- +1-315-215-1633

- sales@thebrainyinsights.com

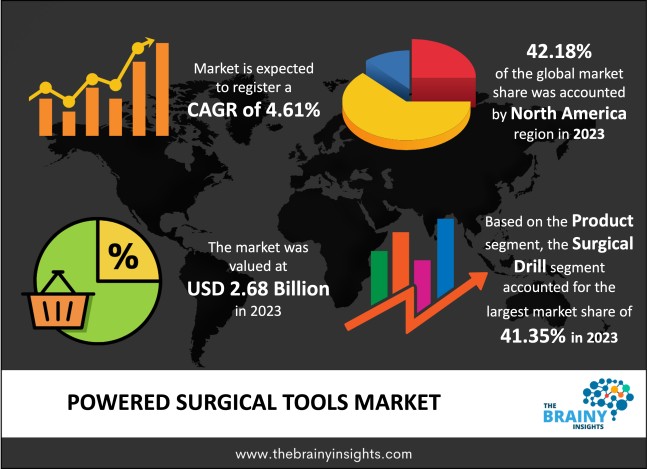

The global Powered Surgical Tools market generated USD 2.68 Billion revenue in 2023 and is projected to grow at a CAGR of 4.61% from 2024 to 2033. The market is expected to reach USD 4.21 billion by 2033. Several significant factors, including advancements in surgical device technology, a rising incidence of facial and head injuries, and the growing global elderly population, fuel the market's expansion. Additionally, the surge in various surgical procedures, such as orthopaedic, cardiothoracic, neurosurgery, spine surgery, and others, is expected to propel market growth further.

Powered surgical tools, also known as surgical power tools, are specialized instruments utilized in various surgical procedures to aid healthcare professionals in performing precise and efficient interventions. These tools are powered by compressed air, electricity or battery sources, enabling them to perform an expansive range of operations such as cutting, drilling, sawing, reaming, and shaping bones or tissues. Powered surgical tools typically have a handle or control unit connected to a powered handpiece or attachment. The handpiece houses a motor that drives the surgical tool's movement, often equipped with interchangeable tips or blades for specific surgical tasks. These tools offer several advantages over traditional manual instruments, including increased speed and precision, reduced physical strain on the surgeon, and enhanced control over surgical manoeuvres. They are commonly used in orthopaedic, neurosurgery, cardiothoracic, plastic, and reconstructive surgeries. In recent years, technological advancements have led to digitally enabled powered surgical tools that provide real-time feedback, improved ergonomics, and enhanced safety features. These tools are crucial in modern surgical practice, contributing to more satisfactory patient outcomes and shorter recovery times.

Get an overview of this study by requesting a free sample

Growing Ageing Population - The ageing population worldwide is prone to age-related health issues that often require surgical interventions. As the elderly population increases, there is a corresponding rise in the demand for surgical procedures, driving the market for powered surgical tools.

Growing Need for Minimally Invasive Procedures - There is a rising tendency for minimally invasive surgeries due to their advantages, such as faster recovery times, reduced scarring, and lower risk of complications. Powered surgical tools play a crucial role in these procedures by enabling surgeons to perform intricate tasks with greater precision and control, thus driving their adoption.

Increasing Surgical Procedures - The rising number of chronic diseases, such as orthopaedic conditions, cardiovascular disorders, and neurological disorders, is leading to an increase in surgical procedures. As a result, there is a higher demand for powered surgical tools to support these procedures across various medical specialities.

High Cost of Powered Surgical Tools - The ageing population worldwide is prone to age-related health issues that constantly require surgical interventions. As the elderly population increases, there is a corresponding rise in the demand for surgical procedures, driving the market for powered surgical tools.

Limited Access to Advanced Healthcare Facilities - In many nations, particularly rural and underserved areas, access to advanced healthcare facilities equipped with powered surgical tools is limited. This lack of infrastructure and resources hinders the widespread adoption of powered surgical tools and restricts market growth in these regions.

Technological Innovation and Product Development - Continuous technological advancements present opportunities for developing innovative surgical tools. Integrating features such as robotics, artificial intelligence, and augmented reality into surgical instruments can enhance precision, efficiency, and patient outcomes, opening new avenues for growth.

Expansion in Emerging Markets - Emerging economies present significant growth opportunities for powered surgical tool manufacturers due to improving healthcare infrastructure, increasing healthcare spending, and rising need for advanced medical technologies. Expanding into these markets can help tap into new patient populations and diversify revenue streams.

Safety and Efficacy Concerns - Ensuring the safety and efficacy of powered surgical tools is paramount. However, concerns regarding device malfunctions, inadequate training, and the potential for surgical errors can undermine confidence in these tools among healthcare professionals. Addressing these concerns through rigorous testing, comprehensive training programs, and ongoing support is essential to foster trust and acceptance.

Regulatory Hurdles - Complying with stringent regulatory requirements and obtaining approvals for powered surgical tools can be lengthy and complex. Delays in regulatory approvals can impede market entry and product launches, hampering manufacturers' growth prospects. Navigating the regulatory landscape effectively and proactively engaging with regulatory authorities are critical for success in the market.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most prominent global Powered Surgical Tools market, with a 42.18% market revenue share in 2023.

North America boasts a highly developed healthcare infrastructure with state-of-the-art medical facilities, advanced surgical centers, and robust regulatory frameworks. The region's well-established healthcare system facilitates the adoption of cutting-edge technologies, including powered surgical tools, and enables healthcare providers to offer high-quality surgical care. North America is a global medical device innovation and research hub. The region is home to numerous leading manufacturers and research institutions dedicated to developing advanced surgical technologies. Continuous innovation drives the introduction of new and improved powered surgical tools, enhancing their efficacy, safety, and precision. Moreover, regulatory bodies like the U.S. FDA maintain rigorous medical device standards, ensuring safety, efficacy, and quality. The stringent regulatory environment fosters trust among healthcare professionals and patients, facilitating North America's widespread adoption of powered surgical tools. Besides, North America consistently allocates a significant portion of its GDP to healthcare expenditures. The willingness to invest in advanced medical technologies, including powered surgical tools, enables healthcare facilities to procure state-of-the-art equipment and provide patients access to cutting-edge treatments and procedures.

North America Region Powered Surgical Tools Market Share in 2023 - 42.18%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The product segment is divided into surgical drill, surgical saw, reamer, staplers, accessories and others. The surgical drill segment dominated the market, with a share of around 41.35% in 2023. Surgical drills are versatile tools used across various medical specialities, including orthopaedics, neurosurgery, dentistry, and ENT (ear, nose, and throat) surgery. They are utilized for tasks such as bone drilling, screw placement, and tissue removal, making them indispensable in a wide range of surgical procedures. Orthopaedic surgeries, such as joint replacement, fracture fixation, and spine surgery, often require precise drilling and cutting of bone. Surgical drills are essential in orthopaedic procedures for preparing bone surfaces, creating channels for implants, and shaping bone grafts, contributing to widespread adoption in this field. Furthermore, the shift towards minimally invasive surgical techniques has increased the demand for powered surgical drills. Minimally invasive procedures require specialized tools that enable surgeons to perform intricate tasks through small incisions with minimal disruption to surrounding tissues. Surgical drills with ergonomic designs, precise control, and variable speed settings are well-suited for minimally invasive surgery, driving their popularity.

The technology segment is classified into battery operated, electric operated and pneumatic operated. The electric operated segment dominated the market, with a share of around 46.21% in 2023. Electric-operated surgical tools offer precise control and consistent performance, making them well-suited for various surgical procedures. Surgeons can adjust the speed, torque, and direction of electric-powered tools with greater precision, allowing for meticulous tissue manipulation and accurate surgical outcomes. In addition, electric-powered surgical tools are versatile and adaptable to various surgical specialities and procedures. They can perform various tasks, including cutting, drilling, reaming, and tissue dissection, across orthopaedic, neurosurgical, dental, and ENT (ear, nose, and throat) surgeries. Their versatility makes them indispensable in modern surgical practice. Besides, the rise of minimally invasive surgical techniques has fueled the demand for electric-operated tools. These tools are well-suited for minimally invasive procedures, where precision, manoeuvrability, and minimal tissue damage are critical. Electric-powered instruments enable surgeons to perform intricate tasks through tiny incisions, resulting in faster recovery and better patient outcomes.

The application segment includes cardiothoracic surgery, orthopaedic surgery, spine and neuro surgery and others. The orthopaedic surgery segment dominated the market, with a share of around 62.19% in 2023. Orthopaedic conditions, such as fractures, osteoarthritis, and sports injuries, are highly prevalent globally, affecting millions of individuals across all age groups. The substantial burden of orthopaedic diseases drives the demand for surgical interventions, including joint replacement, fracture fixation, and spine surgery, which rely heavily on powered surgical tools. Most importantly, orthopaedic surgeries often involve complex procedures that require precision, accuracy, and meticulous bone preparation. Powered surgical tools, such as drills, saws, reamers, and burrs, enable surgeons to perform intricate tasks with greater control and efficiency, resulting in better surgical outcomes and reduced risk of complications. Additionally, continuous advancements in powered surgical tool technology have revolutionized orthopaedic surgery. Manufacturers are developing innovative tools with advanced features, such as variable speed control, ergonomic designs, and integrated navigation systems, to enhance surgical precision, minimize tissue trauma, and improve patient outcomes.

The end user segment is divided into ambulatory surgical centers, hospitals and others. The hospitals segment dominated the market, with a share of around 57.49% in 2023. Hospitals perform surgical procedures across various medical specialities, from orthopaedics and neurosurgery to cardiovascular and dental surgery. The rising number of surgeries in hospitals drives the demand for powered surgical tools, essential for facilitating precise and efficient surgical interventions. Moreover, hospitals serve as primary hubs for comprehensive healthcare services, delivering an expansive range of medical treatments, diagnostic services, and surgical procedures under one roof. Powered surgical tools are integral to hospital surgical suites, where they support diverse surgical specialities and meet the needs of patients requiring complex surgical interventions. Most importantly, hospitals typically have advanced healthcare infrastructure, including well-equipped operating rooms, state-of-the-art surgical equipment, and specialized surgical teams. Powered surgical tools are essential to this infrastructure, enabling surgeons to perform intricate tasks precisely and efficiently, improving patient outcomes.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2023 | USD 2.68 Billion |

| Market size value in 2033 | USD 4.21 Billion |

| CAGR (2024 to 2033) | 4.61% |

| Historical data | 2020-2022 |

| Base Year | 2023 |

| Forecast | 2024-2033 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East & Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Product, Technology, Application, and End User |

As per The Brainy Insights, the size of the powered surgical tools market was valued at USD 2.68 billion in 2023 to USD 4.21 billion by 2033.

The global powered surgical tools market is growing at a CAGR of 4.61% during the forecast period 2024-2033.

North America became the largest market for powered surgical tools.

A growing ageing population and rising demand for minimally invasive procedures drive the market growth.

1. Introduction

1.1. Objectives of the Study

1.2. Market Definition

1.3. Research Scope

1.4. Currency

1.5. Key Target Audience

2. Research Methodology and Assumptions

3. Executive Summary

4. Premium Insights

4.1. Porter’s Five Forces Analysis

4.2. Value Chain Analysis

4.3. Top Investment Pockets

4.3.1. Market Attractiveness Analysis By Product

4.3.2. Market Attractiveness Analysis By Technology

4.3.3. Market Attractiveness Analysis By Application

4.3.4. Market Attractiveness Analysis By Voltage

4.3.5. Market Attractiveness Analysis By Region

4.4. Industry Trends

5. Market Dynamics

5.1. Market Evaluation

5.2. Drivers

5.2.1. Growing Ageing Population

5.2.2. Rising Demand for Minimally Invasive Procedures

5.3. Restraints

5.3.1. High Cost of Powered Surgical Tools

5.4. Opportunities

5.4.1. Technological Innovation and Product Development

5.5. Challenges

5.5.1. Regulatory Hurdles

6. Global Powered Surgical Tools Market Analysis and Forecast, By Product

6.1. Segment Overview

6.2. Surgical Drill

6.3. Surgical Saw

6.4. Reamer

6.5. Staplers

6.6. Accessories

6.7. Others

7. Global Powered Surgical Tools Market Analysis and Forecast, By Technology

7.1. Segment Overview

7.2. Battery Operated

7.3. Electric Operated

7.4. Pneumatic Operated

8. Global Powered Surgical Tools Market Analysis and Forecast, By Application

8.1. Segment Overview

8.2. Cardiothoracic Surgery

8.3. Orthopaedic Surgery

8.4. Spine and Neuro Surgery

8.5. Others

9. Global Powered Surgical Tools Market Analysis and Forecast, By Voltage

9.1. Segment Overview

9.2. Ambulatory Surgical Centers

9.3. Hospitals

9.4. Others

10. Global Powered Surgical Tools Market Analysis and Forecast, By Regional Analysis

10.1. Segment Overview

10.2. North America

10.2.1. U.S.

10.2.2. Canada

10.2.3. Mexico

10.3. Europe

10.3.1. Germany

10.3.2. France

10.3.3. U.K.

10.3.4. Italy

10.3.5. Spain

10.4. Asia-Pacific

10.4.1. Japan

10.4.2. China

10.4.3. India

10.5. South America

10.5.1. Brazil

10.6. Middle East and Africa

10.6.1. UAE

10.6.2. South Africa

11. Global Powered Surgical Tools Market-Competitive Landscape

11.1. Overview

11.2. Market Share of Key Players in the Powered Surgical Tools Market

11.2.1. Global Company Market Share

11.2.2. North America Company Market Share

11.2.3. Europe Company Market Share

11.2.4. APAC Company Market Share

11.3. Competitive Situations and Trends

11.3.1. Product Launches and Developments

11.3.2. Partnerships, Collaborations, and Agreements

11.3.3. Mergers & Acquisitions

11.3.4. Expansions

12. Company Profiles

12.1. Alcon

12.1.1. Business Overview

12.1.2. Company Snapshot

12.1.3. Company Market Share Analysis

12.1.4. Company Product Portfolio

12.1.5. Recent Developments

12.1.6. SWOT Analysis

12.2. Abbott

12.2.1. Business Overview

12.2.2. Company Snapshot

12.2.3. Company Market Share Analysis

12.2.4. Company Product Portfolio

12.2.5. Recent Developments

12.2.6. SWOT Analysis

12.3. Adeor medical AG

12.3.1. Business Overview

12.3.2. Company Snapshot

12.3.3. Company Market Share Analysis

12.3.4. Company Product Portfolio

12.3.5. Recent Developments

12.3.6. SWOT Analysis

12.4. Altra Industrial Motion Corp.

12.4.1. Business Overview

12.4.2. Company Snapshot

12.4.3. Company Market Share Analysis

12.4.4. Company Product Portfolio

12.4.5. Recent Developments

12.4.6. SWOT Analysis

12.5. Arthrex, Inc.

12.5.1. Business Overview

12.5.2. Company Snapshot

12.5.3. Company Market Share Analysis

12.5.4. Company Product Portfolio

12.5.5. Recent Developments

12.5.6. SWOT Analysis

12.6. B. Braun Melsungen AG

12.6.1. Business Overview

12.6.2. Company Snapshot

12.6.3. Company Market Share Analysis

12.6.4. Company Product Portfolio

12.6.5. Recent Developments

12.6.6. SWOT Analysis

12.7. Brasseler USA

12.7.1. Business Overview

12.7.2. Company Snapshot

12.7.3. Company Market Share Analysis

12.7.4. Company Product Portfolio

12.7.5. Recent Developments

12.7.6. SWOT Analysis

12.8. ConMed Corporation

12.8.1. Business Overview

12.8.2. Company Snapshot

12.8.3. Company Market Share Analysis

12.8.4. Company Product Portfolio

12.8.5. Recent Developments

12.8.6. SWOT Analysis

12.9. DePuy Synthes

12.9.1. Business Overview

12.9.2. Company Snapshot

12.9.3. Company Market Share Analysis

12.9.4. Company Product Portfolio

12.9.5. Recent Developments

12.9.6. SWOT Analysis

12.10. De Soutter Medical

12.10.1. Business Overview

12.10.2. Company Snapshot

12.10.3. Company Market Share Analysis

12.10.4. Company Product Portfolio

12.10.5. Recent Developments

12.10.6. SWOT Analysis

12.11. Exactech Inc.

12.11.1. Business Overview

12.11.2. Company Snapshot

12.11.3. Company Market Share Analysis

12.11.4. Company Product Portfolio

12.11.5. Recent Developments

12.11.6. SWOT Analysis

12.12. GEISTER MEDIZINTECHNIK GmbH

12.12.1. Business Overview

12.12.2. Company Snapshot

12.12.3. Company Market Share Analysis

12.12.4. Company Product Portfolio

12.12.5. Recent Developments

12.12.6. SWOT Analysis

12.13. GPC Medical Ltd.

12.13.1. Business Overview

12.13.2. Company Snapshot

12.13.3. Company Market Share Analysis

12.13.4. Company Product Portfolio

12.13.5. Recent Developments

12.13.6. SWOT Analysis

12.14. Johnson & Johnson

12.14.1. Business Overview

12.14.2. Company Snapshot

12.14.3. Company Market Share Analysis

12.14.4. Company Product Portfolio

12.14.5. Recent Developments

12.14.6. SWOT Analysis

12.15. KLS Martin Group

12.15.1. Business Overview

12.15.2. Company Snapshot

12.15.3. Company Market Share Analysis

12.15.4. Company Product Portfolio

12.15.5. Recent Developments

12.15.6. SWOT Analysis

12.16. Medtronic

12.16.1. Business Overview

12.16.2. Company Snapshot

12.16.3. Company Market Share Analysis

12.16.4. Company Product Portfolio

12.16.5. Recent Developments

12.16.6. SWOT Analysis

12.17. MicroAire Surgical Instruments LLC.

12.17.1. Business Overview

12.17.2. Company Snapshot

12.17.3. Company Market Share Analysis

12.17.4. Company Product Portfolio

12.17.5. Recent Developments

12.17.6. SWOT Analysis

12.18. Matortho

12.18.1. Business Overview

12.18.2. Company Snapshot

12.18.3. Company Market Share Analysis

12.18.4. Company Product Portfolio

12.18.5. Recent Developments

12.18.6. SWOT Analysis

12.19. Nouvag AG

12.19.1. Business Overview

12.19.2. Company Snapshot

12.19.3. Company Market Share Analysis

12.19.4. Company Product Portfolio

12.19.5. Recent Developments

12.19.6. SWOT Analysis

12.20. Orthopromed Inc.

12.20.1. Business Overview

12.20.2. Company Snapshot

12.20.3. Company Market Share Analysis

12.20.4. Company Product Portfolio

12.20.5. Recent Developments

12.20.6. SWOT Analysis

12.21. Panther Healthcare

12.21.1. Business Overview

12.21.2. Company Snapshot

12.21.3. Company Market Share Analysis

12.21.4. Company Product Portfolio

12.21.5. Recent Developments

12.21.6. SWOT Analysis

12.22. RIMEC S.R.L.

12.22.1. Business Overview

12.22.2. Company Snapshot

12.22.3. Company Market Share Analysis

12.22.4. Company Product Portfolio

12.22.5. Recent Developments

12.22.6. SWOT Analysis

12.23. Stryker

12.23.1. Business Overview

12.23.2. Company Snapshot

12.23.3. Company Market Share Analysis

12.23.4. Company Product Portfolio

12.23.5. Recent Developments

12.23.6. SWOT Analysis

12.24. Smith & Nephew Inc.

12.24.1. Business Overview

12.24.2. Company Snapshot

12.24.3. Company Market Share Analysis

12.24.4. Company Product Portfolio

12.24.5. Recent Developments

12.24.6. SWOT Analysis

12.25. Surtex Instruments Limited

12.25.1. Business Overview

12.25.2. Company Snapshot

12.25.3. Company Market Share Analysis

12.25.4. Company Product Portfolio

12.25.5. Recent Developments

12.25.6. SWOT Analysis

12.26. Sharma Orthopedic

12.26.1. Business Overview

12.26.2. Company Snapshot

12.26.3. Company Market Share Analysis

12.26.4. Company Product Portfolio

12.26.5. Recent Developments

12.26.6. SWOT Analysis

12.27. Zimmer Biomet

12.27.1. Business Overview

12.27.2. Company Snapshot

12.27.3. Company Market Share Analysis

12.27.4. Company Product Portfolio

12.27.5. Recent Developments

12.27.6. SWOT Analysis

List of Table

1. Global Powered Surgical Tools Market, By Product, 2020-2033 (USD Billion) (Units)

2. Global Surgical Drill, Powered Surgical Tools Market, By Region, 2020-2033 (USD Billion) (Units)

3. Global Surgical Saw, Powered Surgical Tools Market, By Region, 2020-2033 (USD Billion) (Units)

4. Global Reamer, Powered Surgical Tools Market, By Region, 2020-2033 (USD Billion) (Units)

5. Global Staplers, Powered Surgical Tools Market, By Region, 2020-2033 (USD Billion) (Units)

6. Global Accessories, Powered Surgical Tools Market, By Region, 2020-2033 (USD Billion) (Units)

7. Global Others, Powered Surgical Tools Market, By Region, 2020-2033 (USD Billion) (Units)

8. Global Powered Surgical Tools Market, By Technology, 2020-2033 (USD Billion) (Units)

9. Global Battery Operated, Powered Surgical Tools Market, By Region, 2020-2033 (USD Billion) (Units)

10. Global Electric Operated, Powered Surgical Tools Market, By Region, 2020-2033 (USD Billion) (Units)

11. Global Pneumatic Operated, Powered Surgical Tools Market, By Region, 2020-2033 (USD Billion) (Units)

12. Global Powered Surgical Tools Market, By Application, 2020-2033 (USD Billion) (Units)

13. Global Cardiothoracic Surgery, Powered Surgical Tools Market, By Region, 2020-2033 (USD Billion) (Units)

14. Global Orthopaedic Surgery, Powered Surgical Tools Market, By Region, 2020-2033 (USD Billion) (Units)

15. Global Others, Powered Surgical Tools Market, By Region, 2020-2033 (USD Billion) (Units)

16. Global Spine and Neuro Surgery, Powered Surgical Tools Market, By Region, 2020-2033 (USD Billion) (Units)

17. Global Powered Surgical Tools Market, By Voltage, 2020-2033 (USD Billion) (Units)

18. Global Ambulatory Surgical Centers, Powered Surgical Tools Market, By Region, 2020-2033 (USD Billion) (Units)

19. Global Hospitals, Powered Surgical Tools Market, By Region, 2020-2033 (USD Billion) (Units)

20. Global Others, Powered Surgical Tools Market, By Region, 2020-2033 (USD Billion) (Units)

21. Global Powered Surgical Tools Market, By Region, 2020-2033 (USD Billion) (Units)

22. North America Powered Surgical Tools Market, By Product, 2020-2033 (USD Billion) (Units)

23. North America Powered Surgical Tools Market, By Technology, 2020-2033 (USD Billion) (Units)

24. North America Powered Surgical Tools Market, By Application, 2020-2033 (USD Billion) (Units)

25. North America Powered Surgical Tools Market, By Voltage, 2020-2033 (USD Billion) (Units)

26. U.S. Powered Surgical Tools Market, By Product, 2020-2033 (USD Billion) (Units)

27. U.S. Powered Surgical Tools Market, By Technology, 2020-2033 (USD Billion) (Units)

28. U.S. Powered Surgical Tools Market, By Application, 2020-2033 (USD Billion) (Units)

29. U.S. Powered Surgical Tools Market, By Voltage, 2020-2033 (USD Billion) (Units)

30. Canada Powered Surgical Tools Market, By Product, 2020-2033 (USD Billion) (Units)

31. Canada Powered Surgical Tools Market, By Technology, 2020-2033 (USD Billion) (Units)

32. Canada Powered Surgical Tools Market, By Application, 2020-2033 (USD Billion) (Units)

33. Canada Powered Surgical Tools Market, By Voltage, 2020-2033 (USD Billion) (Units)

34. Mexico Powered Surgical Tools Market, By Product, 2020-2033 (USD Billion) (Units)

35. Mexico Powered Surgical Tools Market, By Technology, 2020-2033 (USD Billion) (Units)

36. Mexico Powered Surgical Tools Market, By Application, 2020-2033 (USD Billion) (Units)

37. Mexico Powered Surgical Tools Market, By Voltage, 2020-2033 (USD Billion) (Units)

38. Europe Powered Surgical Tools Market, By Product, 2020-2033 (USD Billion) (Units)

39. Europe Powered Surgical Tools Market, By Technology, 2020-2033 (USD Billion) (Units)

40. Europe Powered Surgical Tools Market, By Application, 2020-2033 (USD Billion) (Units)

41. Europe Powered Surgical Tools Market, By Voltage, 2020-2033 (USD Billion) (Units)

42. Germany Powered Surgical Tools Market, By Product, 2020-2033 (USD Billion) (Units)

43. Germany Powered Surgical Tools Market, By Technology, 2020-2033 (USD Billion) (Units)

44. Germany Powered Surgical Tools Market, By Application, 2020-2033 (USD Billion) (Units)

45. Germany Powered Surgical Tools Market, By Voltage, 2020-2033 (USD Billion) (Units)

46. France Powered Surgical Tools Market, By Product, 2020-2033 (USD Billion) (Units)

47. France Powered Surgical Tools Market, By Technology, 2020-2033 (USD Billion) (Units)

48. France Powered Surgical Tools Market, By Application, 2020-2033 (USD Billion) (Units)

49. France Powered Surgical Tools Market, By Voltage, 2020-2033 (USD Billion) (Units)

50. U.K. Powered Surgical Tools Market, By Product, 2020-2033 (USD Billion) (Units)

51. U.K. Powered Surgical Tools Market, By Technology, 2020-2033 (USD Billion) (Units)

52. U.K. Powered Surgical Tools Market, By Application, 2020-2033 (USD Billion) (Units)

53. U.K. Powered Surgical Tools Market, By Voltage, 2020-2033 (USD Billion) (Units)

54. Italy Powered Surgical Tools Market, By Product, 2020-2033 (USD Billion) (Units)

55. Italy Powered Surgical Tools Market, By Technology, 2020-2033 (USD Billion) (Units)

56. Italy Powered Surgical Tools Market, By Application, 2020-2033 (USD Billion) (Units)

57. Italy Powered Surgical Tools Market, By Voltage, 2020-2033 (USD Billion) (Units)

58. Spain Powered Surgical Tools Market, By Product, 2020-2033 (USD Billion) (Units)

59. Spain Powered Surgical Tools Market, By Technology, 2020-2033 (USD Billion) (Units)

60. Spain Powered Surgical Tools Market, By Application, 2020-2033 (USD Billion) (Units)

61. Spain Powered Surgical Tools Market, By Voltage, 2020-2033 (USD Billion) (Units)

62. Asia Pacific Powered Surgical Tools Market, By Product, 2020-2033 (USD Billion) (Units)

63. Asia Pacific Powered Surgical Tools Market, By Technology, 2020-2033 (USD Billion) (Units)

64. Asia Pacific Powered Surgical Tools Market, By Application, 2020-2033 (USD Billion) (Units)

65. Asia Pacific Powered Surgical Tools Market, By Voltage, 2020-2033 (USD Billion) (Units)

66. Japan Powered Surgical Tools Market, By Product, 2020-2033 (USD Billion) (Units)

67. Japan Powered Surgical Tools Market, By Technology, 2020-2033 (USD Billion) (Units)

68. Japan Powered Surgical Tools Market, By Application, 2020-2033 (USD Billion) (Units)

69. Japan Powered Surgical Tools Market, By Voltage, 2020-2033 (USD Billion) (Units)

70. China Powered Surgical Tools Market, By Product, 2020-2033 (USD Billion) (Units)

71. China Powered Surgical Tools Market, By Technology, 2020-2033 (USD Billion) (Units)

72. China Powered Surgical Tools Market, By Application, 2020-2033 (USD Billion) (Units)

73. China Powered Surgical Tools Market, By Voltage, 2020-2033 (USD Billion) (Units)

74. India Powered Surgical Tools Market, By Product, 2020-2033 (USD Billion) (Units)

75. India Powered Surgical Tools Market, By Technology, 2020-2033 (USD Billion) (Units)

76. India Powered Surgical Tools Market, By Application, 2020-2033 (USD Billion) (Units)

77. India Powered Surgical Tools Market, By Voltage, 2020-2033 (USD Billion) (Units)

78. South America Powered Surgical Tools Market, By Product, 2020-2033 (USD Billion) (Units)

79. South America Powered Surgical Tools Market, By Technology, 2020-2033 (USD Billion) (Units)

80. South America Powered Surgical Tools Market, By Application, 2020-2033 (USD Billion) (Units)

81. South America Powered Surgical Tools Market, By Voltage, 2020-2033 (USD Billion) (Units)

82. Brazil Powered Surgical Tools Market, By Product, 2020-2033 (USD Billion) (Units)

83. Brazil Powered Surgical Tools Market, By Technology, 2020-2033 (USD Billion) (Units)

84. Brazil Powered Surgical Tools Market, By Application, 2020-2033 (USD Billion) (Units)

85. Brazil Powered Surgical Tools Market, By Voltage, 2020-2033 (USD Billion) (Units)

86. Middle East and Africa Powered Surgical Tools Market, By Product, 2020-2033 (USD Billion) (Units)

87. Middle East and Africa Powered Surgical Tools Market, By Technology, 2020-2033 (USD Billion) (Units)

88. Middle East and Africa Powered Surgical Tools Market, By Application, 2020-2033 (USD Billion) (Units)

89. Middle East and Africa Powered Surgical Tools Market, By Voltage, 2020-2033 (USD Billion) (Units)

90. UAE Powered Surgical Tools Market, By Product, 2020-2033 (USD Billion) (Units)

91. UAE Powered Surgical Tools Market, By Technology, 2020-2033 (USD Billion) (Units)

92. UAE Powered Surgical Tools Market, By Application, 2020-2033 (USD Billion) (Units)

93. UAE Powered Surgical Tools Market, By Voltage, 2020-2033 (USD Billion) (Units)

94. South Africa Powered Surgical Tools Market, By Product, 2020-2033 (USD Billion) (Units)

95. South Africa Powered Surgical Tools Market, By Technology, 2020-2033 (USD Billion) (Units)

96. South Africa Powered Surgical Tools Market, By Application, 2020-2033 (USD Billion) (Units)

97. South Africa Powered Surgical Tools Market, By Voltage, 2020-2033 (USD Billion) (Units)

List of Figures

1. Global Powered Surgical Tools Market Segmentation

2. Powered Surgical Tools Market: Research Methodology

3. Market Size Estimation Methodology: Bottom-Up Approach

4. Market Size Estimation Methodology: Top-Down Approach

5. Data Triangulation

6. Porter’s Five Forces Analysis

7. Value Chain Analysis

8. Global Powered Surgical Tools Market Attractiveness Analysis By Product

9. Global Powered Surgical Tools Market Attractiveness Analysis By Technology

10. Global Powered Surgical Tools Market Attractiveness Analysis By Application

11. Global Powered Surgical Tools Market Attractiveness Analysis By Voltage

12. Global Powered Surgical Tools Market Attractiveness Analysis By Region

13. Global Powered Surgical Tools Market: Dynamics

14. Global Powered Surgical Tools Market Share By Product (2024 & 2033)

15. Global Powered Surgical Tools Market Share By Technology (2024 & 2033)

16. Global Powered Surgical Tools Market Share By Application (2024 & 2033)

17. Global Powered Surgical Tools Market Share By Voltage (2024 & 2033)

18. Global Powered Surgical Tools Market Share By Regions (2024 & 2033)

19. Global Powered Surgical Tools Market Share by Company (2023)

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. The Brainy Insights has segmented the global Powered Surgical Tools market based on below-mentioned segments:

Global Powered Surgical Tools Market by Product:

Global Powered Surgical Tools Market by Technology:

Global Powered Surgical Tools Market by Application:

Global Powered Surgical Tools Market by End User:

Global Powered Surgical Tools Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date