- +1-315-215-1633

- sales@thebrainyinsights.com

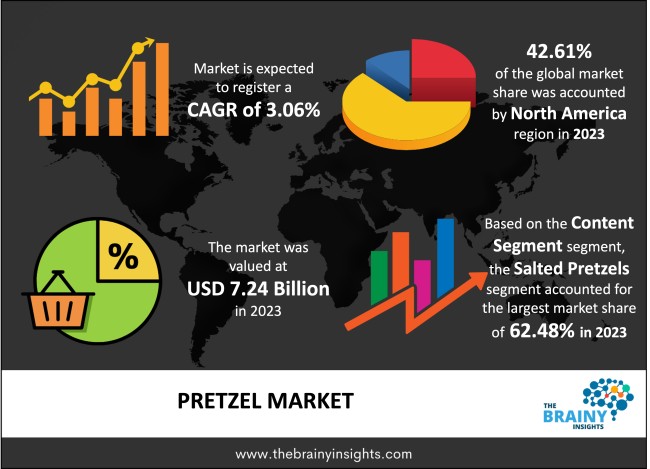

The global pretzel market generated USD 7.24 billion revenue in 2023 and is projected to grow at a CAGR of 3.06% from 2024 to 2033. The market is expected to reach USD 9.79 billion by 2033. The rising disposable personal income of the middle-class population and a growing consumer awareness, particularly in developing regions, emphasizing the significance of maintaining good health, are driving the growth of the pretzels market. In addition, continuous product innovation that introduces novel forms and flavours further augments the market's expansion.

A pretzel is a traditional baked snack typically made from a dough of flour, water, yeast, and salt. The dough is rolled, twisted into a distinctive knot shape, and then briefly boiled in water with baking soda before being baked. This process gives pretzels their characteristic chewy interior and crisp, golden-brown exterior. Pretzels come in various sizes and shapes, from small bite-sized twists to larger traditional forms. They are usually sprinkled with coarse salt before baking, adding a savoury flavour and enhancing the texture. However, pretzels can also be seasoned with various toppings, including sesame, poppy, or cheese. Historically, pretzels were associated with religious symbolism and were often given to children as rewards for learning prayers. Today, they are a popular snack enjoyed around the world. In addition to their classic savoury flavour, pretzels can be found in sweet variations, such as cinnamon sugar-coated pretzel bites or chocolate-dipped pretzel rods. Pretzels are commonly served as a standalone snack or paired with dips like mustard, cheese sauce, or hummus. They are available in bakeries, grocery stores, and specialty shops and are often sold at sporting games, festivals, and fairs. Whether enjoyed on their own or as part of a larger spread, pretzels remain a beloved treat appreciated for their versatility and satisfying crunch.

Get an overview of this study by requesting a free sample

Changing Consumer Preferences - Consumers/buyers are looking for healthier snack options, and pretzels are perceived as a better alternative to chips and other fried snacks due to their lower fat content and simpler ingredients. This shift towards healthier eating habits is driving the demand for pretzels.

Growth in the Snack Industry - The global snack industry is experiencing significant growth caused by rising urbanization, busy lifestyles, and disposable personal incomes. Pretzels, with their convenience and variety of flavours, are well-positioned to capitalize on this trend.

Innovations in Flavours and Varieties - Manufacturers constantly innovate to cater to diverse consumer preferences. This factor includes introducing new flavours, shapes, and textures to appeal to tastes and demographics. The availability of gluten-free and organic options also expands the market reach.

Price Sensitivity - Pretzels are often priced higher than other snack options, which may make them less appealing to price-sensitive consumers, particularly in times of economic downturn or recession. Price competition from private label brands and discount retailers could further impact profitability for pretzel manufacturers.

Competition from Alternative Snacks - The pretzel market faces stiff competition from various snack options, including chips, crackers, popcorn, and nuts. Consumers have diverse preferences, and the availability of these alternatives may limit the growth potential of the pretzel market.

Health and Wellness Marketing - Emphasizing the nutritional benefits of pretzels, such as their low-fat and low-calorie content, can appeal to health-conscious consumers. Marketing campaigns promoting pretzels as a guilt-free snack option can help drive sales and brand loyalty.

Expanding Distribution Channels - As consumer preferences and shopping habits evolve, pretzel manufacturers are looking for new distribution channels to reach a wider audience, which includes online retail, vending machines, convenience stores, and specialty snack shops.

Snack Subscription Services - The rise of subscription-based snack services allows pretzel manufacturers to reach consumers directly. Companies can tap into the growing subscription market by offering curated snack boxes featuring a variety of pretzel flavours and styles.

Seasonality and Demand Fluctuations - The demand for pretzels may vary seasonally, with peak periods coinciding with holidays, sporting events, and other occasions. Managing production schedules, inventory levels, and promotional activities to match fluctuating demand patterns can be challenging for manufacturers.

Supply Chain Complexity - The pretzel manufacturing process involves multiple stages, from sourcing raw ingredients to packaging and distribution. Managing a complex and often globalized supply chain presents challenges related to quality control, supply chain visibility, and logistics efficiency.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most prominent global Pretzel market, with a 42.61% market revenue share in 2023.

Pretzels have a long history in North America. German immigrants who presented them to the region date back to the 18th century. This early introduction laid the foundation for the widespread popularity of pretzels in North America, particularly in the United States. Furthermore, pretzels are deeply ingrained in North American culture and are often associated with sporting games, festivals, and social gatherings. This cultural value has contributed to the ongoing popularity of pretzels in the region. North America has one of the largest global snack markets, driven by busy lifestyles, on-the-go consumption habits, and various snack options. Pretzels, with their convenience, portability, and versatility, appeal to consumers looking for quick and satisfying snack choices. The North American pretzel market also offers various product varieties, flavours, and formats to cater to diverse consumer preferences. This factor includes traditional salted pretzels, flavoured pretzel twists, rods, chips, and even gourmet or artisanal pretzels, providing options for every taste and occasion. Besides, North American pretzel manufacturers have been at the forefront of product innovation and marketing strategies. They continually introduce new flavours, shapes, and packaging formats to captivate consumers and differentiate their brands in the competitive market.

North America Region Pretzel Market Share in 2023 - 42.61%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The content segment is divided into salted pretzels and unsalted pretzels. The salted pretzels segment dominated the market, with a share of around 62.48% in 2023. Salted pretzels have a long history and are considered a classic snack. Their simplicity and familiar taste appeal to a broad range of consumers, from children to adults, making them a staple snack choice for many. Unlike flavoured or speciality pretzels, which may cater to specific tastes or preferences, salted pretzels have a universal appeal that transcends cultural and demographic boundaries. They are widely enjoyed across different regions and demographics, contributing to their dominance in the market. Furthermore, salted pretzels are readily available in convenience stores, supermarkets and hypermarkets, vending machines, and other retail outlets, making them efficiently accessible to buyers. Their widespread availability ensures high visibility and consistent demand in the market.

The type segment is classified into hard pretzels and soft pretzels. The hard pretzels segment dominated the market, with a share of around 63.29%. Hard pretzels have a longer shelf life than soft pretzels or other snack options like chips or crackers. This extended shelf life makes them a convenient and practical snack choice for consumers, contributing to their popularity. Additionally, hard pretzels have a sturdy and compact structure, making them ideal for on-the-go snacking. Their durability ensures they withstand handling and transportation without crumbling or breaking, appealing to consumers looking for convenient snack options. Besides, hard pretzels have a satisfying crunchy texture that appeals to consumers seeking snacks with a satisfying crunch. This unique texture sets them apart from softer snack options and enhances the snacking experience.

The packaging type segment includes bags, boxes, containers and others. The bags segment dominated the market, with a share of around 44.39% in 2023. Bag packaging offers convenience and portability, allowing consumers to grab a serving of pretzels for on-the-go snacking easily. The resealable nature of many bagged pretzel products also enables consumers to seal the bag and save the remaining pretzels for later consumption, maintaining freshness and crunchiness. Most importantly, bag packaging provides protection and preservation for pretzels, shielding them from external factors such as moisture, air, and light that can compromise their quality and freshness. These features help extend the shelf life of pretzels and ensure they remain crispy and flavorful until consumed. In addition, bag packaging comes in various sizes, ranging from single-serve snack packs to family-sized bags. This flexibility allows pretzel manufacturers to cater to different consumer needs and preferences, whether an individual snack for one person or a larger quantity for sharing or stocking up.

The distribution channel segment is split into supermarkets and hypermarkets, convenience stores, specialist retailers, online retailers and others. The supermarkets and hypermarkets segment dominated the market, with a share of around 34.27% in 2023. Supermarkets and hypermarkets typically offer various pretzel brands, flavours, and packaging sizes, giving consumers ample choices to suit their preferences and needs. This extensive product selection allows shoppers to compare options and conveniently find their preferred pretzel products under one roof. Moreover, supermarkets and hypermarkets are widely distributed and easily accessible to consumers in urban, suburban, and rural areas. Their convenient locations and extended operating hours make it convenient for shoppers to purchase pretzels during their regular grocery shopping trips or whenever needed. Additionally, supermarkets and hypermarkets serve as one-stop shopping destinations where consumers can fulfil all their grocery needs, including pretzels and other snacks. The convenience of purchasing pretzels along with other food and household items in the same location enhances the overall shopping experience for consumers.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2023 | USD 7.24 Billion |

| Market size value in 2033 | USD 9.79 Billion |

| CAGR (2024 to 2033) | 3.06% |

| Historical data | 2020-2022 |

| Base Year | 2023 |

| Forecast | 2024-2033 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East & Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Content, Type, Packaging Type and Distribution Channel |

As per The Brainy Insights, the size of the pretzel market was valued at USD 7.24 billion in 2023 to USD 9.79 billion by 2033.

The global pretzel market is growing at a CAGR of 3.06% during the forecast period 2024-2033.

North America became the largest market for pretzel.

Growth in the snack industry and innovations in flavours and varieties drive the market's growth.

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. The Brainy Insights has segmented the global pretzel market based on below-mentioned segments:

Global Pretzel Market by Content:

Global Pretzel Market by Type:

Global Pretzel Market by Packaging Type:

Global Pretzel Market by Distribution Channel:

Global Pretzel Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date