- +1-315-215-1633

- sales@thebrainyinsights.com

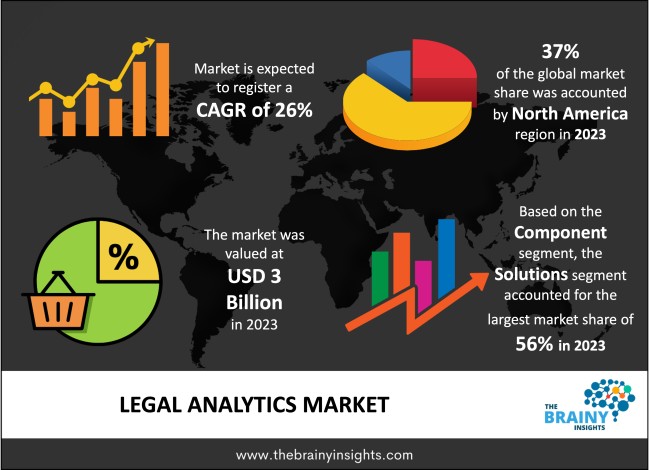

The global legal analytics market was valued at USD 3 billion in 2023 and grew at a CAGR of 26% from 2024 to 2033. The market is expected to reach USD 10.25 billion by 2033. The increasing demand for legal services will drive the growth of the global legal analytics market.

Legal analytics can be defined as the process by which legal professionals utilize data analysis techniques to analyse legal data to arrive at legal decisions. This relatively new discipline overlays conventional legal research on innovative techniques using data analysis, machine learning, and artificial intelligence that significantly transform how law firms, corporate legal departments, and other legal service providers work. In its broadest sense, legal analytics refers to the process of considering, analysing and interpreting a vast amount of data that is legal in nature, including cases, laws, regulations, contracts, briefs. Litigation is one of the primary use cases of legal analytics in order to ensure successful completion of a case. The use of case-based data within a court case allows lawyers to better determine the viability of their case and the best way to move forward with the case. Such tools may also be used also to forecast outcome and inform settlement discussions. Furthermore, legal analytics can add value to risk management since this would help firms recognize possible legal risks before they transform into a significant problem, hence minimizing the use of time as well as cost. In addition, legal analytics are valuable for just legal research and compliance. Analytics can support organizations in their obligation of tracking changes in laws and/or regulations to which organizations must adhere to in order to avoid violation.

Get an overview of this study by requesting a free sample

The increasing legal burden and litigation worldwide – legal service providers employ legal analytics to gain a competitive advantage. Legal analytics enables firms to make informed business decisions backed by extensive analysis of vast amount data. This capability improves the probability of making accurate prognosis of case outcomes so that firms can design adequate strategies to solve them. Legal analytics enhances client relations since the latter receives a detailed description of case progression and related expenses, which enhances trust. Furthermore, legal analytics is useful in resource management since it helps to find bottlenecks in a work process, optimize work, and minimize overhead expenses. This operational efficiency improves service delivery, and hence increases the viability of businesses. The expertise to successfully evaluate compliance risks and to resolve risks or possible litigation enables firms to act as strategic advisors to their clients, enhancing their status in the market. Also, it supports marketing and business advancements, where firms use analytics to understand markets they can attend and services that clients want. First, legal analytics can measure designs assessing employee performance, consequently enhancing the personnel and achieving higher-quality client satisfaction.

High implementation costs – high implementation costs and resistance to change hinder the market’s growth. Implementation costs which consist of many different costs such as cost of the software, hardware, and staff training makes implementation of legal analytics a capital intensive. These software solutions are usually costly as there are large costs related to licensing besides which firms may require new networks and storage servers to plug the solutions into them. It is reasonable to assume that large numbers of legal professionals are satisfactorily meeting their quotas and expectations with prior methods and may feel that integration of legal analytics may lead to job elimination by automating some tasks. This scepticism may result in overall distrust of data-derived information and a simple refusal to learn new tools, as people may see them as difficult. Additionally, they are under immense pressure and focus on immediate casework, which could be at the cost of adopting legal analytics investing in technology, which the professionals value.

Technological advancements – Technologies that are dominant in today’s working environment like AI, machine learning, NLP, cloud, augmented data, big data, and many more are driving product innovations and advancements in legal analytics. For instance, the use of AI means that regular practices such as the review of documents and research are automated and lawyers are able to analyse large volumes of legal documents within no time. Similarly, application of big data analytics enables legal providers to enhance legal planning activities. Features like encryption, and the use of multi-factor identification also increase security of the client data, creating credibility and meeting legal requirements. Additionally, the combination of legal analytics with other systems like the customer relationship management, and electronic discovery platforms make it easier to share data within law firms. They will grow as technologies and will serve the essential function of revolutionising legal practice, refining decisions, improving client experience and most importantly delivering better results in the future.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most significant global legal analytics market, with a 37% market revenue share in 2023.

Availability of a sound technological platform ensures sound application and adoption of innovative legal analytics solutions in North America. High investment levels within legal technology coming from firms indicate the increasing recognition of analytical optimization in productivity. Also, the region has a qualified human capital with proficiency especially in technological and analytical proficiency in executing legal practices. In addition, the current need for transparency and accountability from clients makes legal services both vulnerable and encourage law firms to use analytics. The legal frameworks towards embracing use of technology also augment the market’s growth.

North America Region Legal Analytics Market Share in 2023 - 37%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The component segment is divided into solutions and services. The solutions segment dominated the market, with a market share of around 56% in 2023. Solutions improve decision-making by offering content analysis and conclusions based on historical performance and trends. They also enhance efficiency associated with the analysis of voluminous legal papers by mitigating the need of professionals in the legal field from having to complete mundane work involving the analysis of piles of papers. Further, the majority of solutions include features related to big data analytics and predictive modelling to estimate future events to support strategies in a case or litigation. Solutions facilitate such work processes which can, therefore, result in cost savings.

The deployment model segment is divided into on-premises, cloud-based, and hybrid. The cloud-based segment dominated the market, with a market share of around 45% in 2023. Cloud-based deployment enables the firms to scale up or down the analytics function depending on the work load and the business needs. This flexibility is especially important for law firms of different sizes as it allows them to expand or decrease their operations at any time without a heavy overhead cost. In addition, cloud-based deployment provides the factor of flexibility whereby a legal professional is in a position to access relevant data and analysis tools from any location at any time. This access to a remote system assists the growing practice of decentralised working and cooperation between legal departments and promotes efficient communication between them regardless of the distance. Also, cloud solutions often involve fewer capital costs.

The analytics type segment is divided into descriptive analytics, predictive analytics, and prescriptive analytics. The predictive analytics segment dominated the market, with a market share of around 38% in 2023. It allows lawyers to predict outcomes making it the most popular kind of legal analytics. When combined with past cases and trends, as well as different factors affecting litigation, predictive analytics equips law firms in determining the probabilities of winning particular courses of action, thereby enabling the firms to properly allocate the available resources, while handling their clients. It also allows lawyers to discover latent risks, and opportunities for value creation, in the course of the legal undertaking, at an earlier stage of the legal process. For example, the legal departments can predict the actions and counteractions from other sides of the conflict, be better positioned to know client’s requirements, estimate the likely time and cost of legal processes. But perhaps its greatest benefit is in anticipating issues that may arise in court and making those all-important changes before they are relayed to the client, saving on time and increasing the overall satisfaction of the case-handling process. In addition, settlement strategies can be enhanced by predictive analytics which gives a probability of success to a case that goes to trial or a case that is to be settled out of court. This means that through this analytical approach legal professions can in turn advice their clients on the best step to take. By and large, delivering meaningful information and improving the strategic decision-making makes predictive analytics as one of the foundational elements of contemporary legal analytics and defining its leadership in the market.

The end user segment is divided into law firms, corporate legal departments, government agencies, and consulting firms. The law firms segment dominated the market, with a market share of around 37% in 2023. Law firms are the biggest purchasers of legal analytics owing to the need to perform better, for clients and more importantly to gain a competitive-advantages over others. Law firms use legal analytics to analyse a vast amount of case data to identify patterns that back their strategies and decisions. Lega analytics gives law firms the capability of inspecting case precedents, analysing past and current legal facets, thereby deducing the best course of action every time it deals with cases and clients, which positions them above its competitors and improves client trust and brand image. These tools automate redundant and mundane tasks which enables firms to focus on their core competencies and enhance productivity, efficiency and outcomes.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2023 | USD 3 Billion |

| Market size value in 2033 | USD 10.25 Billion |

| CAGR (2024 to 2033) | 26% |

| Historical data | 2020-2022 |

| Base Year | 2023 |

| Forecast | 2024-2033 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Component, Deployment Model, Analytics Type and End User |

As per The Brainy Insights, the size of the global legal analytics market was valued at USD 3 billion in 2023 to USD 10.25 billion by 2033.

Global legal analytics market is growing at a CAGR of 26% during the forecast period 2024-2033.

The market's growth will be influenced by the increasing legal burden and litigation worldwide.

High implementation costs could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. The Brainy Insights has segmented the global legal analytics market based on below mentioned segments:

Global Legal Analytics Market by Component:

Global Legal Analytics Market by Deployment Model:

Global Legal Analytics Market by Analytics Type:

Global Legal Analytics Market by End User:

Global Legal Analytics Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date