- +1-315-215-1633

- sales@thebrainyinsights.com

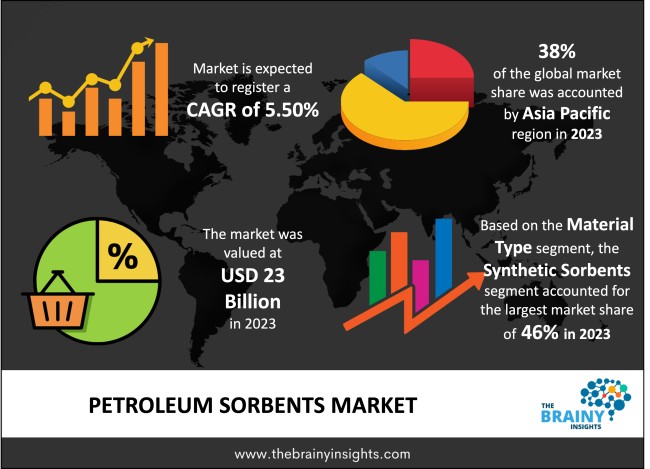

The global petroleum sorbents market was valued at USD 23 billion in 2023 and grew at a CAGR of 5.50% from 2024 to 2033. The market is expected to reach USD 39.28 billion by 2033. The increasing incidence of oil spills will drive the growth of the global petroleum sorbents market.

Petroleum sorbent can be defined as a substance that can absorb petroleum, primarily oil, from surfaces or other media. These sorbents are primarily developed to absorb and recover oil and other hydrocarbon liquids and derivatives from water, ground, and other affected territories. The main application of petroleum sorbents is to soak the oil and enclose it within their matrix, making it easier to collect and preventing any more harm than an oil spillage. These sorbents could be produced from natural materials, such as cotton, wool, peat, etc., and synthetic materials, such as polypropylene, polyurethane and other polymers. Natural sorbents are eco-friendly materials and are mostly used in environment-friendly applications. On the other hand, synthetic sorbents still have higher absorption capacity values than natural sorbents, making them suitable for use in some industries. Petroleum sorbents are primarily categorized into three types: Among these three types of functional sorbents are effective sorbents, non-polar sorbents, polar sorbents, absorptive, adsorptive, and reactive sorbents. There are absorptive sorbents that envelop the oil and adsorptive sorbents that have an affinity for sticking on the outer layer surface of the oil. The last ones are called reactive ones, which are relatively younger, interact with the oil chemically and decompose the oil or form a new solid more amenable to removal. These materials are useful for preventing the other effects of oil spills in different ecosystems, such as marine, riverine and terrestrial ecosystems. They are applied to different industries, from marine to industrial and even automotive. Petroleum sorbents vary in efficiency depending on the selected sorbent material, the type of petroleum product, and environmental conditions. Petroleum sorbents have been in demand due to environmental consciousness and new legislation.

Get an overview of this study by requesting a free sample

The increasing incidence of oil spills and rising environmental concerns – The primary reason for the growing use of petroleum sorbents is the rate at which people are becoming more conscious of the damage that goes along with oil spills to the environment. Accidental oil releases, especially in aquatic ecosystems, pollute wildlife and the ecosystem for a long time. Recently, pollution and climatic change have wreaked havoc in the world; hence, conservation of natural resources has become critical. The increased concern about the effects of oil spills and pollution of the environment has forced an increase in the search for environmentally sensitive and efficient methods of handling and addressing spills. The importance of petroleum sorbents lies in their containment of oil, hence aiding in faster absorption and preventing or reducing the impact of pollution on marine life. Governments have been gradually developing even stricter regulations for spill readiness and response. Such regulations require industries to have the capability to contain and clean up oil spills, and this has popularized the use of petroleum sorbents. For instance, maritime laws specify that ships or rigs like offshore oil installations must be provided with the response equipment.

High costs of petroleum sorbents – Fine pore sorbents, including polypropylene, polyurethane or nanomaterial-based products, are sometimes more costly because of the extensive fabrication processes and cost of the materials used. These sorbents present higher oil absorption capacities and efficiency. However, their costs may be considerably higher than others, making it difficult for small companies or industries to apply them. Besides the purchase price, other costs, such as the maintenance, disposal, and replacement of these sorbents, form part of the overall costs required to meet the environmental compliance standards. To industries located in areas with limited amounts of money or industries in fields where the initial capital is rather limited to an amount, the price of petroleum sorbents poses a major disadvantage. At other times, companies prefer suboptimal, cheaper spill management solutions, albeit with high long-term environmental and operational costs. Furthermore, the availability of good quality petroleum sorbents restricts access for many industry players and will hamper the market's growth.

Enhancements in sorbent technologies – The extensive use of petroleum sorbents has been further improved by the enhanced development of sorbent technology, thus contributing to their use. The development of more effective materials also contributes to the market’s growth. Synthetic sorbents can pick up several times their weight in oil, effectively cleaning up oil spills. In addition, the development of nanotechnology has resulted in the synthesis of nanomaterial-based sorbents, which are known to exhibit extraordinary absorption ability because of their large surface area and fine porosity. Another important innovation is that biodegradable sorbents are beginning to be used in the sciences. Increasing requirements for more sustainable products and solutions have led to environmentally friendly materials with the help of advancing sorbent technology, including plant-based fibre, natural rubber, algae, etc. Therefore, sorbent technology enhancements will drive the industry's development and growth during the forecast period.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. Asia Pacific emerged as the most significant global petroleum sorbents market, with a 38% market revenue share in 2023.

Asia-Pacific is the largest consuming region, as the region is diverse with increased industrialization, oil and gas drilling expansion, and transportation industries in countries such as China, India, Japan and South Korea. The region has developed into the epicentre of oil production, processing and transportation; hence, there is an immense requirement for capable, efficient mechanisms for the management of oil spill incidents. Several Asian-Pacific countries are among the largest imports as well as the exporters of petroleum products, and as such, are heavily dependent on the oil and gas industry that classifies petroleum sorbents as indispensable tools for managing the associated dangers tied to leaks and spills, mainly in the offshore and industrial settings. The large market share of Asia-Pacific is also due to the shipping industry and maritime in general. Its key ports and shipping lanes are in Asian countries, including China, Singapore, and Japan. This creates high environmental risks, especially through oil spills, hence the need to import more petroleum sorbents. Stringent requirements and measures by environmental acts like the MARPOL compel shipping companies in this region to possess optimal spill-combating capacity, including petroleum sorbents.

Asia Pacific Region Petroleum Sorbents Market Share in 2023 - 38%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The material type segment is divided into natural sorbents, synthetic sorbents and biodegradable sorbents. The synthetic sorbents segment dominated the market, with a share of around 46% in 2023. Organosols and other synthetic sorbents derived from petroleum are leading the market owing to their efficacy, adaptability and comparison. These sorbents often include polypropylene, polyurethane, or other polymers, which are superior to natural and biodegradable equivalents. Synthetic sorbents can absorb oil many times its weight, making them useful in large-scale oil spills. Their flexibility allows them to soak up both thin and thick oils and withstand tough weather conditions, making them a favourite among many industries. Synthetic sorbents are also more robust to degradation than natural sorbents; they have a much longer life cycle and can be regenerated and used after washing. Moreover, escalations in the management activities of oil spills within industries such as oil and gas, shipping, and offshore drilling have boosted demand for synthetic sorbents.

The product type segment is divided into pads, booms, rolls, pillows, and granules. The granules segment dominated the market, with a market share of around 44% in 2023. Granules hold the largest share of the petroleum sorbents market because they can be used in almost all the response types, have the biggest absorption capability, and are quite easy to use. As opposed to the forms that are either in pads, booms, or others, granules are used for onshore and offshore purposes and are, therefore, used universally. Due to their particle size, it is relatively easy to distribute them over contaminated surfaces or simply pour the substance directly into the affected zone so that it quickly absorbs the oil. Thus, the ease of application of the formulated granules is complimented by its coverage of large surface areas, making it ideal for large-scale messes, most especially in industrial environments or remote inaccessible areas where quick containment and absorption are the order of the day. These sorbents can collect a vast amount of the oil in proportion to their weight, and the material's structure enables the maximum possible degree of oil absorption regardless of the extremely rigorous conditions.

The application segment is divided into marine, industrial, land, automotive and oil refineries. The oil refineries segment dominated the market, with a market share of around 38% in 2023. Refineries are big infrastructures which transform crude oil into different products, meaning that the danger of oil leakage, spillage and handling of hazardous materials is potentially imminent all the time. Therefore, to ensure safe operation, compliance with the requirements of current legislation, and minimisation of the negative impact on the environment, it is necessary to monitor the effectiveness of oil collection and prevent its leakage into the environment. Refineries, therefore, require petroleum sorbents to mitigate these risks when they occur. The major factor that can initialize the domination of oil refineries in the petroleum sorbent market is the heavy and repeated usage of the sorbents in operations, maintenance, and during incidents. Processing plants, especially refineries, work with high volumes of oils and refined petroleum products and stand high risks of spilling.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2023 | USD 23 Billion |

| Market size value in 2033 | USD 39.28 Billion |

| CAGR (2024 to 2033) | 5.50% |

| Historical data | 2020-2022 |

| Base Year | 2023 |

| Forecast | 2024-2033 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Material Type, Product Type and Application |

As per The Brainy Insights, the size of the global petroleum sorbents market was valued at USD 23 billion in 2023 to USD 39.28 billion by 2033.

Global petroleum sorbents market is growing at a CAGR of 5.50% during the forecast period 2024-2033.

The market's growth will be influenced by the increasing incidence of oil spills and rising environmental concerns.

High costs of petroleum sorbents could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. The Brainy Insights has segmented the global petroleum sorbents market based on below mentioned segments:

Global Petroleum Sorbents Market by Material Type:

Global Petroleum Sorbents Market by Product Type:

Global Petroleum Sorbents Market by Application:

Global Petroleum Sorbents Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date