- +1-315-215-1633

- sales@thebrainyinsights.com

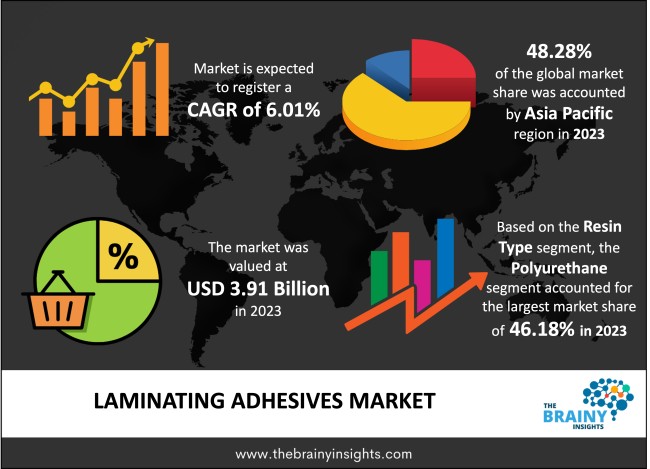

The global laminating adhesives market generated USD 3.91 billion revenue in 2023 and is projected to grow at a CAGR of 6.01% from 2024 to 2033. The market is expected to reach USD 7.01 billion by 2033. The increasing need for flexible packaging across various industries, such as pharmaceuticals, food and beverage (F&B), and personal care, is a significant driver of market revenue growth. Additionally, the need for cost-effective bonding solutions to help businesses reduce production expenses and improve product quality further propels market growth.

Laminating adhesives are specially formulated adhesives used in laminating, which involves mixing two or more layers of materials to construct a single composite structure. These adhesives are designed to provide strong, durable bonds between various substrates such as films, foils, papers, or fabrics. They are generally utilized in flexible packaging, labels, graphic arts, and industrial applications. Depending on the application's specific requirements and environmental considerations, laminating adhesives can be solvent- or water-based or solventless. They are engineered to deliver specific performance characteristics, such as adhesion strength, flexibility, clarity, and heat resistance, tailored to the end-user requirements. These adhesives are crucial in packaging materials, providing barrier properties to protect contents from moisture, oxygen, light, and other external factors. Additionally, they contribute to the overall aesthetics and functionality of the laminated product, ensuring its performance throughout its lifecycle. As manufacturers and consumers increasingly prioritize environmental sustainability, there is a growing demand for eco-friendly laminating adhesives that minimize environmental impact while maintaining performance standards. This factor has led to the development of bio-based, recyclable, and compostable formulations that offer viable alternatives to traditional adhesive solutions.

Get an overview of this study by requesting a free sample

Increasing Demand from the Packaging Sector - The packaging industry is a major consumer of laminating adhesives because they enhance product appearance, provide barrier properties, and improve durability. With the growing demand for packaged goods, especially in food and beverage, pharmaceuticals, and cosmetics, the demand for laminating adhesives continues to rise.

Advancements in Flexible Packaging - Flexible packaging is gaining acceptance due to its lightweight, cost-effectiveness, and sustainability compared to traditional rigid packaging. Laminating adhesives are crucial in bonding multiple layers of flexible packaging materials, such as foils, films, and papers. As the flexible packaging market expands, so does the demand for laminating adhesives.

Growing Demand for Green and Sustainable Adhesives - Environmental concerns and regulations prompt industries to adopt eco-friendly and sustainable adhesive solutions. Water-based and solvent-free laminating adhesives are gaining traction as they reduce emissions and minimize environmental impact. The shift towards sustainable adhesives drives market growth, especially in regions with stringent environmental regulations.

Stringent Environmental Regulations - While there's a growing demand for eco-friendly adhesives, compliance with stringent environmental regulations poses a challenge for manufacturers. Adhesives containing volatile organic compounds (VOCs) or hazardous chemicals may face restrictions or require costly reformulations to meet regulatory standards, impacting production costs and profitability.

Fluctuating Raw Material Prices - Laminating adhesives rely on various raw materials, including resins, solvents, and additives. Fluctuations in these raw materials prices, driven by supply-demand dynamics, geopolitical tensions, and crude oil prices, can significantly impact adhesive manufacturers' production costs and profit margins.

Geographical Expansion - Exploring new markets and increasing distribution networks can help laminating adhesives manufacturers reach new customers and drive revenue growth. Emerging markets in Latin America, Asia-Pacific, and Africa offer considerable growth opportunities due to rapid industrialization, urbanization, and infrastructure development. Manufacturers can capitalize on the rising need for adhesive solutions by establishing local presence and partnerships in these regions.

Technological Advancements - Continuous advancements in adhesive technology allow manufacturers to develop high-performance laminating adhesives with improved bonding strength, durability, and versatility. Investing in research and development to create innovative formulations that address specific customer needs and emerging market trends can help companies differentiate themselves and capture market share.

Customization and Differentiation - Providing customized adhesive solutions tailored to specific customer requirements and applications can help laminating adhesives manufacturers differentiate themselves in the market. Manufacturers can strengthen customer relationships and gain a competitive edge by collaborating closely with customers to understand their unique bonding challenges and offering personalized technical support and services.

Performance Requirements - Meeting stringent performance requirements for laminating adhesives, such as heat resistance, chemical resistance, and adhesion to various substrates, can be challenging. Industries such as automotive, aerospace, and electronics demand high-performance adhesives capable of withstanding extreme conditions and providing long-term durability. Developing adhesive formulations that meet these performance criteria while maintaining cost-effectiveness is challenging for manufacturers.

Supply Chain Disruptions - Disturbances in the supply chain, such as raw material shortages, transportation bottlenecks, and geopolitical uncertainties, can disrupt production schedules and lead to delays in product delivery. Managing supply chain risks and building resilient supply networks are essential to mitigate the impact of unforeseen disruptions on manufacturing operations and customer service.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. Asia Pacific emerged as the most prominent global laminating adhesives market, with a 48.28% market revenue share in 2023.

With a rapidly growing population, Asia Pacific offers a vast consumer base for packaged goods, automobiles, electronics, and other products that utilize laminating adhesives. Rising disposable income levels in countries like Japan, China, India, and Southeast Asian nations fuel consumption, boosting demand for laminating adhesives in packaging and other applications. Furthermore, Asia Pacific has been experiencing significant industrialization and urbanization, driving the market for laminating adhesives across various end-use industries such as packaging, automotive, construction, and electronics. The region's expanding manufacturing sector and growing consumer markets contribute to the high demand for laminating adhesives. The packaging industry is a major consumer of laminating adhesives, and Asia Pacific accounts for a significant share of global packaging production. The region's booming e-commerce sector, coupled with increased demand for packaged food, beverages, cosmetics, and pharmaceuticals, drives the growth of the packaging industry and, consequently, the laminating adhesives market. North America held a significant market share in 2023. North America is a hub for technological innovation, research, and development in adhesive formulations and application methods. Manufacturers in the region continuously invest in developing high-performance laminating adhesives that offer superior bonding strength, versatility, and sustainability. These innovations help meet end-users' evolving needs and drive market growth. In addition, North America has a growing emphasis on sustainability and environmental responsibility, leading to increased demand for eco-friendly and sustainable adhesive solutions. Water-based, solvent-free, and bio-based laminating adhesives are gaining traction in the region as companies seek to lessen their carbon footprint and fulfil sustainability goals.

Asia Pacific Region Laminating Adhesives Market Share in 2023 - 48.28%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The resin type segment is divided into acrylic, polyurethane and others. The polyurethane segment dominated the market, with a share of around 46.18% in 2023. Polyurethane resins are highly versatile and can be formulated to meet various performance requirements. They exhibit excellent adhesion to various substrates, including metals, plastics, wood, and composites, making them suitable for diverse laminating applications across industries such as packaging, automotive, construction, and electronics. In addition, polyurethane laminating adhesives offer exceptional bonding strength, providing durable and long-lasting bonds between different substrates. They can withstand mechanical stress, temperature fluctuations, and environmental exposure, making them ideal for demanding applications where reliable bonding is crucial. Besides, polyurethane resins exhibit excellent flexibility and elasticity, allowing bonded assemblies to withstand dynamic loads, vibrations, and movements without compromising bond integrity. They also offer good resistance to abrasion, impact, and moisture, assuring the longevity and durability of laminated products.

The technology segment is classified into solvent-based, water-based and others. The solvent-based segment dominated the market, with a share of around 48.31% in 2023. Solvent-based laminating adhesives offer excellent bonding performance, providing strong and durable bonds between various substrates such as films, foils, papers, and textiles. They adhere well to various materials, including plastics, metals, and composites, ensuring reliable adhesion in diverse laminating applications. Furthermore, solvent-based adhesives dry and cure quickly, allowing for rapid production speeds and increased throughput in manufacturing processes. The fast drying time minimizes assembly time and enables faster turnaround times for laminated products, improving overall productivity and efficiency. Moreover, solvent-based laminating adhesives demonstrate compatibility with a wide range of substrates, including difficult-to-bond materials such as low-surface energy plastics and metals. This compatibility ensures consistent adhesion and bonding performance across materials and laminating applications.

The application segment includes automotive & transportation, industrial, packaging and others. The packaging segment dominated the market, with a share of around 61.47% in 2023. Packaging protects products from physical damage, contamination, and spoilage during storage, transportation, and handling. Laminating adhesives provide strong, secure bonds that ensure the integrity of packaging materials, preventing leaks, tears, or tampering. This protection is important for perishable goods, sensitive electronic devices, and fragile items. Additionally, flexible packaging has gained popularity over traditional rigid packaging due to its lightweight nature, cost-effectiveness, and sustainability benefits. Flexible packaging materials such as pouches, films, and bags require laminating adhesives to bond multiple layers together, provide barrier properties, and enhance shelf life. The increasing adoption of flexible packaging across various industries drives the demand for laminating adhesives.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) and Volume (Tons) |

| Market size value in 2023 | USD 3.91 Billion |

| Market size value in 2033 | USD 7.01 Billion |

| CAGR (2024 to 2033) | 6.01% |

| Historical data | 2020-2022 |

| Base Year | 2023 |

| Forecast | 2024-2033 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East & Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Resin Type, Technology and Application |

As per The Brainy Insights, the size of the laminating adhesives market was valued at USD 3.91 billion in 2023 to USD 7.01 billion by 2033.

The global laminating adhesives market is growing at a CAGR of 6.01% during the forecast period 2024-2033.

Asia Pacific became the largest market for laminating adhesives.

Increasing demand from packaging industry and advancements in flexible packaging drive the market's growth.

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. The Brainy Insights has segmented the global laminating adhesives market based on below-mentioned segments:

Global Laminating Adhesives Market by Resin Type:

Global Laminating Adhesives Market by Technology:

Global Laminating Adhesives Market by Application:

Global Laminating Adhesives Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date