- +1-315-215-1633

- sales@thebrainyinsights.com

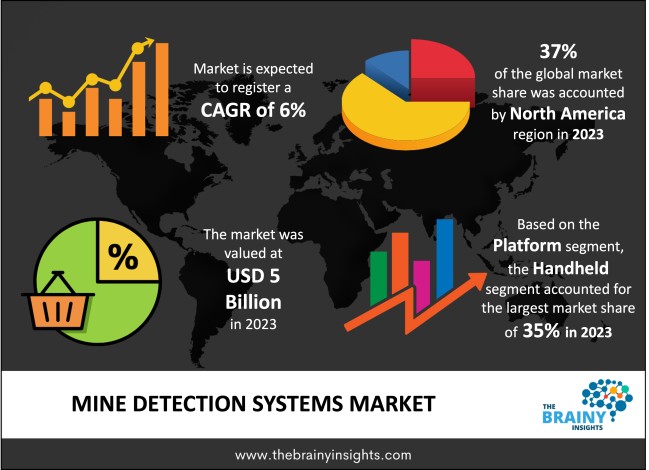

The global mine detection systems market was valued at USD 5 billion in 2023 and grew at a CAGR of 6% from 2024 to 2033. The market is expected to reach USD 8.95 billion by 2033. The growing concerns about unexploded mines from historical wars will drive the growth of the global mine detection systems market.

Mine detection systems are modern tools which help in identifying and locating mines and unexploded ordnance, which are essential for humanitarian and military purposes. The mentioned systems consist of metal detectors, ground penetrating radar GPR, acoustic technique, infrared and thermal imaging, and biological detectors. Metal detectors locate metallic mines using differences in magnetic fields while the GPR employs the radar sections to give an image of the ground surface as it searches for mines. The acoustic methods determine the intensity of sound waves for identifying objects beneath the surface and the infrared and thermal imaging recognize differences in temperature on the surface due to presence of mines. Biological detection is largely done through animals like dogs that have undergone training in how to detect explosive compounds through their smelling sense. Plants also exhibit change in response to presence of explosive compounds. The optimization of these systems is made possible by integration with robotics and automation.

Get an overview of this study by requesting a free sample

Increasing humanitarian efforts to demine conflict zones – land mines and unidentified UXO are threats to civilian life and impede utilization of terrain. Several organizations advocate for efficiency in the mine clearance in order to enhance safety and reconstruction. In the military and defence industry the product demand is widely driven by the necessity to increase efficiency in dangerous conditions by using highly effective mine detection systems increasing the safety and performance of troops. Similarly, commercial and industrial land use plays a significant role since land used in conflict is depressed and requires to be developed. Infrastructure developments such as construction of roads and industrial development necessitates appropriate mine identification so as to avoid incidences during developments and usage of the land.

High costs of mine detection systems – High costs include the costs related to installation of new sophisticated systems like GPR and robotics systems, costs for maintenance and the operating costs. Personnel have to be trained on how to operate these technologies, which is another cost factor. The problem of accuracy and sensitivity, along with other limitations in technologies such as restrictions in operating in certain soil types of with certain non-metallic ammunition will also limit the market’s growth. The use of multiple technologies to increase the accuracy of the system makes it to be complex and expensive.

Government and regulatory policies – Technological advancements refer to advances in detection instruments including, better Metal detectors, Ground penetrating radars (GPRs) and electromagnetic sensors as they are more accurate and reduce false alarms. Incorporation of robotics and automation has enhanced the efficiency of mine detection and removal without exposing human beings to danger. Another factor therefore enhancing the market through regulations is government and regulatory policies which offer funding and grants towards demining processes as well as demand adherence to stringent rules facilitating such processes. This support assists in obtaining and improving the specialised technologies for mine detection and implementing the safety and humanitarian norms. Awareness and advocacy campaigns launched by various International and National Non-Governmental Organizations, humanitarian organizations and other stakeholders also augment the market’s market. Such initiatives foster the public and governmental support for mine clearance initiatives hence creating a market for efficient detection devices.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most significant global mine detection systems market, with a 37% market revenue share in 2023.

There is focus on research and development among the countries in the region to enhance mine detection technologies. North America is home to key players and organizations whose main specialization is the creation of hi-tech systems for vehicles like Ground Penetrating Radar (GPR), robotic units, and upgraded metal detectors with high-budget investments in technology and defence industries. North American military and defence leadership also augments the market’s growth. North American governments as well as NGOs are heavily involved with financing and implementing humanitarian mine clearance programmes in addition to offering personnel and material support to these areas. For a long time, North America’s partnerships and collaborations with international bodies also enhance the regional market’s growth.

North America Region Mine Detection Systems Market Share in 2023 - 37%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The platform segment is divided into vehicle mounted, ship mounted, airborne mounted, and handheld. The handheld segment dominated the market, with a market share of around 35% in 2023. Handheld mine detection systems can be deployed in different locations – urban infrastructures, rural areas and other closed spaces. They provide accurate detection features. Pricing is another reason for their dominance as they are comparatively affordable. Another advantage of handheld systems is that they have relatively low costs and this makes them versatile for use. They also have less operational costs as they don’t require specifically fitted vehicles or complex network. Ease of use also bodes well for the segment. The handheld systems are quite compact in size and thus flexible to manoeuvre in areas that have tough terrains for operators to survey. Also, it is easy to operate and explain to personnel for optimal usage.

The technology segment is divided into ground penetration radar, microwave radiometer, metal detector, and others. The metal detector segment dominated the market, with a market share of around 38% in 2023. Metal detectors have the largest market share in the mine detection systems market since they are efficient, cheap and easy to use. metal detectors are very efficient in detecting the metallic part of the LMOs like casings and fuses regardless of the depth of burial. Owing to their high sensitivity and measures of discrimination they are ideal to be used in detecting various types of mines. Metal detectors are considerably cheaper due to which they are more mobile, affordable to different stakeholders – from NGOs to local demining teams. Operational expenses are lower too and due to this they do not need highly sophisticated equipment and parts to sustain. Metal detectors themselves are easy to use, they are based on rather simple principles and therefore the training usually does not take a lot of either time or effort. Their mobility makes it easier to deploy them especially in regions with numerous structures, and regions with huge open fields.

The type of mines segment is divided into landmine, unexploded ordnance, abandoned ordnance, IED, and others. The landmine segment dominated the market, with a market share of around 39% in 2023. The alarmingly high prevalence of landmines drives the segment’s dominance. the immense danger they present to civilian lives and due to the disruption, they present in the lives of the affected communities there is emphasis placed on identifying and eliminating them. Detection technologies such as ‘metal detectors and Ground Penetrating Radar (GPR) are particularly designed to fit the challenges posed by landmines. Most of the mine detection methods and training strategies have been developed with landmines in mind in order to maximize effectiveness of technologies used. Several treaties and conventions focus on issues of removing landmines and thus, there are sizeable funds and attention to these concerns.

The end user segment is divided into military, law enforcement, and others. The military segment dominated the market, with a market share of around 45% in 2023. The Military is the largest application segment worldwide for mine detection systems due to the large-scale usage in war zones and a constant requirement for better technologies. The principal use of the mine detection systems in military contexts involves facilitation of safe movements and conduct of operations in areas affected by landmines and UXO. These systems are important for demining in the post war theatres, in which they have the major responsibility of ensuring security of regions, guarding civilian populace and supporting rebuilding processes. Due to large financial commitment towards mine detection devices and systems including Ground Penetrating Radar (GPR) systems, robotic devices, and updated metal detectors, the military creates the requirements for the development of better technologies. This investment is unique due to the necessity for accurate and effective mine detection in military environments.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2023 | USD 5 Billion |

| Market size value in 2033 | USD 8.95 Billion |

| CAGR (2024 to 2033) | 6% |

| Historical data | 2020-2022 |

| Base Year | 2023 |

| Forecast | 2024-2033 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Platform, Technology, Type of Mines and End User |

As per The Brainy Insights, the size of the global mine detection systems market was valued at USD 5 billion in 2023 to USD 8.95 billion by 2033.

Global mine detection systems market is growing at a CAGR of 6% during the forecast period 2024-2033.

The market's growth will be influenced by increasing humanitarian efforts to demine conflict zones.

High costs of mine detection systems could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. The Brainy Insights has segmented the global mine detection systems market based on below mentioned segments:

Global Mine Detection Systems Market by Platform:

Global Mine Detection Systems Market by Technology:

Global Mine Detection Systems Market by Type of Mines:

Global Mine Detection Systems Market by End User:

Global Mine Detection Systems Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date