- +1-315-215-1633

- sales@thebrainyinsights.com

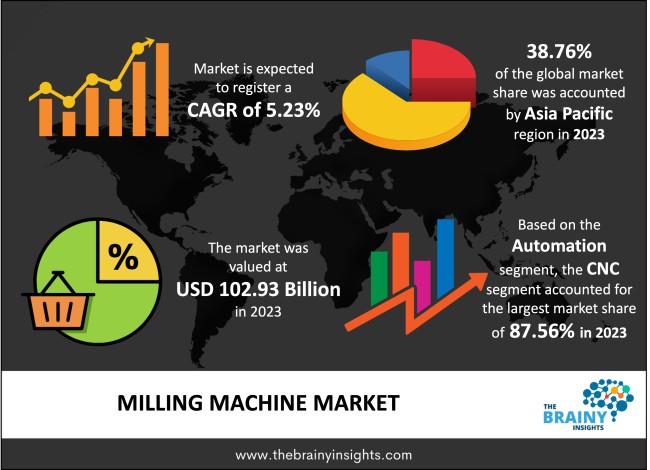

The global Milling Machine market was valued at USD 102.93 Billion in 2023 and growing at a CAGR of 5.23% from 2023 to 2033. The market is expected to reach USD 171.38 Billion by 2033. There is a demand for superior quality products and CNC (compute numerical control) machines, propelling the market's growth. Milling machine tools help develop complex shapes and products conveniently and easily, and they help industries develop superior-quality products with improved dimensional accuracy. Milling machines are used to cut, bore gears, create slots and drill. Milling is also used for machine-curved surfaces. These are some of the factors which are fueling the Milling Machine market.

There is a surge in the demand for passenger cars and commercial vehicles, which eventually is driving the milling machine market. Also, the popularity of CNC machines is growing, which is also helping the growth of the market as the demand for automation is growing at a fast pace. Milling machines, especially horizontal ones, provide better accuracy and precision; hence, these are broadly used in the aerospace and automotive sectors. Manufacturers are looking for new technologies to enhance products; hence, the demand for milling machines and other machine tools is growing. It can accommodate several materials, such as metals, ceramics and engineered materials. It makes it easier for the manufacturers to choose from several materials based on their requirements. Hence, milling machines are broadly used in the aerospace sector, commercial, automotive, medical, electronics, transportation, and telecommunications. In the aerospace sector, CNC milling machines make lightweight flight parts of the best quality. These milling machines offer exact and accurate parts that act as replacements, prototypes, fuel bodies, transmissions, manifolds, and aircraft structures.

Similarly, machines, especially CNC milling, have broad applications in the automotive sector, from engine blocks to cylinders, water pumps, piston rods, etc. It is the main technique used in the making of OEM parts. It applies to making parts like interior lighting and car headlights. These machine tools are also used to make sterile and safe equipment in the medical field. Also, equipment such as biopsy tubes, hip stems, bone screws, reamers, spacers, hip cups, inserts and mould cavities are produced using the milling machines. All players depend on CNC milling machines to manufacture essential components like turbines, valves, gears, fuel pumps and gearboxes in the renewable and non-renewable energy sectors. Milling is also required to make precision parts for the military sector. Its application ranges from gun components to firearms, drones, UAVs and pistol locking. The electronics sector is also broadly dependent on CNC machines as they have applications for the electronic components of car parts, laptops, televisions, CPUs, mobile phones, smartphones, and sound systems, among others. All these factors are driving the use of milling machines market.

Get an overview of this study by requesting a free sample

Growing demand for milling machines in Industries – The milling machine has applications in several sectors. It is used in the production of mechanized agriculture equipment; the use of CNC machines helps create several parts in the agriculture sector, like transmission housings, gearboxes, incubator components, etc. Milling machines are playing a big role in the manufacturing sector. For instance, many appliances and gadgets are manufactured in the electronic sector using CNC milling machines. It has applications in making smartphone parts, HDTV components, automotive parts, mainframes, etc. It is also broadly used in the food production and processing sector as it provides efficiency and effectiveness in processing several types of grains like wheat, rice, corn and oats, among others. It also processes other food products, such as many species and flour. These factors are eventually driving the Milling Machine market.

Shortage of skilled professionals – Milling machines make more noise, which can contribute to noise pollution and hinder their adoption in some places. Also, a shortage of skilled professionals can lead to many injuries and slow adoption in many sectors. Also, awareness of worker safety in such situations can lead to its use in limited numbers. All these factors are acting as restraints for the market.

Growing demand for automation in machine tools – It has been observed that machine plants are switching towards automation and smart milling to decrease human involvement in work. The automated milling machines provide the best possible capacity and efficiency. These milling machines are integrated with CNC machine tools, which automate the process and decrease the need for labour. It also increases the production rate. CNC milling machine leads to high production rates and decreased labour costs. It results in the most efficient and cost-effective operation. In the future, AI and machine learning will also be involved in the CNC milling machine. It will help optimize the tool paths for the best surface finish or fastest cycle time. All these factors eventually drive the Milling Machine market in the forecasting period.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. Asia Pacific emerged as the largest market for the global Milling Machine market, with a 38.76% share of the market revenue in 2023. It is attributed to the leading organizations in the region. Also, many government initiatives like “Make in India” and “Skill India” by the government of India further propel the machine tools that eventually drive the milling machines in the region. China is considered the largest producer of machine tools. Also, there is a growing adoption of automation due to the ageing population of Japan and China. It contributes to the growing demand for automated systems like CNC milling machines. It is further pushing the market to grow in the region.

Asia Pacific Region Milling Machine Market Share in 2023 - 38.76%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The automation segment is divided into conventional and CNC. The CNC segment dominated the market, with a market share of around 87.56% in 2023. It has been observed that most OEMs in the automotive sector use CNC milling machines, which help create the complete part of the vehicle. It is also used to produce motorcycle parts, engine spare parts, etc. Also, many of the key equipment and tools like cavities moulds, hip stems and prosthetics which are used in the medical sector are produced using a CNC milling machine.

The type segment is divided into horizontal and vertical. Horizontal segment dominated the market, with a market share of around 62.11% in 2023. This significant market share is attributed to the surge in the preference for horizontal milling machines. These horizontal mills are best for cutting heavier and deeper groves in the material. This type is broadly preferred as it has higher speed and quick turnaround time, even in the case of large projects. Also, it makes faster cuts in comparison to vertical mills without losing the detail and precision required.

The end user segment is divided into automotive, aerospace & defence, construction equipment, power and energy, industrial and others. Industrial segment dominated the market, with a market share of around 28.31% in 2023. It is attributed to the broad use of horizontal milling machines in many result-oriented operations. Also, there has been a surge in the production of several goods, such as consumer electronics and household appliances, which led to the highest market share of the industrial segment.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2023 | USD 102.93 Billion |

| Market size value in 2033 | USD 171.38 Billion |

| CAGR (2024 to 2033) | 5.23% |

| Historical data | 2020-2022 |

| Base Year | 2023 |

| Forecast | 2024-2033 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East & Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Automation, Type and End User |

Asia Pacific region emerged as the largest market for the Milling Machine.

The market's growth will be influenced by growing demand for milling machines in Industries.

Shortage of skilled professionals could hamper the market growth.

Growing demand for automation in machine tools will provide huge opportunities to the market.

1. Introduction

1.1. Objectives of the Study

1.2. Market Definition

1.3. Research Scope

1.4. Currency

1.5. Key Target Audience

2. Research Methodology and Assumptions

3. Executive Summary

4. Premium Insights

4.1. Porter’s Five Forces Analysis

4.2. Value Chain Analysis

4.3. Top Investment Pockets

4.3.1. Market Attractiveness Analysis By Automation

4.3.2. Market Attractiveness Analysis By Type

4.3.3. Market Attractiveness Analysis By End User

4.3.4. Market Attractiveness Analysis By Region

4.4. Industry Trends

5. Market Dynamics

5.1. Market Evaluation

5.2. Drivers

5.2.1. Growing demand for milling machines in Industries

5.3. Restraints

5.3.1. Shortage of skilled professionals

5.4. Opportunities

5.5. Growing demand for automation in machine tools Challenges

5.5.1. Economic slowdown

6. Global Milling Machine Market Analysis and Forecast, By Automation

6.1. Segment Overview

6.2. Conventional

6.3. CNC

7. Global Milling Machine Market Analysis and Forecast, By Type

7.1. Segment Overview

7.2. Horizontal

7.3. Vertical

8. Global Milling Machine Market Analysis and Forecast, By End User

8.1. Segment Overview

8.2. Automotive

8.3. Aerospace & Defence

8.4. Construction Equipment

8.5. Power and Energy

8.6. Industrial

8.7. Others

9. Global Milling Machine Market Analysis and Forecast, By Regional Analysis

9.1. Segment Overview

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.2.3. Mexico

9.3. Europe

9.3.1. Germany

9.3.2. France

9.3.3. U.K.

9.3.4. Italy

9.3.5. Spain

9.4. Asia-Pacific

9.4.1. Japan

9.4.2. China

9.4.3. India

9.5. South America

9.5.1. Brazil

9.6. Middle East and Africa

9.6.1. UAE

9.6.2. South Africa

10. Global Milling Machine Market-Competitive Landscape

10.1. Overview

10.2. Market Share of Key Players in Global Milling Machine Market

10.2.1. Global Company Market Share

10.2.2. North America Company Market Share

10.2.3. Europe Company Market Share

10.2.4. APAC Company Market Share

10.3. Competitive Situations and Trends

10.3.1. Product Launches and Developments

10.3.2. Partnerships, Collaborations, and Agreements

10.3.3. Mergers & Acquisitions

10.3.4. Expansions

11. Company Profiles

11.1. Hass Automation, Inc.

11.1.1. Business Overview

11.1.2. Company Snapshot

11.1.3. Company Market Share Analysis

11.1.4. Company Product Portfolio

11.1.5. Recent Developments

11.1.6. SWOT Analysis

11.2. Yamazaki Mazak Corporation

11.2.1. Business Overview

11.2.2. Company Snapshot

11.2.3. Company Market Share Analysis

11.2.4. Company Product Portfolio

11.2.5. Recent Developments

11.2.6. SWOT Analysis

11.3. ANDRITZ Group

11.3.1. Business Overview

11.3.2. Company Snapshot

11.3.3. Company Market Share Analysis

11.3.4. Company Product Portfolio

11.3.5. Recent Developments

11.3.6. SWOT Analysis

11.4. Datron Dynamics Inc.

11.4.1. Business Overview

11.4.2. Company Snapshot

11.4.3. Company Market Share Analysis

11.4.4. Company Product Portfolio

11.4.5. Recent Developments

11.4.6. SWOT Analysis

11.5. Anderson Europe GMBH

11.5.1. Business Overview

11.5.2. Company Snapshot

11.5.3. Company Market Share Analysis

11.5.4. Company Product Portfolio

11.5.5. Recent Developments

11.5.6. SWOT Analysis

11.6. Okuma Corporation

11.6.1. Business Overview

11.6.2. Company Snapshot

11.6.3. Company Market Share Analysis

11.6.4. Company Product Portfolio

11.6.5. Recent Developments

11.6.6. SWOT Analysis

11.7. Amera-Seiki

11.7.1. Business Overview

11.7.2. Company Snapshot

11.7.3. Company Market Share Analysis

11.7.4. Company Product Portfolio

11.7.5. Recent Developments

11.7.6. SWOT Analysis

11.8. Buhler Group

11.8.1. Business Overview

11.8.2. Company Snapshot

11.8.3. Company Market Share Analysis

11.8.4. Company Product Portfolio

11.8.5. Recent Developments

11.8.6. SWOT Analysis

11.9. CPM Roskamp Champion

11.9.1. Business Overview

11.9.2. Company Snapshot

11.9.3. Company Market Share Analysis

11.9.4. Company Product Portfolio

11.9.5. Recent Developments

11.9.6. SWOT Analysis

11.10. EMCO Group

11.10.1. Business Overview

11.10.2. Company Snapshot

11.10.3. Company Market Share Analysis

11.10.4. Company Product Portfolio

11.10.5. Recent Developments

11.10.6. SWOT Analysis

11.11. Sprout Waldron & Company

11.11.1. Business Overview

11.11.2. Company Snapshot

11.11.3. Company Market Share Analysis

11.11.4. Company Product Portfolio

11.11.5. Recent Developments

11.11.6. SWOT Analysis

11.12. Hurco Companies

11.12.1. Business Overview

11.12.2. Company Snapshot

11.12.3. Company Market Share Analysis

11.12.4. Company Product Portfolio

11.12.5. Recent Developments

11.12.6. SWOT Analysis

List of Table

1. Global Milling Machine Market, By Automation, 2020-2033 (USD Billion)

2. Global Conventional, Milling Machine Market, By Region, 2020-2033 (USD Billion)

3. Global CNC, Milling Machine Market, By Region, 2020-2033 (USD Billion)

4. Global Milling Machine Market, By End User, 2020-2033 (USD Billion)

5. Global Automotive, Milling Machine Market, By Region, 2020-2033 (USD Billion)

6. Global Aerospace & Defence, Milling Machine Market, By Region, 2020-2033 (USD Billion)

7. Global Construction Equipment, Milling Machine Market, By Region, 2020-2033 (USD Billion)

8. Global Power and Energy, Milling Machine Market, By Region, 2020-2033 (USD Billion)

9. Global Industrial, Milling Machine Market, By Region, 2020-2033 (USD Billion)

10. Global Others, Milling Machine Market, By Region, 2020-2033 (USD Billion)

11. Global Milling Machine Market, By Type, 2020-2033 (USD Billion)

12. Global Horizontal, Milling Machine Market, By Region, 2020-2033 (USD Billion)

13. Global Vertical, Milling Machine Market, By Region, 2020-2033 (USD Billion)

14. North America Milling Machine Market, By Automation, 2020-2033 (USD Billion)

15. North America Milling Machine Market, By End User, 2020-2033 (USD Billion)

16. North America Milling Machine Market, By Type, 2020-2033 (USD Billion)

17. U.S. Milling Machine Market, By Automation, 2020-2033 (USD Billion)

18. U.S. Milling Machine Market, By End User, 2020-2033 (USD Billion)

19. U.S. Milling Machine Market, By Type, 2020-2033 (USD Billion)

20. Canada Milling Machine Market, By Automation, 2020-2033 (USD Billion)

21. Canada Milling Machine Market, By End User, 2020-2033 (USD Billion)

22. Canada Milling Machine Market, By Type, 2020-2033 (USD Billion)

23. Mexico Milling Machine Market, By Automation, 2020-2033 (USD Billion)

24. Mexico Milling Machine Market, By End User, 2020-2033 (USD Billion)

25. Mexico Milling Machine Market, By Type, 2020-2033 (USD Billion)

26. Europe Milling Machine Market, By Automation, 2020-2033 (USD Billion)

27. Europe Milling Machine Market, By End User, 2020-2033 (USD Billion)

28. Europe Milling Machine Market, By Type, 2020-2033 (USD Billion)

29. Germany Milling Machine Market, By Automation, 2020-2033 (USD Billion)

30. Germany Milling Machine Market, By End User, 2020-2033 (USD Billion)

31. Germany Milling Machine Market, By Type, 2020-2033 (USD Billion)

32. France Milling Machine Market, By Automation, 2020-2033 (USD Billion)

33. France Milling Machine Market, By End User, 2020-2033 (USD Billion)

34. France Milling Machine Market, By Type, 2020-2033 (USD Billion)

35. U.K. Milling Machine Market, By Automation, 2020-2033 (USD Billion)

36. U.K. Milling Machine Market, By End User, 2020-2033 (USD Billion)

37. U.K. Milling Machine Market, By Type, 2020-2033 (USD Billion)

38. Italy Milling Machine Market, By Automation, 2020-2033 (USD Billion)

39. Italy Milling Machine Market, By End User, 2020-2033 (USD Billion)

40. Italy Milling Machine Market, By Type, 2020-2033 (USD Billion)

41. Spain Milling Machine Market, By Automation, 2020-2033 (USD Billion)

42. Spain Milling Machine Market, By End User, 2020-2033 (USD Billion)

43. Spain Milling Machine Market, By Type, 2020-2033 (USD Billion)

44. Asia Pacific Milling Machine Market, By Automation, 2020-2033 (USD Billion)

45. Asia Pacific Milling Machine Market, By End User, 2020-2033 (USD Billion)

46. Asia Pacific Milling Machine Market, By Type, 2020-2033 (USD Billion)

47. Japan Milling Machine Market, By Automation, 2020-2033 (USD Billion)

48. Japan Milling Machine Market, By End User, 2020-2033 (USD Billion)

49. Japan Milling Machine Market, By Type, 2020-2033 (USD Billion)

50. China Milling Machine Market, By Automation, 2020-2033 (USD Billion)

51. China Milling Machine Market, By End User, 2020-2033 (USD Billion)

52. China Milling Machine Market, By Type, 2020-2033 (USD Billion)

53. India Milling Machine Market, By Automation, 2020-2033 (USD Billion)

54. India Milling Machine Market, By End User, 2020-2033 (USD Billion)

55. India Milling Machine Market, By Type, 2020-2033 (USD Billion)

56. South America Milling Machine Market, By Automation, 2020-2033 (USD Billion)

57. South America Milling Machine Market, By End User, 2020-2033 (USD Billion)

58. South America Milling Machine Market, By Type, 2020-2033 (USD Billion)

59. Brazil Milling Machine Market, By Automation, 2020-2033 (USD Billion)

60. Brazil Milling Machine Market, By End User, 2020-2033 (USD Billion)

61. Brazil Milling Machine Market, By Type, 2020-2033 (USD Billion)

62. Middle East and Africa Milling Machine Market, By Automation, 2020-2033 (USD Billion)

63. Middle East and Africa Milling Machine Market, By End User, 2020-2033 (USD Billion)

64. Middle East and Africa Milling Machine Market, By Type, 2020-2033 (USD Billion)

65. UAE Milling Machine Market, By Automation, 2020-2033 (USD Billion)

66. UAE Milling Machine Market, By End User, 2020-2033 (USD Billion)

67. UAE Milling Machine Market, By Type, 2020-2033 (USD Billion)

68. South Africa Milling Machine Market, By Automation, 2020-2033 (USD Billion)

69. South Africa Milling Machine Market, By End User, 2020-2033 (USD Billion)

70. South Africa Milling Machine Market, By Type, 2020-2033 (USD Billion)

List of Figures

1. Global Milling Machine Market Segmentation

2. Global Milling Machine Market: Research Methodology

3. Market Size Estimation Methodology: Bottom-Up Approach

4. Market Size Estimation Methodology: Top-Down Approach

5. Data Triangulation

6. Porter’s Five Forces Analysis

7. Value Chain Analysis

8. Global Milling Machine Market Attractiveness Analysis By Automation

9. Global Milling Machine Market Attractiveness Analysis By End User

10. Global Milling Machine Market Attractiveness Analysis By Type

11. Global Milling Machine Market Attractiveness Analysis By Region

12. Global Milling Machine Market: Dynamics

13. Global Milling Machine Market Share By Automation (2023 & 2033)

14. Global Milling Machine Market Share By End User (2023 & 2033)

15. Global Milling Machine Market Share By Type (2023 & 2033)

16. Global Milling Machine Market Share By Regions (2023 & 2033)

17. Global Milling Machine Market Share By Company (2023)

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. The Brainy Insights has segmented the global Milling Machine market based on below mentioned segments:

Global Milling Machine Market by Automation:

Global Milling Machine Market by Type:

Global Milling Machine Market by End User:

Global Milling Machine by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date