- +1-315-215-1633

- sales@thebrainyinsights.com

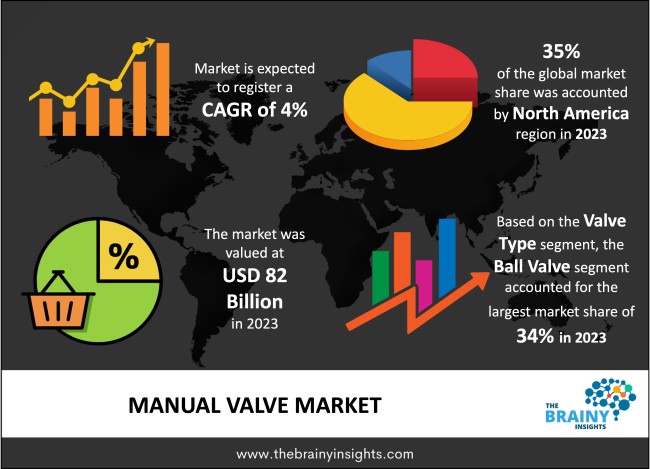

The global manual valve market was valued at USD 82 billion in 2023 and grew at a CAGR of 4% from 2024 to 2033. The market is expected to reach USD 121.38 billion by 2033. The stringent safety regulations will drive the growth of the global manual valve market.

A manual valve is an important element and hardware in the piping system responsible for the realistic regulation of streams containing liquids or gasses and other bulk materials. On these valves, operation necessitates the use of manpower instead of automated systems or electrical power. The manual valves are widely employed in oil and gas industry, chemical industry, water treatment process, HVAC systems etc., where close control over the flow of fluids and gases is needed. Manual valve generally has a handle, a lever or a wheel through which the operator can open, close or control the valve. A valve is mechanically operated on a site by the operator to start the flow, stop the flow, regulate pressure, and manage the amount of fluid passing through. While for some types of the valves the operation is as basic as opening or closing, more complex operations such as throttling or pressure control may be involved in others. These types of valves include ball valves, gate valves, globe valves and butterfly valves, each having individual working and depending on the application. For instance, ball valves are chosen because they provide fast opening and closing functionality and also leak-tight shut off while globe valves are considered to be best suited for flow control because they make gradual changes to the flow in small steps. Manual valves give benefits of ease of application, economy, and efficiency where the systems are modest or uncomplicated.

Get an overview of this study by requesting a free sample

The higher safety and ease of operation associated with manual valve – Manual valves are mostly in high demand due to its affordability, coupled with the fact that they can be used in simple systems, or by corporations that may not be able to afford complex systems. Manual valves are cheaper than automated valves as they do not incorporate expensive control systems, sensors, and power sources. A number of industries may not require automation and manual valves can be used in them. also, they do not require much investment upfront and little maintenance makes them perfect for small companies or factories. Furthermore, their simplicity overcomes many installation problems and enhances the cost advantages of the integrated structures. One of the other factors that have boosted their demand includes is its cost-effectiveness. They are often simple in construction with no electricity and other components external to the valve.

The growing automation of industries – In the sectors where speed, timeliness and high throughput is paramount, automation has become a necessity. Another advantage of automated valves is that they are usually part of extensive control systems to monitor and control them remotely – an element that tremendously improves efficiency. Finally, process control can also be efficiently carried out with automated systems, including flow rate manipulation, pressure and temperature measurement as well as interface with general process control systems. These capabilities provide a degree of control over the flow rates, thereby allowing the system the be managed within the desired range. Needs such as real-time data and remote operation in industries including the Internet of Things (IoT) are also driving the market away from manual valves. As the new and more intelligent systems are adopted by the industries the market for manual valves is gradually being driven out by the better and more efficient systems.

Stringent safety regulations – In some applications, the authorities demand valves that should be opened or closed manually so that control stays with the human who can directly monitor the process. Furthermore, these manual valves are very flexible. These valves are specifically designed to handle very high pressures, under both high and low temperatures. They are also used often because they have long lifespans and can work so well even in more challenging conditions. Moreover, maintenance and replacement are critical to supporting demand for manual valves to remain strong in the coming years. Manual valve designs are much more straightforward than their powered counterparts, meaning maintenance is not as complicated and therefore be repaired by almost anyone. The ease of maintenance means that manual valves are ideally suited for several diverse industries.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most significant global manual valve market, with a 35% market revenue share in 2023.

The North America is the largest market for manual valve due to increasing demand for them especially in oil and gas, water treatment and chemical processing industries. The extensive industrial production, continuous exploration of oil and gas, and appropriate developed infrastructure in the United States also contributes to the regional growth. It is also noteworthy that the region invests heavily in industrial and infrastructure ventures, and the technological outlook lends good support to the growth of the manual valve market. North American region and particularly the United States and Canada have significant importance in the demand for manual valves in the oil and gas sector. The demand for accurate and affordable fluid control systems in the oil exploration, extraction, transportation, as well as refining processes will remain crucial for manual operation valves. Also, North America boasts of a high industrialization process, some of the industrial processes such as manufacturing industries, pharmaceutical industries as well as power industries make use of manual valves for controlling fluid flow. In addition, the emphasis on reliable and low maintenance valve systems resulting from stringent safety regulations in the region coupled with the hazards involved in this area also strengthens the need for manual valves.

North America Region Manual Valve Market Share in 2023 - 35%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The valve type segment is divided into ball valves, gate valves, globe valves, butterfly valves, check valves and plug valves. The ball valves segment dominated the market, with a market share of around 34% in 2023. Manual valves are largely comprised of ball valves as these are found to be more reliable than other forms, versatile and easier to operate. They are designed using a round, mostly metallic ball with an aperture along its centre, which rotates to regulate their opening. Their design also provides a good leak-off characteristic and excellent shutoff capability even under high pressure and high temperature conditions. Ball valves are universal and can be utilised across all fluid types like gases, liquids and slurry applications. they can be found in the oil and gas industry, chemical industry, water utilities, power stations and so on. They are low maintenance and durable. The other advantage is that ball valves work well for small and big companies, which may explain why it is used more frequently. It could be applied to all capacities, either, being small residential systems or big industrial pipelines, at the same time. All in all, reliability, flexibility, fool proof nature and corrosion resistance ensure that ball valves dominate the manual valves market.

The application segment is divided into on/off control, flow regulation/throttling, and pressure control. The on/off control segment dominated the market, with a market share of around 38% in 2023. The most popular type in the manual valve market is on/off control mainly because of its simplicity combined with efficiency and diverse applicability. They are basic, require reliable and simple-to-operate equipment. On/off control valves are usually used in systems in which there is full on and full off requirement for the fluid flow to give safety and operational efficiency. Oil and gas treatment, water utilities, and power plants, to name a few, depend on on/off control for the flow and storage of fluids and gases in pipes, tanks, and reactors. For example, basic on/off control valves minimize chances of valve failure and need for adjustments, conditions that are undesirable especially in hazardous processes. Furthermore, on/off control valves are cheaper and less complex than throttling or pressure regulating controls and therefore most suitable for businesses considering cost effectiveness as well as ease of maintenance.

The industry segment is divided into oil and gas, chemical and petrochemical, water and wastewater treatment, power generation, food and beverage and pharmaceuticals. The oil and gas segment dominated the market, with a market share of around 36% in 2023. The oil and gas segment will remain the leading segment in the manual valve market because they remain indispensable in the management of flow of oil, gas and other fluid both in the upstream, midstream as well as downstream processes in any of the oil and gas companies. Manual valves are used widely for the fluid isolation, pressure control and flow control in drilling rigs, refineries and storage tanks, pipelines etc. Requirement for strong and durable valves in the oil and gas industries will remain high due to need to regulate such dangerous substances effective in situations with high pressure, and high temperatures. Manual valves offer advantages of simplicity, reliability, and ease of use necessary to guarantee free operation in such extreme conditions. In offshore platforms, refineries, and oil fields, it is easy to maintain and repair manual valves and this has made them dominate these areas. This makes them capable of operating with little equipment and less knowledge making them more efficient than manually operated valves.

The material segment is divided into stainless steel, brass, cast iron and alloys. The stainless-steel segment dominated the market, with a market share of around 33% in 2023. Stainless steel is the leading material used in the manual valve industry because of its superior strength/weight ratios, durability, and corrosion resistance the material offers particularly in industrial applications. Stainless Steel Valves plays vital role in Industries like oil and gas, chemical processing, water treatment and pharmaceuticals because they are requirement for the durable and dependable of fluid control application. One of the most crucial factors of this material is its immunity to corrosion in aggressive chemical environments, pressures, or high moisture content regions where the failure or deterioration of other materials is likely. Besides, stainless steel is also flexible, which is one of the reasons why it has become so prominent. Stainless steel valves do not need operational repairs or replacements as often and this makes it cheaper to use for business in the long run. Moreover, the stainless-steel material is non-corrosive with most chemicals to guarantee that the valve has steady reliability without reacting with the fluid to be carried.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2023 | USD 82 Billion |

| Market size value in 2033 | USD 121.38 Billion |

| CAGR (2024 to 2033) | 4% |

| Historical data | 2020-2022 |

| Base Year | 2023 |

| Forecast | 2024-2033 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Valve Type, Application, Industry and Material |

As per The Brainy Insights, the size of the global manual valve market was valued at USD 82 billion in 2023 to USD 121.38 billion by 2033.

Global manual valve market is growing at a CAGR of 4% during the forecast period 2024-2033.

The market's growth will be influenced by the higher safety and ease of operation associated with manual valve.

The growing automation of industries could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. The Brainy Insights has segmented the global manual valve market based on below mentioned segments:

Global Manual Valve Market by Valve Type:

Global Manual Valve Market by Application:

Global Manual Valve Market by Industry:

Global Manual Valve Market by Material:

Global Manual Valve Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date