS solutions. Customization makes it possible to meet users’ requirements and interface with other applications, processes, systems, and third parties without depending on Internet-based services or web links. Furthermore, local tools often work faster in processing and overall performance than their cloud counterparts since they use in-house local servers and hardware machinery. This aspect is particularly useful when the user is dealing with large files or complicated layouts and high-resolution pictures, as it is designed to work in real time for efficient processing.

The platform segment is classified into mobile, PC and others. The PC segment dominated the market with a share of around 52.63% in 2023. It is well documented that personal computers have played a prominent role in typesetting since software typesetting was introduced in the 1980s. Typesetting software emerged for PCs, and Adobe PageMaker and QuarkXPress programs were breeding grounds for successive PC dominance in the typesetting tools market. Personal computers have high-performance processors, advanced captivating memories, and a disposition for the excellent graphics processing unit (GPUs) that typesetting software requires. Furthermore, the high-basic system hardware of PCs allows users to fix complicated patterns and graphic designs, as well as satisfactory typography and layouts, which are preferred in professional typographic work. Moreover, PCs are flexible and can work seamlessly with numerous composing software and equipment types, like InDesign of Adobe, Publisher Microsoft, and QuarkXPress. It also ensures its performance with several applications and file types, thus enabling users to work more efficiently and cohesively transfer files to others in their work or business.

The application segment includes publication, media design and others. The publication segment dominated the market with a share of around 49.28% in 2023. There is a wide range of uses of typesetting tools in the publication industry concerning different segments of book publishing & designing, magazine layout & designing, newspaper designing, advertisement designing, sales promotion material, and corporate communication. The complexity of production and distribution in various industries enhances the necessity of typesetting tools, especially for publishers. Also, there is a need for publications to obtain high-value layouts, typography, and graphics that make readers pay attention to the publications and understand the information presented. Typesetting tools help publishers produce sophisticated-looking texts that add value to many desired high looks in their publications, thereby retaining a strategic edge on the market. Most publication industries already have acceptable sizes and layouts for designing publications. The employees in this industry use specialized typesetters to perform this work and ensure that it meets these standards and enhances efficiency. Consequently, available typesetting tools specifically meant for the publication industry depict the market trends.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Million) |

| Market size value in 2023 | USD 721.38 Million |

| Market size value in 2033 | USD 1225.23 Million |

| CAGR (2024 to 2033) | 5.44% |

| Historical data | 2020-2022 |

| Base Year | 2023 |

| Forecast | 2024-2033 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East & Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Deployment Mode, Platform and Application |

As per The Brainy Insights, the size of the typesetting tools market was valued at USD 721.38 million in 2023 to USD 1225.23 million by 2033.

The global typesetting tools market is growing at a CAGR of 5.44% during the forecast period 2024-2033.

North America became the largest market for typesetting tools.

Technological advancements and rise in self-publishing drive the market's growth.

1. Introduction

1.1. Objectives of the Study

1.2. Market Definition

1.3. Research Scope

1.4. Currency

1.5. Key Target Audience

2. Research Methodology and Assumptions

3. Executive Summary

4. Premium Insights

4.1. Porter’s Five Forces Analysis

4.2. Value Chain Analysis

4.3. Top Investment Pockets

4.3.1. Market Attractiveness Analysis By Deployment Mode

4.3.2. Market Attractiveness Analysis By Platform

4.3.3. Market Attractiveness Analysis By Application

4.3.4. Market Attractiveness Analysis By Region

4.4. Industry Trends

5. Market Dynamics

5.1. Market Evaluation

5.2. Drivers

5.2.1. Technological Advancements

5.2.2. Rise in Self-Publishing

5.3. Restraints

5.3.1. High Initial Investment

5.4. Opportunities

5.4.1. Emerging Markets

5.5. Challenges

5.5.1. Fragmented Market Landscape

6. Global Typesetting Tools Market Analysis and Forecast, By Deployment Mode

6.1. Segment Overview

6.2. On-Premise

6.3. Cloud-Based

7. Global Typesetting Tools Market Analysis and Forecast, By Platform

7.1. Segment Overview

7.2. Mobile

7.3. PC

7.4. Others

8. Global Typesetting Tools Market Analysis and Forecast, By Application

8.1. Segment Overview

8.2. Publication

8.3. Media Design

8.4. Others

9. Global Typesetting Tools Market Analysis and Forecast, By Regional Analysis

9.1. Segment Overview

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.2.3. Mexico

9.3. Europe

9.3.1. Germany

9.3.2. France

9.3.3. U.K.

9.3.4. Italy

9.3.5. Spain

9.4. Asia-Pacific

9.4.1. Japan

9.4.2. China

9.4.3. India

9.5. South America

9.5.1. Brazil

9.6. Middle East and Africa

9.6.1. UAE

9.6.2. South Africa

10. Global Typesetting Tools Market-Competitive Landscape

10.1. Overview

10.2. Market Share of Key Players in the Typesetting Tools Market

10.2.1. Global Company Market Share

10.2.2. North America Company Market Share

10.2.3. Europe Company Market Share

10.2.4. APAC Company Market Share

10.3. Competitive Situations and Trends

10.3.1. Product Launches and Developments

10.3.2. Partnerships, Collaborations, and Agreements

10.3.3. Mergers & Acquisitions

10.3.4. Expansions

11. Company Profiles

11.1. Adobe Systems Incorporated

11.1.1. Business Overview

11.1.2. Company Snapshot

11.1.3. Company Market Share Analysis

11.1.4. Company Product Portfolio

11.1.5. Recent Developments

11.1.6. SWOT Analysis

11.2. Beijing Heima Feiteng Technology

11.2.1. Business Overview

11.2.2. Company Snapshot

11.2.3. Company Market Share Analysis

11.2.4. Company Product Portfolio

11.2.5. Recent Developments

11.2.6. SWOT Analysis

11.3. Lucid Software

11.3.1. Business Overview

11.3.2. Company Snapshot

11.3.3. Company Market Share Analysis

11.3.4. Company Product Portfolio

11.3.5. Recent Developments

11.3.6. SWOT Analysis

11.4. MAP Systems

11.4.1. Business Overview

11.4.2. Company Snapshot

11.4.3. Company Market Share Analysis

11.4.4. Company Product Portfolio

11.4.5. Recent Developments

11.4.6. SWOT Analysis

11.5. Magplus Software Private Limited

11.5.1. Business Overview

11.5.2. Company Snapshot

11.5.3. Company Market Share Analysis

11.5.4. Company Product Portfolio

11.5.5. Recent Developments

11.5.6. SWOT Analysis

11.6. OPTUME Technologies

11.6.1. Business Overview

11.6.2. Company Snapshot

11.6.3. Company Market Share Analysis

11.6.4. Company Product Portfolio

11.6.5. Recent Developments

11.6.6. SWOT Analysis

11.7. Peking University Founder Group

11.7.1. Business Overview

11.7.2. Company Snapshot

11.7.3. Company Market Share Analysis

11.7.4. Company Product Portfolio

11.7.5. Recent Developments

11.7.6. SWOT Analysis

11.8. Quark Software

11.8.1. Business Overview

11.8.2. Company Snapshot

11.8.3. Company Market Share Analysis

11.8.4. Company Product Portfolio

11.8.5. Recent Developments

11.8.6. SWOT Analysis

11.9. River Valley Technologies

11.9.1. Business Overview

11.9.2. Company Snapshot

11.9.3. Company Market Share Analysis

11.9.4. Company Product Portfolio

11.9.5. Recent Developments

11.9.6. SWOT Analysis

11.10. Techosoft

11.10.1. Business Overview

11.10.2. Company Snapshot

11.10.3. Company Market Share Analysis

11.10.4. Company Product Portfolio

11.10.5. Recent Developments

11.10.6. SWOT Analysis

11.11. TrueTeX

11.11.1. Business Overview

11.11.2. Company Snapshot

11.11.3. Company Market Share Analysis

11.11.4. Company Product Portfolio

11.11.5. Recent Developments

11.11.6. SWOT Analysis

11.12. Wuhan Mengtai Technology

11.12.1. Business Overview

11.12.2. Company Snapshot

11.12.3. Company Market Share Analysis

11.12.4. Company Product Portfolio

11.12.5. Recent Developments

11.12.6. SWOT Analysis

11.13. Xara Group Limited

11.13.1. Business Overview

11.13.2. Company Snapshot

11.13.3. Company Market Share Analysis

11.13.4. Company Product Portfolio

11.13.5. Recent Developments

11.13.6. SWOT Analysis

List of Table

1. Global Typesetting Tools Market, By Deployment Mode, 2020-2033 (USD Million)

2. Global On-Premise, Typesetting Tools Market, By Region, 2020-2033 (USD Million)

3. Global Cloud-Based, Typesetting Tools Market, By Region, 2020-2033 (USD Million)

4. Global Typesetting Tools Market, By Platform, 2020-2033 (USD Million)

5. Global Mobile, Typesetting Tools Market, By Region, 2020-2033 (USD Million)

6. Global PC, Typesetting Tools Market, By Region, 2020-2033 (USD Million)

7. Global Others, Typesetting Tools Market, By Region, 2020-2033 (USD Million)

8. Global Typesetting Tools Market, By Application, 2020-2033 (USD Million)

9. Global Publication, Typesetting Tools Market, By Region, 2020-2033 (USD Million)

10. Global Media Design, Typesetting Tools Market, By Region, 2020-2033 (USD Million)

11. Global Others, Typesetting Tools Market, By Region, 2020-2033 (USD Million)

12. Global Typesetting Tools Market, By Region, 2020-2033 (USD Million)

13. North America Typesetting Tools Market, By Deployment Mode, 2020-2033 (USD Million)

14. North America Typesetting Tools Market, By Platform, 2020-2033 (USD Million)

15. North America Typesetting Tools Market, By Application, 2020-2033 (USD Million)

16. U.S. Typesetting Tools Market, By Deployment Mode, 2020-2033 (USD Million)

17. U.S. Typesetting Tools Market, By Platform, 2020-2033 (USD Million)

18. U.S. Typesetting Tools Market, By Application, 2020-2033 (USD Million)

19. Canada Typesetting Tools Market, By Deployment Mode, 2020-2033 (USD Million)

20. Canada Typesetting Tools Market, By Platform, 2020-2033 (USD Million)

21. Canada Typesetting Tools Market, By Application, 2020-2033 (USD Million)

22. Mexico Typesetting Tools Market, By Deployment Mode, 2020-2033 (USD Million)

23. Mexico Typesetting Tools Market, By Platform, 2020-2033 (USD Million)

24. Mexico Typesetting Tools Market, By Application, 2020-2033 (USD Million)

25. Europe Typesetting Tools Market, By Deployment Mode, 2020-2033 (USD Million)

26. Europe Typesetting Tools Market, By Platform, 2020-2033 (USD Million)

27. Europe Typesetting Tools Market, By Application, 2020-2033 (USD Million)

28. Germany Typesetting Tools Market, By Deployment Mode, 2020-2033 (USD Million)

29. Germany Typesetting Tools Market, By Platform, 2020-2033 (USD Million)

30. Germany Typesetting Tools Market, By Application, 2020-2033 (USD Million)

31. France Typesetting Tools Market, By Deployment Mode, 2020-2033 (USD Million)

32. France Typesetting Tools Market, By Platform, 2020-2033 (USD Million)

33. France Typesetting Tools Market, By Application, 2020-2033 (USD Million)

34. U.K. Typesetting Tools Market, By Deployment Mode, 2020-2033 (USD Million)

35. U.K. Typesetting Tools Market, By Platform, 2020-2033 (USD Million)

36. U.K. Typesetting Tools Market, By Application, 2020-2033 (USD Million)

37. Italy Typesetting Tools Market, By Deployment Mode, 2020-2033 (USD Million)

38. Italy Typesetting Tools Market, By Platform, 2020-2033 (USD Million)

39. Italy Typesetting Tools Market, By Application, 2020-2033 (USD Million)

40. Spain Typesetting Tools Market, By Deployment Mode, 2020-2033 (USD Million)

41. Spain Typesetting Tools Market, By Platform, 2020-2033 (USD Million)

42. Spain Typesetting Tools Market, By Application, 2020-2033 (USD Million)

43. Asia Pacific Typesetting Tools Market, By Deployment Mode, 2020-2033 (USD Million)

44. Asia Pacific Typesetting Tools Market, By Platform, 2020-2033 (USD Million)

45. Asia Pacific Typesetting Tools Market, By Application, 2020-2033 (USD Million)

46. Japan Typesetting Tools Market, By Deployment Mode, 2020-2033 (USD Million)

47. Japan Typesetting Tools Market, By Platform, 2020-2033 (USD Million)

48. Japan Typesetting Tools Market, By Application, 2020-2033 (USD Million)

49. China Typesetting Tools Market, By Deployment Mode, 2020-2033 (USD Million)

50. China Typesetting Tools Market, By Platform, 2020-2033 (USD Million)

51. China Typesetting Tools Market, By Application, 2020-2033 (USD Million)

52. India Typesetting Tools Market, By Deployment Mode, 2020-2033 (USD Million)

53. India Typesetting Tools Market, By Platform, 2020-2033 (USD Million)

54. India Typesetting Tools Market, By Application, 2020-2033 (USD Million)

55. South America Typesetting Tools Market, By Deployment Mode, 2020-2033 (USD Million)

56. South America Typesetting Tools Market, By Platform, 2020-2033 (USD Million)

57. South America Typesetting Tools Market, By Application, 2020-2033 (USD Million)

58. Brazil Typesetting Tools Market, By Deployment Mode, 2020-2033 (USD Million)

59. Brazil Typesetting Tools Market, By Platform, 2020-2033 (USD Million)

60. Brazil Typesetting Tools Market, By Application, 2020-2033 (USD Million)

61. Middle East and Africa Typesetting Tools Market, By Deployment Mode, 2020-2033 (USD Million)

62. Middle East and Africa Typesetting Tools Market, By Platform, 2020-2033 (USD Million)

63. Middle East and Africa Typesetting Tools Market, By Application, 2020-2033 (USD Million)

64. UAE Typesetting Tools Market, By Deployment Mode, 2020-2033 (USD Million)

65. UAE Typesetting Tools Market, By Platform, 2020-2033 (USD Million)

66. UAE Typesetting Tools Market, By Application, 2020-2033 (USD Million)

67. South Africa Typesetting Tools Market, By Deployment Mode, 2020-2033 (USD Million)

68. South Africa Typesetting Tools Market, By Platform, 2020-2033 (USD Million)

69. South Africa Typesetting Tools Market, By Application, 2020-2033 (USD Million)

List of Figures

1. Global Typesetting Tools Market Segmentation

2. Typesetting Tools Market: Research Methodology

3. Market Size Estimation Methodology: Bottom-Up Approach

4. Market Size Estimation Methodology: Top-Down Approach

5. Data Triangulation

6. Porter’s Five Forces Analysis

7. Value Chain Analysis

8. Global Typesetting Tools Market Attractiveness Analysis By Deployment Mode

9. Global Typesetting Tools Market Attractiveness Analysis By Platform

10. Global Typesetting Tools Market Attractiveness Analysis By Application

11. Global Typesetting Tools Market Attractiveness Analysis by Region

12. Global Typesetting Tools Market: Dynamics

13. Global Typesetting Tools Market Share By Deployment Mode (2024 & 2033)

14. Global Typesetting Tools Market Share By Platform (2024 & 2033)

15. Global Typesetting Tools Market Share By Application (2024 & 2033)

16. Global Typesetting Tools Market Share by Regions (2024 & 2033)

17. Global Typesetting Tools Market Share by Company (2023)

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. The Brainy Insights has segmented the global Typesetting Tools market based on below-mentioned segments:

Global Typesetting Tools Market by Deployment Mode:

Global Typesetting Tools Market by Platform:

Global Typesetting Tools Market by Application:

Global Typesetting Tools Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date