- +1-315-215-1633

- sales@thebrainyinsights.com

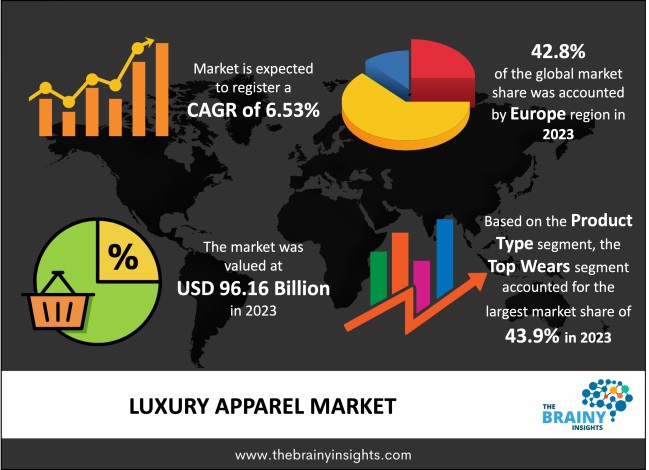

The global luxury apparel market was valued at USD 96.16 billion in 2023 and is anticipated to grow at a CAGR of 6.53% from 2024 to 2033. The market is expected to reach USD 181.02 billion by 2033. The rising disposable personal income and consumer expenditure on luxury goods are driving the growth of the luxury apparel market. The growing consumer belief that luxury items enhance social recognition fuels the demand for luxury apparel products. The increase in the population of millionaires and the strong customer loyalty towards brands are anticipated to witness new market opportunities during the forecast period.

First-time purchasers of luxury clothing often aim to experience high quality and exude a certain image in society, ultimately leading to brand loyalty. Renowned luxury brands maintain consistent product quality while carefully considering their consumers' perceptions, shaping the evolution of their namesake. Public word-of-mouth is also pivotal in promoting luxurious apparel since its higher price range and style are significant selling points; however, counterfeit products that emulate top-tier brands hinder this market's growth by offering similar designs at lower prices without regard for authenticity or customer well-being. The lack of awareness surrounding these items can lead loyal customers to be wary of legitimate merchandise options.

Luxury apparel encompasses a range of high-end clothing and accessories that exemplify sophistication, exclusivity, and superior craftsmanship. These pieces are meticulously designed and carefully produced to fulfil the most elevated standards of quality and aesthetics. Luxury garments are often crafted from the finest fabrics and materials available. These might include silk, cashmere, fine wool, and rare textiles worldwide. Using such premium materials enhances the overall look and feel of the apparel and contributes to its longevity and comfort. The production of luxury apparel involves meticulous attention to detail and skilled craftsmanship. Expert artisans and tailors work on each piece, ensuring that every seam, stitch, and embellishment is executed precisely. This level of dedication results in clothing that fits impeccably and looks flawless. Luxury apparel features unique and innovative designs that differentiate them from mass-market alternatives. Designers often incorporate creative elements, intricate patterns, and artistic embellishments, highlighting their creativity and individuality. These luxury items are often created in limited quantities to maintain a sense of exclusivity. This scarcity contributes to the allure of owning a piece of clothing that is not widely available, fostering a sense of prestige and desirability among consumers. From carefully aligned patterns to precisely matched seams, luxury apparel pays excellent attention to the finer details. Buttons, zippers, linings, and other components are chosen and placed thoughtfully to ensure a harmonious and visually appealing final product. Luxury apparel tends to have a timeless quality, transcending fleeting fashion trends. Classic styles and designs allow these pieces to remain relevant and stylish for years, contributing to their long-lasting value.

Get an overview of this study by requesting a free sample

Brand Identity and Heritage - Established luxury brands have a strong sense of brand identity and heritage, often spanning decades or even centuries. This legacy attracts consumers who value these brands' history, craftsmanship, and prestige. This factor is propelling the growth of the luxury apparel market.

Exclusivity and Rarity - Luxury apparel brands often produce limited quantities of their products, creating an aura of exclusivity and rarity. Consumers are drawn to owning unique pieces that distinguish them from the mass market. As a result, this is driving the demand for luxury apparel products.

Consumer Aspirations and Status Symbol - Luxury apparel is a status symbol for consumers, reflecting their success and social standing. Aspiring to own high-end fashion items drives demand for luxury apparel among those seeking to showcase their affluence.

Economic Uncertainty - Economic downturns or recessions can impact consumer spending on luxury items, decreasing demand for high-end apparel as consumers prioritize essential purchases.

Changing Consumer Preferences - Shifts in consumer preferences towards more casual and comfortable clothing may affect the demand for traditional luxury formalwear, requiring brands to adapt their offerings.

Rise of Fast Fashion - The proliferation of fast fashion brands offering trendy and affordable alternatives can divert consumers' attention from luxury apparel, affecting sales for high-end brands.

Direct-to-Consumer (DTC) Channels - Luxury brands can establish and strengthen their DTC channels to forge direct customer relationships, gather valuable data, and control their brand image.

Digital Transformation - Embracing digital platforms and technologies can enhance the luxury shopping experience through immersive online showrooms, virtual fitting rooms, and personalized digital customer interactions. This factor is anticipated to witness significant opportunities during the forecast period.

Counterfeiting and Brand Imitation - Counterfeit products and imitation of luxury designs can erode brand value and trust, leading to revenue loss and reputation damage.

Inclusivity and Diversity - For lack of inclusivity, the luxury market has been criticized. This factor can alienate potential customers and limit brand appeal.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. Europe region emerged as the most prominent global luxury apparel market, with a 42.8% market revenue share in 2023.

Europe is home to many of the world's oldest and most renowned luxury fashion houses, some of which have histories dating back several centuries. This heritage and tradition give European brands a strong foundation and reputation in the luxury market. European countries have a long tradition of craftsmanship and artistry, highly valued in the luxury sector. The meticulous attention to detail, quality materials, and skilled artisans contribute to the allure of European luxury fashion. Additionally, Europe has been a hub of cultural and artistic innovation for centuries. This creative environment has led to the development of iconic fashion trends, designs, and styles that continue to shape the luxury market. European cities like Paris, Milan, London, and Florence have been renowned as fashion capitals, hosting significant fashion weeks and attracting designers, buyers, and fashion enthusiasts worldwide. These cities set the tone for global fashion trends. Thus, further boosting the growth of the market. The Asia Pacific (APAC) region is anticipated to witness the fastest-growing market during the forecast years. Many nations in the Asia Pacific region, such as China, India, and Southeast Asian countries, have experienced fast economic growth over the past few decades. This growth has led to a significant increase in disposable incomes and a burgeoning middle and upper class with the purchasing power to afford luxury goods.

Europe Region Luxury Apparel Market Share in 2023 - 42.8%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The product type segment includes top wears, bottom wears, one piece and others. The top wears segment accounted for the largest market share of 43.9% in 2023. Top wears are highly visible and contribute significantly to an individual's appearance and style. They are often the focal point of an outfit and can make a strong fashion statement, making them attractive to consumers seeking to showcase their taste and status. Top wear items can be designed for different seasons, from lightweight blouses and shirts for summer to warm sweaters and coats for winter. This versatility allows luxury brands to offer various products throughout the year. In addition, the top wear segment offers ample room for design innovation and creativity. Designers can experiment with various cuts, fabrics, embellishments, and details to create unique and striking pieces.

The application segment is classified into formal wear, sports wear, casual wear and others. The formal wear segment dominated the market, with a share of around 42.2% in 2023. Formal wear is mainly for special occasions such as weddings, galas, ceremonies, and upscale events. The infrequent nature of these events often encourages consumers to invest in high-quality luxury formal wear that can make a lasting impression. These formal wears are associated with elegance, sophistication, and refinement. Luxury apparel brands excel in creating exquisite formal wear that aligns with consumers' desire to present themselves in a polished and distinguished manner. Furthermore, luxury formal wear conveys a sense of social status and prestige. Consumers are drawn to displaying their affluence through well-crafted, designer formal wear. Thus, fueling the demand for formal wear.

The end-user segment is classified into men and women. The men segment dominated the market, with a share of 57.3% in 2023. Men's fashion consciousness has increased, with more men paying attention to their appearance, grooming, and personal style. This change in mindset has led to increased demand for luxury apparel among men. Additionally, modern workplaces have become more flexible and open to diverse dress codes. As a result, men are seeking high-quality, versatile, and stylish clothing that can transition from formal to business-casual settings. Also, men's incomes have risen globally, giving them more purchasing power to invest in luxury apparel. The increasing affordability further drives demand for upscale fashion items.

The distribution channel segment includes offline and online. The offline segment dominated the market, with a share of 76.5% in 2023. Luxury shopping is often seen as a sensory and experiential activity. Physical stores allow customers to touch, feel, and try on the products, which enhances the luxury shopping experience. Moreover, luxury shoppers expect personalized and attentive service. In-store staff can provide individualized attention, product recommendations, and tailored assistance, creating a high-touch shopping experience. Besides, luxury retail spaces are carefully designed to convey an exclusive and aspirational atmosphere. The ambience, interior design, and attention to detail contribute to the overall sense of luxury.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2023 | USD 96.16 Billion |

| Market size value in 2033 | USD 181.02 Billion |

| CAGR (2024 to 2033) | 6.53% |

| Historical data | 2020-2022 |

| Base Year | 2023 |

| Forecast | 2024-2033 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East & Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Product Type, Application, End-User and Distribution Channel |

As per The Brainy Insights, the size of the luxury apparel market was valued at USD 96.16 billion in 2023 to USD 181.02 billion by 2033.

The global luxury apparel market is growing at a CAGR of 6.53% during the forecast period 2024-2033.

The Europe region became the largest market for luxury apparel.

Brand identity and heritage, and consumer aspirations and status symbol are influencing the market's growth.

1. Introduction

1.1. Objectives of the Study

1.2. Market Definition

1.3. Research Scope

1.4. Currency

1.5. Key Target Audience

2. Research Methodology and Assumptions

3. Executive Summary

4. Premium Insights

4.1. Porter’s Five Forces Analysis

4.2. Value Chain Analysis

4.3. Top Investment Pockets

4.3.1. Market Attractiveness Analysis by Product Type

4.3.2. Market Attractiveness Analysis by Application

4.3.3. Market Attractiveness Analysis by End-User

4.3.4. Market Attractiveness Analysis by Distribution Channel

4.3.5. Market Attractiveness Analysis by Region

4.4. Industry Trends

5. Market Dynamics

5.1. Market Evaluation

5.2. Drivers

5.2.1. Brand Identity and Heritage

5.2.2. Exclusivity and Rarity

5.2.3. Consumer Aspirations and Status Symbol

5.3. Restraints

5.3.1. Economic Uncertainty

5.3.2. Changing Consumer Preferences

5.3.3. Rise of Fast Fashion

5.4. Opportunities

5.4.1. Direct-to-Consumer (DTC) Channels

5.4.2. Digital Transformation

5.5. Challenges

5.5.1. Counterfeiting and Brand Imitation

5.5.2. Inclusivity and Diversity

6. Global Luxury Apparel Market Analysis and Forecast, By Product Type

6.1. Segment Overview

6.2. Top Wears

6.3. Bottom Wears

6.4. One Piece

6.5. Others

7. Global Luxury Apparel Market Analysis and Forecast, By Application

7.1. Segment Overview

7.2. Formal Wear

7.3. Sports Wear

7.4. Casual Wear

7.5. Others

8. Global Luxury Apparel Market Analysis and Forecast, By End-User

8.1. Segment Overview

8.2. Men

8.3. Women

9. Global Luxury Apparel Market Analysis and Forecast, By Distribution Channel

9.1. Segment Overview

9.2. Offline

9.3. Online

10. Global Luxury Apparel Market Analysis and Forecast, By Regional Analysis

10.1. Segment Overview

10.2. North America

10.2.1. U.S.

10.2.2. Canada

10.2.3. Mexico

10.3. Europe

10.3.1. Germany

10.3.2. France

10.3.3. U.K.

10.3.4. Italy

10.3.5. Spain

10.4. Asia-Pacific

10.4.1. Japan

10.4.2. China

10.4.3. India

10.5. South America

10.5.1. Brazil

10.6. Middle East and Africa

10.6.1. UAE

10.6.2. South Africa

11. Global Luxury Apparel Market-Competitive Landscape

11.1. Overview

11.2. Market Share of Key Players in the Luxury Apparel Market

11.2.1. Global Company Market Share

11.2.2. North America Company Market Share

11.2.3. Europe Company Market Share

11.2.4. APAC Company Market Share

11.3. Competitive Situations and Trends

11.3.1. Product Launches and Developments

11.3.2. Partnerships, Collaborations, and Agreements

11.3.3. Mergers & Acquisitions

11.3.4. Expansions

12. Company Profiles

12.1. Giorgio Armani

12.1.1. Business Overview

12.1.2. Company Snapshot

12.1.3. Company Market Share Analysis

12.1.4. Company Product Portfolio

12.1.5. Recent Developments

12.1.6. SWOT Analysis

12.2. Burberry

12.2.1. Business Overview

12.2.2. Company Snapshot

12.2.3. Company Market Share Analysis

12.2.4. Company Product Portfolio

12.2.5. Recent Developments

12.2.6. SWOT Analysis

12.3. Dolce & Gabbana

12.3.1. Business Overview

12.3.2. Company Snapshot

12.3.3. Company Market Share Analysis

12.3.4. Company Product Portfolio

12.3.5. Recent Developments

12.3.6. SWOT Analysis

12.4. Prada

12.4.1. Business Overview

12.4.2. Company Snapshot

12.4.3. Company Market Share Analysis

12.4.4. Company Product Portfolio

12.4.5. Recent Developments

12.4.6. SWOT Analysis

12.5. Fendi

12.5.1. Business Overview

12.5.2. Company Snapshot

12.5.3. Company Market Share Analysis

12.5.4. Company Product Portfolio

12.5.5. Recent Developments

12.5.6. SWOT Analysis

12.6. Kate Spade

12.6.1. Business Overview

12.6.2. Company Snapshot

12.6.3. Company Market Share Analysis

12.6.4. Company Product Portfolio

12.6.5. Recent Developments

12.6.6. SWOT Analysis

12.7. Phillip Lim

12.7.1. Business Overview

12.7.2. Company Snapshot

12.7.3. Company Market Share Analysis

12.7.4. Company Product Portfolio

12.7.5. Recent Developments

12.7.6. SWOT Analysis

12.8. PVH Corp.

12.8.1. Business Overview

12.8.2. Company Snapshot

12.8.3. Company Market Share Analysis

12.8.4. Company Product Portfolio

12.8.5. Recent Developments

12.8.6. SWOT Analysis

12.9. Louis Vuitton SE

12.9.1. Business Overview

12.9.2. Company Snapshot

12.9.3. Company Market Share Analysis

12.9.4. Company Product Portfolio

12.9.5. Recent Developments

12.9.6. SWOT Analysis

12.10. Versace

12.10.1. Business Overview

12.10.2. Company Snapshot

12.10.3. Company Market Share Analysis

12.10.4. Company Product Portfolio

12.10.5. Recent Developments

12.10.6. SWOT Analysis

12.11. Kering

12.11.1. Business Overview

12.11.2. Company Snapshot

12.11.3. Company Market Share Analysis

12.11.4. Company Product Portfolio

12.11.5. Recent Developments

12.11.6. SWOT Analysis

12.12. Valentino S.p.A.

12.12.1. Business Overview

12.12.2. Company Snapshot

12.12.3. Company Market Share Analysis

12.12.4. Company Product Portfolio

12.12.5. Recent Developments

12.12.6. SWOT Analysis

12.13. Coach IP Holdings LLC

12.13.1. Business Overview

12.13.2. Company Snapshot

12.13.3. Company Market Share Analysis

12.13.4. Company Product Portfolio

12.13.5. Recent Developments

12.13.6. SWOT Analysis

12.14. Ralph Lauren Corporation

12.14.1. Business Overview

12.14.2. Company Snapshot

12.14.3. Company Market Share Analysis

12.14.4. Company Product Portfolio

12.14.5. Recent Developments

12.14.6. SWOT Analysis

12.15. Christian Dior

12.15.1. Business Overview

12.15.2. Company Snapshot

12.15.3. Company Market Share Analysis

12.15.4. Company Product Portfolio

12.15.5. Recent Developments

12.15.6. SWOT Analysis

12.16. Michael Kors

12.16.1. Business Overview

12.16.2. Company Snapshot

12.16.3. Company Market Share Analysis

12.16.4. Company Product Portfolio

12.16.5. Recent Developments

12.16.6. SWOT Analysis

12.17. Gianni Versace S.P.A.

12.17.1. Business Overview

12.17.2. Company Snapshot

12.17.3. Company Market Share Analysis

12.17.4. Company Product Portfolio

12.17.5. Recent Developments

12.17.6. SWOT Analysis

12.18. Hermes International, Inc.

12.18.1. Business Overview

12.18.2. Company Snapshot

12.18.3. Company Market Share Analysis

12.18.4. Company Product Portfolio

12.18.5. Recent Developments

12.18.6. SWOT Analysis

12.19. Tommy Hilfiger Inc.

12.19.1. Business Overview

12.19.2. Company Snapshot

12.19.3. Company Market Share Analysis

12.19.4. Company Product Portfolio

12.19.5. Recent Developments

12.19.6. SWOT Analysis

12.20. Balenciaga

12.20.1. Business Overview

12.20.2. Company Snapshot

12.20.3. Company Market Share Analysis

12.20.4. Company Product Portfolio

12.20.5. Recent Developments

12.20.6. SWOT Analysis

12.21. Chanel

12.21.1. Business Overview

12.21.2. Company Snapshot

12.21.3. Company Market Share Analysis

12.21.4. Company Product Portfolio

12.21.5. Recent Developments

12.21.6. SWOT Analysis

12.22. Hermès International S.A.

12.22.1. Business Overview

12.22.2. Company Snapshot

12.22.3. Company Market Share Analysis

12.22.4. Company Product Portfolio

12.22.5. Recent Developments

12.22.6. SWOT Analysis

12.23. Tapestry, Inc.

12.23.1. Business Overview

12.23.2. Company Snapshot

12.23.3. Company Market Share Analysis

12.23.4. Company Product Portfolio

12.23.5. Recent Developments

12.23.6. SWOT Analysis

12.24. Legrand SA

12.24.1. Business Overview

12.24.2. Company Snapshot

12.24.3. Company Market Share Analysis

12.24.4. Company Product Portfolio

12.24.5. Recent Developments

12.24.6. SWOT Analysis

List of Table

1. Global Luxury Apparel Market, By Product Type, 2020-2033 (USD Billion) (K Units)

2. Global Top Wears, Luxury Apparel Market, By Region, 2020-2033 (USD Billion) (K Units)

3. Global Bottom Wears, Luxury Apparel Market, By Region, 2020-2033 (USD Billion) (K Units)

4. Global One Piece, Luxury Apparel Market, By Region, 2020-2033 (USD Billion) (K Units)

5. Global Others, Luxury Apparel Market, By Region, 2020-2033 (USD Billion) (K Units)

6. Global Luxury Apparel Market, By Application, 2020-2033 (USD Billion) (K Units)

7. Global Formal Wear Luxury Apparel Market, By Region, 2020-2033 (USD Billion) (K Units)

8. Global Sports Wear Luxury Apparel Market, By Region, 2020-2033 (USD Billion) (K Units)

9. Global Casual Wear Luxury Apparel Market, By Region, 2020-2033 (USD Billion) (K Units)

10. Global Others Luxury Apparel Market, By Region, 2020-2033 (USD Billion) (K Units)

11. Global Luxury Apparel Market, By End-User, 2020-2033 (USD Billion) (K Units)

12. Global Men Luxury Apparel Market, By Region, 2020-2033 (USD Billion) (K Units)

13. Global Women Luxury Apparel Market, By Region, 2020-2033 (USD Billion) (K Units)

14. Global Luxury Apparel Market, By Distribution Channel, 2020-2033 (USD Billion) (K Units)

15. Global Offline Luxury Apparel Market, By Region, 2020-2033 (USD Billion) (K Units)

16. Global Online Luxury Apparel Market, By Region, 2020-2033 (USD Billion) (K Units)

17. Global Luxury Apparel Market, By Region, 2020-2033 (USD Billion) (K Units)

18. North America Luxury Apparel Market, By Product Type, 2020-2033 (USD Billion) (K Units)

19. North America Luxury Apparel Market, By Application, 2020-2033 (USD Billion) (K Units)

20. North America Luxury Apparel Market, By End-User, 2020-2033 (USD Billion) (K Units)

21. North America Luxury Apparel Market, By Distribution Channel, 2020-2033 (USD Billion) (K Units)

22. U.S. Luxury Apparel Market, By Product Type, 2020-2033 (USD Billion) (K Units)

23. U.S. Luxury Apparel Market, By Application, 2020-2033 (USD Billion) (K Units)

24. U.S. Luxury Apparel Market, By End-User, 2020-2033 (USD Billion) (K Units)

25. U.S. Luxury Apparel Market, By Distribution Channel, 2020-2033 (USD Billion) (K Units)

26. Canada Luxury Apparel Market, By Product Type, 2020-2033 (USD Billion) (K Units)

27. Canada Luxury Apparel Market, By Application, 2020-2033 (USD Billion) (K Units)

28. Canada Luxury Apparel Market, By End-User, 2020-2033 (USD Billion) (K Units)

29. Canada Luxury Apparel Market, By Distribution Channel, 2020-2033 (USD Billion) (K Units)

30. Mexico Luxury Apparel Market, By Product Type, 2020-2033 (USD Billion) (K Units)

31. Mexico Luxury Apparel Market, By Application, 2020-2033 (USD Billion) (K Units)

32. Mexico Luxury Apparel Market, By End-User, 2020-2033 (USD Billion) (K Units)

33. Mexico Luxury Apparel Market, By Distribution Channel, 2020-2033 (USD Billion) (K Units)

34. Europe Luxury Apparel Market, By Product Type, 2020-2033 (USD Billion) (K Units)

35. Europe Luxury Apparel Market, By Application, 2020-2033 (USD Billion) (K Units)

36. Europe Luxury Apparel Market, By End-User, 2020-2033 (USD Billion) (K Units)

37. Europe Luxury Apparel Market, By Distribution Channel, 2020-2033 (USD Billion) (K Units)

38. Germany Luxury Apparel Market, By Product Type, 2020-2033 (USD Billion) (K Units)

39. Germany Luxury Apparel Market, By Application, 2020-2033 (USD Billion) (K Units)

40. Germany Luxury Apparel Market, By End-User, 2020-2033 (USD Billion) (K Units)

41. Germany Luxury Apparel Market, By Distribution Channel, 2020-2033 (USD Billion) (K Units)

42. France Luxury Apparel Market, By Product Type, 2020-2033 (USD Billion) (K Units)

43. France Luxury Apparel Market, By Application, 2020-2033 (USD Billion) (K Units)

44. France Luxury Apparel Market, By End-User, 2020-2033 (USD Billion) (K Units)

45. France Luxury Apparel Market, By Distribution Channel, 2020-2033 (USD Billion) (K Units)

46. U.K. Luxury Apparel Market, By Product Type, 2020-2033 (USD Billion) (K Units)

47. U.K. Luxury Apparel Market, By Application, 2020-2033 (USD Billion) (K Units)

48. U.K. Luxury Apparel Market, By End-User, 2020-2033 (USD Billion) (K Units)

49. U.K. Luxury Apparel Market, By Distribution Channel, 2020-2033 (USD Billion) (K Units)

50. Italy Luxury Apparel Market, By Product Type, 2020-2033 (USD Billion) (K Units)

51. Italy Luxury Apparel Market, By Application, 2020-2033 (USD Billion) (K Units)

52. Italy Luxury Apparel Market, By End-User, 2020-2033 (USD Billion) (K Units)

53. Italy Luxury Apparel Market, By Distribution Channel, 2020-2033 (USD Billion) (K Units)

54. Spain Luxury Apparel Market, By Product Type, 2020-2033 (USD Billion) (K Units)

55. Spain Luxury Apparel Market, By Application, 2020-2033 (USD Billion) (K Units)

56. Spain Luxury Apparel Market, By End-User, 2020-2033 (USD Billion) (K Units)

57. Spain Luxury Apparel Market, By Distribution Channel, 2020-2033 (USD Billion) (K Units)

58. Asia Pacific Luxury Apparel Market, By Product Type, 2020-2033 (USD Billion) (K Units)

59. Asia Pacific Luxury Apparel Market, By Application, 2020-2033 (USD Billion) (K Units)

60. Asia Pacific Luxury Apparel Market, By End-User, 2020-2033 (USD Billion) (K Units)

61. Asia Pacific Luxury Apparel Market, By Distribution Channel, 2020-2033 (USD Billion) (K Units)

62. Japan Luxury Apparel Market, By Product Type, 2020-2033 (USD Billion) (K Units)

63. Japan Luxury Apparel Market, By Application, 2020-2033 (USD Billion) (K Units)

64. Japan Luxury Apparel Market, By End-User, 2020-2033 (USD Billion) (K Units)

65. Japan Luxury Apparel Market, By Distribution Channel, 2020-2033 (USD Billion) (K Units)

66. China Luxury Apparel Market, By Product Type, 2020-2033 (USD Billion) (K Units)

67. China Luxury Apparel Market, By Application, 2020-2033 (USD Billion) (K Units)

68. China Luxury Apparel Market, By End-User, 2020-2033 (USD Billion) (K Units)

69. China Luxury Apparel Market, By Distribution Channel, 2020-2033 (USD Billion) (K Units)

70. India Luxury Apparel Market, By Product Type, 2020-2033 (USD Billion) (K Units)

71. India Luxury Apparel Market, By Application, 2020-2033 (USD Billion) (K Units)

72. India Luxury Apparel Market, By End-User, 2020-2033 (USD Billion) (K Units)

73. India Luxury Apparel Market, By Distribution Channel, 2020-2033 (USD Billion) (K Units)

74. South America Luxury Apparel Market, By Product Type, 2020-2033 (USD Billion) (K Units)

75. South America Luxury Apparel Market, By Application, 2020-2033 (USD Billion) (K Units)

76. South America Luxury Apparel Market, By End-User, 2020-2033 (USD Billion) (K Units)

77. South America Luxury Apparel Market, By Distribution Channel, 2020-2033 (USD Billion) (K Units)

78. Brazil Luxury Apparel Market, By Product Type, 2020-2033 (USD Billion) (K Units)

79. Brazil Luxury Apparel Market, By Application, 2020-2033 (USD Billion) (K Units)

80. Brazil Luxury Apparel Market, By End-User, 2020-2033 (USD Billion) (K Units)

81. Brazil Luxury Apparel Market, By Distribution Channel, 2020-2033 (USD Billion) (K Units)

82. Middle East and Africa Luxury Apparel Market, By Product Type, 2020-2033 (USD Billion) (K Units)

83. Middle East and Africa Luxury Apparel Market, By Application, 2020-2033 (USD Billion) (K Units)

84. Middle East and Africa Luxury Apparel Market, By End-User, 2020-2033 (USD Billion) (K Units)

85. Middle East and Africa Luxury Apparel Market, By Distribution Channel, 2020-2033 (USD Billion) (K Units)

86. UAE Luxury Apparel Market, By Product Type, 2020-2033 (USD Billion) (K Units)

87. UAE Luxury Apparel Market, By Application, 2020-2033 (USD Billion) (K Units)

88. UAE Luxury Apparel Market, By End-User, 2020-2033 (USD Billion) (K Units)

89. UAE Luxury Apparel Market, By Distribution Channel, 2020-2033 (USD Billion) (K Units)

90. South Africa Luxury Apparel Market, By Product Type, 2020-2033 (USD Billion) (K Units)

91. South Africa Luxury Apparel Market, By Application, 2020-2033 (USD Billion) (K Units)

92. South Africa Luxury Apparel Market, By End-User, 2020-2033 (USD Billion) (K Units)

93. South Africa Luxury Apparel Market, By Distribution Channel, 2020-2033 (USD Billion) (K Units)

List of Figures

1. Global Luxury Apparel Market Segmentation

2. Luxury Apparel Market: Research Methodology

3. Market Size Estimation Methodology: Bottom-Up Approach

4. Market Size Estimation Methodology: Top-Down Approach

5. Data Triangulation

6. Porter’s Five Forces Analysis

7. Value Chain Analysis

8. Global Luxury Apparel Market Attractiveness Analysis by Product Type

9. Global Luxury Apparel Market Attractiveness Analysis by Application

10. Global Luxury Apparel Market Attractiveness Analysis by End-User

11. Global Luxury Apparel Market Attractiveness Analysis by Distribution Channel

12. Global Luxury Apparel Market Attractiveness Analysis by Region

13. Global Luxury Apparel Market: Dynamics

14. Global Luxury Apparel Market Share by Product Type (2023 & 2033)

15. Global Luxury Apparel Market Share by Application (2023 & 2033)

16. Global Luxury Apparel Market Share by End-User (2023 & 2033)

17. Global Luxury Apparel Market Share by Distribution Channel (2023 & 2033)

18. Global Luxury Apparel Market Share by Regions (2023 & 2033)

19. Global Luxury Apparel Market Share by Company (2023)

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. The Brainy Insights has segmented the global luxury apparel market based on below-mentioned segments:

Global Luxury Apparel Market by Product Type:

Global Luxury Apparel Market by Application:

Global Luxury Apparel Market by End-User:

Global Luxury Apparel Market by Distribution Channel:

Global Luxury Apparel Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date