- +1-315-215-1633

- sales@thebrainyinsights.com

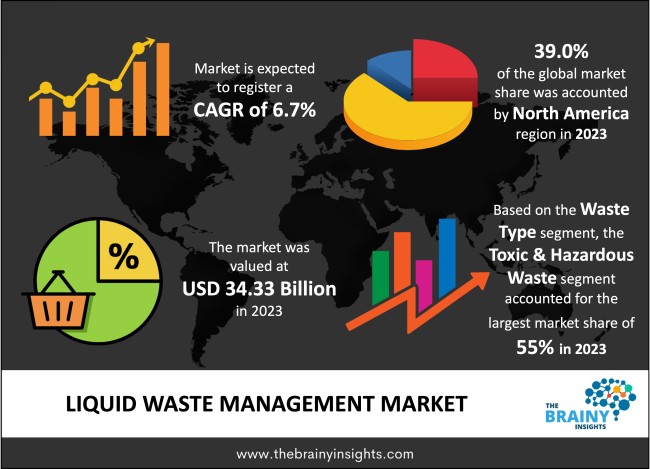

The global liquid waste management market was valued at USD 34.33 billion in 2023 and is anticipated to grow at a CAGR of 6.7% from 2024 to 2033. Managing liquid waste involves a series of steps aimed at safely disposing of toxic and non-toxic liquids from various sources. This process includes collecting, segregating, processing, and ultimately removing the liquid refuse appropriately. Such unwelcome waste can be derived from different origins, such as domestic excreta or used water from industrial activities, including stormwater runoff and sludge treatment facilities. Due to multiple impurities, including microbes alongside chemical residues and metal particles, among other vegetative debris, discarded fluids exhibit notable characteristics like offensive odors coupled with turbid discoloration, rendering them unpleasant for human consumption without due treatment using sophisticated technology. Proper management helps mitigate environmental degradation by minimizing health hazards associated with contaminated water-borne diseases while improving efficiency rates when functioning machinery within manufacturing operations.

The systematic process of managing, treating and disposing of liquid substances resulting from human activities, industries and natural processes can be termed as liquid waste management. These liquids could comprise wastewater from diverse sources like domestic households, agricultural practices or industrial setups. They may also include potentially harmful fluids such as chemicals, solvents or oils, for example. Efficient handling of this type of waste holds immense importance to ensure the well-being of humans whilst prioritizing environmental safety for sustained development efforts. Fundamentally, liquid waste management comprises a series of interrelated proceedings that strive to limit detrimental effects on ecosystems, water reserves and human welfare. The customary procedures entail gathering, conveyance, sanitation and relinquishing or recycling fluid debris. Prudent preparation alongside an appropriate framework infrastructure is imperative for each phase within the cycle, along with technological advancements and regulatory scrutiny, which are essential for favorable results.

Get an overview of this study by requesting a free sample

Growing Emphasis on Sustainability - The global market for liquid waste management is experiencing rapid growth, driven largely by the increasing urbanization and industrialization seen across many regions. With expanding populations in cities and intensified commercial production, significant quantities of liquid waste are generated from households and manufacturing facilities. Effective infrastructure must be implemented to ensure proper handling, treatment and disposal methods can manage these surging volumes of hazardous liquids, with safety being a top priority. The liquid waste management market is influenced by urbanization, industrialization and the growing environmental awareness. The detrimental effects of wastewater on ecosystems, water resources and human health have led governments, regulatory bodies and environmental organizations to establish strict regulations to minimize such impacts. To meet these standards, it has become essential for industries and municipalities to invest in advanced treatment technologies and implement pollution control measures that are sustainable practices which drive demand for solutions in the liquid waste management industry.

Cost Considerations and Lack of infrastructure – Due to inadequate infrastructure, effective waste management systems face a significant obstacle in developing regions. Insufficient facilities for collecting, treating and disposing of liquid waste hinder these efforts. Access barriers such as limited technology, transportation networks, and treatment plants make it difficult to properly handle liquid waste, leading to environmental pollution and public health concerns. A lack of robust infrastructure impedes the potential growth of liquid waste management markets in such places, making it difficult to establish efficient and sustainable waste disposal methods. Furthermore, resistance towards change from industries and communities presents another obstacle for this market segment. Persuading stakeholders to embrace innovative and eco-friendly waste disposal methods can be difficult due to the deep roots of established practices and traditional modes. Stakeholders may resist change because they fear disturbances in operations, need to become more familiar with new technology, or hesitate to invest in updated infrastructure.

Rising Focus on Circular Economy - The increasing focus on conserving resources and implementing circular economy practices is propelling the utilization of waste-to-energy techniques as well as resource retrieval programs in liquid waste management. Innovations such as generating biogas, anaerobic digestion, and deriving nutrients from wastewater provide ways to extract value from organic refuse while reducing dependence on traditional energy sources and mitigating environmental impacts. Governments and enterprises are anticipated to invest more in procedures for converting waste into renewable forms of energy, along with facilities designed for liquid waste management. Circular economy principles present promising opportunities in the liquid waste management industry as they convert waste into a valuable resource. Companies can take advantage of this by formulating solutions that prioritize recycling and recovery processes, reducing environmental impact while creating new revenue streams by extracting and repurposing beneficial materials. This approach is sustainable and assists businesses in contributing towards eco-friendly waste management for an efficient usage of the resource ecosystem.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America region emerged as the most prominent global liquid waste management market, with a 39.0% market revenue share in 2023. The liquid waste management market in North America, which consists mostly of the United States and Canada, is quite substantial due to factors like strong industrialization practices, strict environmental regulations and advanced waste disposal systems. The region has an experienced sector with well-established industry leaders with access to high-tech methodologies while continuously emphasizing sustainable ecological solutions. Of these two countries, though, it's specifically the United States that carries a significant amount of influence within North America because of its sizable economy paired with extended commercial operations and stringent regulatory policies concerning efficient handling and proper storage methods for all types of hazardous wastes. Furthermore, the North American market gains an advantage from making strategic investments in upgrading infrastructure, expanding projects and innovating initiatives that aim to increase waste treatment capabilities. This aspect also improves operational efficiency while decreasing dependence on landfill disposal. The regional market players also engage in various market strategies such as product innovation, product differentiation, mergers, acquisitions, partnerships, and strategic alliances to maintain their competitive edge.

North America Region Liquid Waste Management Market Share in 2022 - 39.0%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The waste type segment includes toxic & hazardous waste and organic & non-hazardous waste. The toxic & hazardous waste segment dominated, with a market share of around 55% in 2023. A considerable share of the global market for managing liquid waste is comprised of toxic and hazardous materials resulting from industrial operations, chemical production, healthcare facilities and other industries producing dangerous substances. These types of wastes present distinct challenges due to their toxicity, flammability or reactivity which require special handling procedures with targeted treatment methods aimed at minimizing public health risks as well as environmental damage. Industries including manufacturing, petrochemicals, pharmaceuticals, electronics and mining contribute significantly to the toxic and hazardous waste sector by producing a wide range of harmful substances like heavy metals, solvents, radioactive materials as well as persistent organic pollutants (POPs). These industries need specific waste management solutions which are tailored for hazardous wastes; these include collection services for disposing of such wastes properly. Adherence with regulatory requirements is important in order to mitigate liabilities associated with poor handling practices.

The source segment is bifurcated into residential, industrial and commercial. The residential segment dominated, with a market share of around 58% in 2023. The liquid waste management market is greatly influenced by residential sources, propelled by urbanization, population expansion and evolving lifestyles. Day-to-day tasks such as bathroom usage, laundry and cooking generate significant amounts of domestic wastewater that necessitate appropriate treatment to safeguard people's and nature's well-being. Besides this sewage or sanitary waste produced in households, there are also other types of fluid wastes (like hazardous household goods, automotive fluids or electronic garbage) generated within these houses. To effectively manage residential liquid waste streams, municipal wastewater treatment facilities employ multiple treatment processes such as screening, sedimentation, biological oxidation and disinfection. These remove pollutants and pathogens before discharge into receiving waters or reuse for irrigation, industrial purposes or groundwater recharge. With advanced technologies like membrane filtration systems, ultraviolet (UV) disinfection technology and ozonation methods gaining popularity, municipalities can now meet arduous regulatory standards while also efficiently addressing emerging contaminants of concern.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2023 | USD 34.33 Billion |

| Market size value in 2033 | USD 65.65 Billion |

| CAGR (2024 to 2033) | 6.7% |

| Historical data | 2020-2022 |

| Base Year | 2023 |

| Forecast | 2024-2033 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East & Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Source, Waste Type |

As per The Brainy Insights, the size of the liquid waste management market was valued at 34.33 billion in 2023 to USD 65.65 billion by 2033.

The global liquid waste management market is growing at a CAGR of 6.7% during the forecast period 2024-2033.

North America region became the largest market for liquid waste management.

The rising demand for liquid waste management practice across end-user vertical is driving the market's growth.

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. The Brainy Insights has segmented the global liquid waste management market based on below-mentioned segments:

Global Liquid Waste Management Market by Waste Type:

Global Liquid Waste Management Market by Source:

Global Liquid Waste Management Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date