- +1-315-215-1633

- sales@thebrainyinsights.com

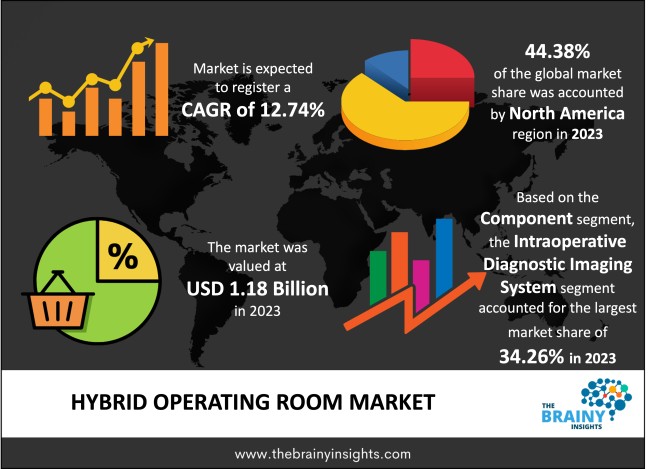

The global Hybrid Operating Room market generated USD 1.18 Billion revenue in 2023 and is projected to grow at a CAGR of 12.74% from 2024 to 2033. The market is expected to reach USD 3.91 Billion by 2033. Owing to the changing demographics characterized by a thriving number of individuals suffering from chronic diseases and those with injuries resulting from falls that are common among the ageing population, there is a need to expand the use of HORs since MIS (minimally invasive surgery) is highly required. Moreover, increasing hospital and ambulatory surgery centre counters, enhanced patients’ preferences to undergo sophisticated and convenient, relatively cheaper and faster surgeries, and increasing investment in hybrid operating room (HOR) equipment contribute to the concerned market.

A hybrid operating room, also known as a combined-modality operating room, is a relatively new concept in actualizing surgical procedures that blends imaging technology with a conventional operating theatre. This hybrid OR has advanced medical imaging technologies, such as fluoroscopy, CT, and MRI, as well as angiography and surgical instrumentation, that allow for imaging during sophisticated surgeries. These rooms are innovated and developed to serve diverse surgical areas, including neurosurgery, cardiovascular, interventional radiology, and orthopaedic. They offer medical experts/professionals or surgeons tremendous visibility of structures within the body and direction in conducting less invasive operations. These facilities may include technological tools like sophisticated surgical platforms, digitized imaging apparatus, robotic surgical machinery, and diverse surgical utensils. The plan's spatial organization is rational and schematic to organize the workflow and introduce cooperation between surgery and imaging. Hybrid operating rooms are a great technological development supporting minimally invasive surgeries that cut the patient's body havoc, lessen recovery time, and enhance outcomes. By implementing the combination of imagining modality in the precise environment of the surgical procedure, the dynamics of contraction and relaxation of the anatomical structure can be visualized in real-time. They can be treated promptly by the relevant measures. Furthermore, hybrid ORs are flexible to meet the dynamics of surgery and its consecutive technological advancements. They can be described as thinking institutions and core comities of academics and students applying their combined prowess in developing new medical science approaches and enhancing patient care delivery. In conclusion, hybrid operating rooms continue to be one of the most progressive concepts within surgical practice as they feature optimal imaging and operating features characteristics. They are fully equipped, help in research and development explorations about minimally invasive surgery, facilitate better results for patients, and determine the future of healthcare.

Get an overview of this study by requesting a free sample

Extreme Geriatric Cases - With increased life spans and easy access to health facilities, it has become common to find elderly patients with multiple ailments. Hybrid operating rooms are valuable tools that enable efficient and more effective complex procedures with decreased risk for patients and are responsive to the escalating demand in geriatric surgery.

Increased Incidence of Chronic Illnesses - There is an expanded rate of cardiovascular illnesses, neurological ailments, as well as cancer, and these compel the progression of enhanced surgeries. Hybrid operating rooms or Hybrid ORs are highly adaptable infrastructures comprising the essential features of an operating room and special imaging equipment or intervention devices of ORs that enable nervous interventional and minimally invasive surgeries.

Improved Technology - The growth of interventional imaging armamentariums, which include imaging systems, sophisticated surgical tools, and robotics, has enhanced the establishment of hybrid operating rooms. These technologies also support the enhancement of a minimally invasive approach, specific interventions, and better results and outcomes for the patient, thus affecting the increase in the need for hybrid OR construction.

Extreme Initial Investment - Another disadvantage of hybrid ORs is the cost of having these installed and the cost of equipment acquisition at the onset. Techniques that set out the need to incorporate the newest imaging systems, surgical instruments, and techniques may be slightly expensive since they entail high capital investment and may prove to be a disadvantage in the case of the small bases of healthcare providers.

Challenges Associated with Implementation - Hybrid ORs require integration and adaptation to various specialities, and time-consuming process planning is needed to establish the processes for using the ORs for specific surgical specialities. Technology integration, harmonization, and staff education and development for interdisciplinary technology implementation remain arduous and lengthy processes which might slow an organization’s pace of technology adoption and make it costly.

The Rise of Minimally Invasive Technologies - With the growing usage of ‘Open’ MIS (minimally invasive surgical) technology such as robotic surgery and image-guided surgery, the prospects for hybrid operating rooms are bound to arise. Minimally Invasive surgery can benefit people in terms of shorter hospitalization, less pain, and early discharge. Hybrid operating theatres fitted with state-of-the-art imaging modalities and robots are particularly suitable for offering efficient minimally invasive operations.

Advantages of Hybrid Operating Rooms - The discussion so far has provided an overview regarding the fact that hybrid operating rooms are not only limited to cardiac and vascular surgery but are being used by almost all surgical specialities such as neurosurgery, orthopaedic surgery, oncology, and multiple others. Further, the growth in the range of hybrid procedures means there is potential to create specific hybrid ORs for distinct surgical specialities based upon the specific needs of the discipline and thus reach a larger population base, gaining more market share.

Coupling and Interface Challenges - Hybrid ORs expect the smooth running of the OR and timely coordination of professional cross-functional teams of surgeons, interventionalists, imaging specialists, and support staff. Patient flows and resource intensiveness must be optimized, giving priority to minimal time turnaround and maximum equipment usage. Nonetheless, the smooth integration of multitudes of end users to accomplish top-notch coordination and cooperation in the hybrid OR context can be complex, especially in stressful operations arena contexts.

Staff Training and Learning - A clear implication of managing a hybrid OR is that individuals operating in this field would require adequate experience and understanding of how to work with improved equipment, along with having a repertoire of diagnostic skills that would be instrumental in analyzing images and engaging with complicated techniques. We can also take some actions to address the challenge, such as training and educating the doctors, nurses, technologists, and other staff to carry out operations in a hybrid OR, improving patient care and achieving better clinical outcomes. However, informing the personnel about novelties in IT, collaboration with other disciplines, and the set of protocols could take time, means, and continual further education.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most prominent global Hybrid Operating Room market, with a 44.38% market revenue share in 2023.

The medical facilities in North America are some of the most developed in the world and feature modern equipment, high-end technology, and experienced staff. Due to a strong healthcare fulfilment in the region, there are fine prospects for implementing and incorporating investment in hybrid ORs, using innovative surgical methods, imaging technology, and medical instruments. In addition, technological advancement is high in the United States and Canada as many manufacturers of medical devices, research, and organizations offering healthcare services embrace high technology. The Middle Eastern region also has a healthy investment in research & development, and technological advances remain the key to improvements in imaging systems, in particular robotic surgery platforms and minimum invasions that form the essence of operating theatres. Furthermore, North America is confronted with a large number of cases coupled with cardiovascular diseases, cancer, as well as neurological disorders that require enhanced levels of surgery. Hybrid ORs provide a flexible environment in which a wide spectrum of diagnostic and therapy procedures that are invasive and image-guided, such as minimally invasive surgery, can be carried out as they assist in the administration of patients with chronic and complex ailments.

North America Region Hybrid Operating Room Market Share in 2023 - 44.38%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The component segment is divided into audiovisual display systems and tools, intraoperative diagnostic imaging system, operating room fixtures, surgical instruments and others. The intraoperative diagnostic imaging system segment dominated the market with a share of around 34.26% in 2023. Special imaging techniques and intraoperative diagnostic imaging systems- fluoroscopy, CT scanners, MRI machines and angiography systems monitor and guide during surgeries. These imaging technologies help surgeons understand the features of intricate different anatomic areas, evaluate tissue perfusion, define the areas with pathology, and take the appropriate actions in the operative theatre, which results in improved accuracy and decreased risk in surgery. Further, intraoperative imaging can also provide various imaging solutions within the setup of the hybrid operating rooms and ease multimodality integration. Fluoroscopy can visualize the vascular structures during surgery when surgery requires further visual information, while CT/MRI can be applied to focus on soft tissues. Also, intraoperative diagnostic imaging systems allow the effective use of minimally invasive approaches, including endovascular interventions, percutaneous procedures, and image-guided therapy. These systems offer a detailed image of the desired area to guide catheters, guidewires, and instruments into areas that are otherwise difficult to access while avoiding harm to any tissues; this helps deliver correct treatment with reduced discomfort to the patient.

The application segment is classified into cardiovascular, neurosurgical, thoracic, orthopedic and others. The cardiovascular segment dominated the market with a share of around 32.17% in 2023. Cardiovascular diseases (CVDs) encompass coronary artery disease, a defect of structure in the heart, a disorder in large blood vessels or pulses, and claim to be the prime global health challenge based on the complexity of the multidisciplinary field and the magnitude of the impact it has on health care delivery systems globally. Hybrid ORs are versatile facilities that may provide comfort and an environment for cardiovascular operations, such as complicated cardiac operations, minimally invasive surgery, and endovascular procedures depending on patients with cardiovascular diseases. It’s important to note that there is a trend on the side of cardiology interventional procedures that call for less invasive methods because of decreased trauma, shorter recovery periods, and enhanced patient results. Hybrid OR assets that possess integrated imaging, robot-assisted work environments, and cath labs help cardiac surgeons and interventional cardiologists execute minimally invasive surgeries with increased accuracy, clarity, and directional authority, stimulating the growth of hybrid OR solutions in cardiovascular applications. In addition, cardiovascular surgeries require cross-sectional imaging for therapy planning, disease evaluation, and intraoperative positioning. Intraoperative MRI, Fluoroscopy, CT angiography, and angiography can be integrated into Hybrid ORs and are advantageous for imaging examinations and meticulous procedural suggestions during cardiovascular interventions. Integrating imaging technologies into the hybrid OR environment plays a climactic role in a specific surgery, the required accuracy of a particular procedure, patient safety, and overall surgical outcomes in various cardiovascular processes.

The end user segment includes ambulatory surgical centers, and hospital and surgical centers. The hospital and surgical centers segment dominated the market with a share of around 67.13% in 2023. Hospitals and surgical centers are the main places that offer an enhanced level of medical care that includes all the necessities of having specialized buildings, staff, and instruments. Given that hospitals and surgical centers can provide vast medical services, they can afford to integrate hybrid OR technology as part of the approach needed for complex surgeries. In addition, hospitals and surgical centers also have a broader client base in terms of the caseload and presenting pathology, where patients may present for minor, elective surgical procedures to more critical, complex surgeries that would involve other specialties within the healthcare system. As evident from the speciality needs of cardiovascular surgery, neurosurgery, orthopaedic, oncology and trauma care, among others, hybrid ORs bring in the needed clinical focus. They are likely to expand the market share of these institutions in the hybrid OR market. Surgical centers and hospitals' organizational setups and super operational capabilities make them well-suited for operating and stewardship hybrid ORs, including distinct spaces designated for surgery, critical care, imaging, and ancillary services. These institutions can also commit dedicated capital to purchase specific or well-advanced tools, developed image capabilities, well-coordinated technology infrastructure needed in conjunction with hybrid surgery, and effective coordination and integration of these hybrid OR assets.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2023 | USD 1.18 Billion |

| Market size value in 2033 | USD 3.91 Billion |

| CAGR (2024 to 2033) | 12.74% |

| Historical data | 2020-2022 |

| Base Year | 2023 |

| Forecast | 2024-2033 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East & Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Component, Application and End User |

As per The Brainy Insights, the size of the hybrid operating room market was valued at USD 1.18 billion in 2023 to USD 3.91 billion by 2033.

The global hybrid operating room market is growing at a CAGR of 12.74% during the forecast period 2024-2033.

North America became the largest market for hybrid operating room.

Rising geriatric population and growing prevalence of chronic diseases drive the market's growth.

1. Introduction

1.1. Objectives of the Study

1.2. Market Definition

1.3. Research Scope

1.4. Currency

1.5. Key Target Audience

2. Research Methodology and Assumptions

3. Executive Summary

4. Premium Insights

4.1. Porter’s Five Forces Analysis

4.2. Value Chain Analysis

4.3. Top Investment Pockets

4.3.1. Market Attractiveness Analysis By Component

4.3.2. Market Attractiveness Analysis By Application

4.3.3. Market Attractiveness Analysis By End User

4.3.4. Market Attractiveness Analysis By Region

4.4. Industry Trends

5. Market Dynamics

5.1. Market Evaluation

5.2. Drivers

5.2.1. Extreme Geriatric Cases

5.2.2. Increased Incidence of Chronic Illnesses

5.3. Restraints

5.3.1. Extreme Initial Investment

5.4. Opportunities

5.4.1. The Rise of Minimally Invasive Technologies

5.5. Challenges

5.5.1. Coupling and Interface Challenges

6. Global Hybrid Operating Room Market Analysis and Forecast, By Component

6.1. Segment Overview

6.2. Audiovisual Display Systems and Tools

6.3. Intraoperative Diagnostic Imaging System

6.4. Operating Room Fixtures

6.5. Surgical Instruments

6.6. Others

7. Global Hybrid Operating Room Market Analysis and Forecast, By Application

7.1. Segment Overview

7.2. Cardiovascular

7.3. Neurosurgical

7.4. Thoracic

7.5. Orthopedic

7.6. Others

8. Global Hybrid Operating Room Market Analysis and Forecast, By End User

8.1. Segment Overview

8.2. Ambulatory Surgical Centers

8.3. Hospital and Surgical Centers

9. Global Hybrid Operating Room Market Analysis and Forecast, By Regional Analysis

9.1. Segment Overview

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.2.3. Mexico

9.3. Europe

9.3.1. Germany

9.3.2. France

9.3.3. U.K.

9.3.4. Italy

9.3.5. Spain

9.4. Asia-Pacific

9.4.1. Japan

9.4.2. China

9.4.3. India

9.5. South America

9.5.1. Brazil

9.6. Middle East and Africa

9.6.1. UAE

9.6.2. South Africa

10. Global Hybrid Operating Room Market-Competitive Landscape

10.1. Overview

10.2. Market Share of Key Players in the Hybrid Operating Room Market

10.2.1. Global Company Market Share

10.2.2. North America Company Market Share

10.2.3. Europe Company Market Share

10.2.4. APAC Company Market Share

10.3. Competitive Situations and Trends

10.3.1. Product Launches and Developments

10.3.2. Partnerships, Collaborations, and Agreements

10.3.3. Mergers & Acquisitions

10.3.4. Expansions

11. Company Profiles

11.1. ALVO Medical

11.1.1. Business Overview

11.1.2. Company Snapshot

11.1.3. Company Market Share Analysis

11.1.4. Company Product Portfolio

11.1.5. Recent Developments

11.1.6. SWOT Analysis

11.2. Getinge AB

11.2.1. Business Overview

11.2.2. Company Snapshot

11.2.3. Company Market Share Analysis

11.2.4. Company Product Portfolio

11.2.5. Recent Developments

11.2.6. SWOT Analysis

11.3. GE Healthcare

11.3.1. Business Overview

11.3.2. Company Snapshot

11.3.3. Company Market Share Analysis

11.3.4. Company Product Portfolio

11.3.5. Recent Developments

11.3.6. SWOT Analysis

11.4. Hill-Rom Holdings Inc.

11.4.1. Business Overview

11.4.2. Company Snapshot

11.4.3. Company Market Share Analysis

11.4.4. Company Product Portfolio

11.4.5. Recent Developments

11.4.6. SWOT Analysis

11.5. IMRIS

11.5.1. Business Overview

11.5.2. Company Snapshot

11.5.3. Company Market Share Analysis

11.5.4. Company Product Portfolio

11.5.5. Recent Developments

11.5.6. SWOT Analysis

11.6. Koninklijke Philips N.V.

11.6.1. Business Overview

11.6.2. Company Snapshot

11.6.3. Company Market Share Analysis

11.6.4. Company Product Portfolio

11.6.5. Recent Developments

11.6.6. SWOT Analysis

11.7. Mizuho Corporation

11.7.1. Business Overview

11.7.2. Company Snapshot

11.7.3. Company Market Share Analysis

11.7.4. Company Product Portfolio

11.7.5. Recent Developments

11.7.6. SWOT Analysis

11.8. NDS Surgical Imaging LLC

11.8.1. Business Overview

11.8.2. Company Snapshot

11.8.3. Company Market Share Analysis

11.8.4. Company Product Portfolio

11.8.5. Recent Developments

11.8.6. SWOT Analysis

11.9. Siemens

11.9.1. Business Overview

11.9.2. Company Snapshot

11.9.3. Company Market Share Analysis

11.9.4. Company Product Portfolio

11.9.5. Recent Developments

11.9.6. SWOT Analysis

11.10. Steris Corporation

11.10.1. Business Overview

11.10.2. Company Snapshot

11.10.3. Company Market Share Analysis

11.10.4. Company Product Portfolio

11.10.5. Recent Developments

11.10.6. SWOT Analysis

11.11. Stryker

11.11.1. Business Overview

11.11.2. Company Snapshot

11.11.3. Company Market Share Analysis

11.11.4. Company Product Portfolio

11.11.5. Recent Developments

11.11.6. SWOT Analysis

11.12. Trumpf Medical

11.12.1. Business Overview

11.12.2. Company Snapshot

11.12.3. Company Market Share Analysis

11.12.4. Company Product Portfolio

11.12.5. Recent Developments

11.12.6. SWOT Analysis

11.13. Toshiba Corporation

11.13.1. Business Overview

11.13.2. Company Snapshot

11.13.3. Company Market Share Analysis

11.13.4. Company Product Portfolio

11.13.5. Recent Developments

11.13.6. SWOT Analysis

List of Table

1. Global Hybrid Operating Room Market, By Component, 2020-2033 (USD Billion)

2. Global Audiovisual Display Systems and Tools, Hybrid Operating Room Market, By Region, 2020-2033 (USD Billion)

3. Global Intraoperative Diagnostic Imaging System, Hybrid Operating Room Market, By Region, 2020-2033 (USD Billion)

4. Global Operating Room Fixtures, Hybrid Operating Room Market, By Region, 2020-2033 (USD Billion)

5. Global Surgical Instruments, Hybrid Operating Room Market, By Region, 2020-2033 (USD Billion)

6. Global Others, Hybrid Operating Room Market, By Region, 2020-2033 (USD Billion)

7. Global Hybrid Operating Room Market, By Application, 2020-2033 (USD Billion)

8. Global Cardiovascular, Hybrid Operating Room Market, By Region, 2020-2033 (USD Billion)

9. Global Neurosurgical, Hybrid Operating Room Market, By Region, 2020-2033 (USD Billion)

10. Global Thoracic, Hybrid Operating Room Market, By Region, 2020-2033 (USD Billion)

11. Global Orthopedic, Hybrid Operating Room Market, By Region, 2020-2033 (USD Billion)

12. Global Others, Hybrid Operating Room Market, By Region, 2020-2033 (USD Billion)

13. Global Hybrid Operating Room Market, By End User, 2020-2033 (USD Billion)

14. Global Ambulatory Surgical Centers, Hybrid Operating Room Market, By Region, 2020-2033 (USD Billion)

15. Global Hospital and Surgical Centers, Hybrid Operating Room Market, By Region, 2020-2033 (USD Billion)

16. Global Hybrid Operating Room Market, By Region, 2020-2033 (USD Billion)

17. North America Hybrid Operating Room Market, By Component, 2020-2033 (USD Billion)

18. North America Hybrid Operating Room Market, By Application, 2020-2033 (USD Billion)

19. North America Hybrid Operating Room Market, By End User, 2020-2033 (USD Billion)

20. U.S. Hybrid Operating Room Market, By Component, 2020-2033 (USD Billion)

21. U.S. Hybrid Operating Room Market, By Application, 2020-2033 (USD Billion)

22. U.S. Hybrid Operating Room Market, By End User, 2020-2033 (USD Billion)

23. Canada Hybrid Operating Room Market, By Component, 2020-2033 (USD Billion)

24. Canada Hybrid Operating Room Market, By Application, 2020-2033 (USD Billion)

25. Canada Hybrid Operating Room Market, By End User, 2020-2033 (USD Billion)

26. Mexico Hybrid Operating Room Market, By Component, 2020-2033 (USD Billion)

27. Mexico Hybrid Operating Room Market, By Application, 2020-2033 (USD Billion)

28. Mexico Hybrid Operating Room Market, By End User, 2020-2033 (USD Billion)

29. Europe Hybrid Operating Room Market, By Component, 2020-2033 (USD Billion)

30. Europe Hybrid Operating Room Market, By Application, 2020-2033 (USD Billion)

31. Europe Hybrid Operating Room Market, By End User, 2020-2033 (USD Billion)

32. Germany Hybrid Operating Room Market, By Component, 2020-2033 (USD Billion)

33. Germany Hybrid Operating Room Market, By Application, 2020-2033 (USD Billion)

34. Germany Hybrid Operating Room Market, By End User, 2020-2033 (USD Billion)

35. France Hybrid Operating Room Market, By Component, 2020-2033 (USD Billion)

36. France Hybrid Operating Room Market, By Application, 2020-2033 (USD Billion)

37. France Hybrid Operating Room Market, By End User, 2020-2033 (USD Billion)

38. U.K. Hybrid Operating Room Market, By Component, 2020-2033 (USD Billion)

39. U.K. Hybrid Operating Room Market, By Application, 2020-2033 (USD Billion)

40. U.K. Hybrid Operating Room Market, By End User, 2020-2033 (USD Billion)

41. Italy Hybrid Operating Room Market, By Component, 2020-2033 (USD Billion)

42. Italy Hybrid Operating Room Market, By Application, 2020-2033 (USD Billion)

43. Italy Hybrid Operating Room Market, By End User, 2020-2033 (USD Billion)

44. Spain Hybrid Operating Room Market, By Component, 2020-2033 (USD Billion)

45. Spain Hybrid Operating Room Market, By Application, 2020-2033 (USD Billion)

46. Spain Hybrid Operating Room Market, By End User, 2020-2033 (USD Billion)

47. Asia Pacific Hybrid Operating Room Market, By Component, 2020-2033 (USD Billion)

48. Asia Pacific Hybrid Operating Room Market, By Application, 2020-2033 (USD Billion)

49. Asia Pacific Hybrid Operating Room Market, By End User, 2020-2033 (USD Billion)

50. Japan Hybrid Operating Room Market, By Component, 2020-2033 (USD Billion)

51. Japan Hybrid Operating Room Market, By Application, 2020-2033 (USD Billion)

52. Japan Hybrid Operating Room Market, By End User, 2020-2033 (USD Billion)

53. China Hybrid Operating Room Market, By Component, 2020-2033 (USD Billion)

54. China Hybrid Operating Room Market, By Application, 2020-2033 (USD Billion)

55. China Hybrid Operating Room Market, By End User, 2020-2033 (USD Billion)

56. India Hybrid Operating Room Market, By Component, 2020-2033 (USD Billion)

57. India Hybrid Operating Room Market, By Application, 2020-2033 (USD Billion)

58. India Hybrid Operating Room Market, By End User, 2020-2033 (USD Billion)

59. South America Hybrid Operating Room Market, By Component, 2020-2033 (USD Billion)

60. South America Hybrid Operating Room Market, By Application, 2020-2033 (USD Billion)

61. South America Hybrid Operating Room Market, By End User, 2020-2033 (USD Billion)

62. Brazil Hybrid Operating Room Market, By Component, 2020-2033 (USD Billion)

63. Brazil Hybrid Operating Room Market, By Application, 2020-2033 (USD Billion)

64. Brazil Hybrid Operating Room Market, By End User, 2020-2033 (USD Billion)

65. Middle East and Africa Hybrid Operating Room Market, By Component, 2020-2033 (USD Billion)

66. Middle East and Africa Hybrid Operating Room Market, By Application, 2020-2033 (USD Billion)

67. Middle East and Africa Hybrid Operating Room Market, By End User, 2020-2033 (USD Billion)

68. UAE Hybrid Operating Room Market, By Component, 2020-2033 (USD Billion)

69. UAE Hybrid Operating Room Market, By Application, 2020-2033 (USD Billion)

70. UAE Hybrid Operating Room Market, By End User, 2020-2033 (USD Billion)

71. South Africa Hybrid Operating Room Market, By Component, 2020-2033 (USD Billion)

72. South Africa Hybrid Operating Room Market, By Application, 2020-2033 (USD Billion)

73. South Africa Hybrid Operating Room Market, By End User, 2020-2033 (USD Billion)

List of Figures

1. Global Hybrid Operating Room Market Segmentation

2. Hybrid Operating Room Market: Research Methodology

3. Market Size Estimation Methodology: Bottom-Up Approach

4. Market Size Estimation Methodology: Top-Down Approach

5. Data Triangulation

6. Porter’s Five Forces Analysis

7. Value Chain Analysis

8. Global Hybrid Operating Room Market Attractiveness Analysis By Component

9. Global Hybrid Operating Room Market Attractiveness Analysis By Application

10. Global Hybrid Operating Room Market Attractiveness Analysis By End User

11. Global Hybrid Operating Room Market Attractiveness Analysis by Region

12. Global Hybrid Operating Room Market: Dynamics

13. Global Hybrid Operating Room Market Share By Component (2024 & 2033)

14. Global Hybrid Operating Room Market Share By Application (2024 & 2033)

15. Global Hybrid Operating Room Market Share By End User (2024 & 2033)

16. Global Hybrid Operating Room Market Share by Regions (2024 & 2033)

17. Global Hybrid Operating Room Market Share by Company (2023)

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. The Brainy Insights has segmented the global Hybrid Operating Room market based on below-mentioned segments:

Global Hybrid Operating Room Market by Component:

Global Hybrid Operating Room Market by Application:

Global Hybrid Operating Room Market by End User:

Global Hybrid Operating Room Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date