- +1-315-215-1633

- sales@thebrainyinsights.com

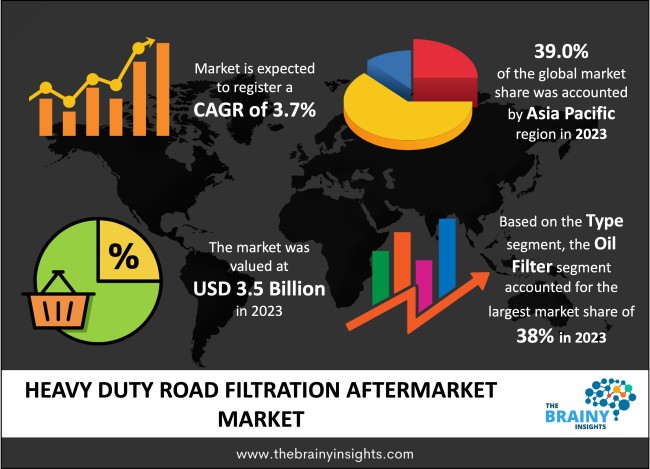

The global heavy duty road filtration aftermarket market was valued at USD 3.5 Billion in 2023 and is anticipated to grow at a CAGR of 3.7% from 2024 to 2033. The heavy-duty road filtration aftermarket pertains to the industry and market that specializes in replacing and upgrading filtration systems for heavy-duty vehicles after being sold. Vehicles such as trucks, buses, construction equipment, agricultural machinery, and industrial gear rely heavily on filtration systems to shield crucial components from contaminants. These essential filters include air, oil, and other filters - all purposefully designed to prevent destructive particles from infiltrating engines or other sensitive areas. The demand for these products arises when original manufacturer-installed filtrations require replacement due to wear and tear or when owners look into enhancing machine performance with better quality alternatives available within the aftermarket segment.

The heavy-duty road filtration aftermarket pertains to the resale market for systems that purify and eliminate debris. Typically engineered from synthetic materials with glass fiber, these filters can endure environmental factors and high acidity levels found in oil vapor. Heavy-duty filtration is a crucial method to extract harmful pollutants like nitrogen oxides emitted by vehicles at their origin point while circulating through the ambient airflow. This kind of filter's applications span multiple sectors such as engine, cabin interior, fuel tanks, and lubricant reservoirs, making them highly valuable within industries including automotive manufacturing or construction development fields along with mining operations.

The heavy-duty road filtration aftermarket has experienced considerable growth in recent years due to various factors. These include the rise of heavy-duty vehicles on roads, an ageing vehicle fleet, and the expansion of agriculture, logistics, and construction industries. Replacement parts like filters are needed when vehicles age; however, advancements made in filtration technology have allowed companies to create superior-performing products, which prompt owners to upgrade existing systems for a better outcome. This increased demand for efficient filter performance within specific operating conditions has led to the industry's growth and intense competition among numerous companies offering tailored filtrations across different types of vehicles, prompting intense customization by aftermarket providers. The robust, heavy-duty road filtration aftermarket also has a vast distribution structure encompassing authorized dealers, independent distributors and online platforms. This network guarantees prompt availability of replacement filters to vehicle operators irrespective of their geographical location. The proliferation of e-commerce has been instrumental in expanding this market by offering customers seamless access to an array of filtration products and a means for evaluating prices and features before committing to a purchase decision.

Get an overview of this study by requesting a free sample

Importance of Heavy Duty Road Filtration - Many heavy-duty vehicles around the world are getting older, and a lot of them remain in use for longer periods. As these vehicles age, there is an increasing need to replace parts like filters. The wear and tear on outdated equipment makes maintenance necessary more often, which can necessitate numerous replacement activities. This trend is particularly noticeable in regions where financial limitations or disruptions within the supply chain have hampered procuring new vehicles—causing operators to keep their current fleets running beyond what was initially planned. The gradual increase in the age of heavy-duty vehicles is a key factor that fuels the aftermarket industry. This creates an unceasing need for replacement filters, which help uphold vehicle efficiency and trustworthiness. Moreover, older automobiles usually mandate high-grade filtration mechanisms to comply with ever-changing environmental regulations while boosting fuel economy levels. Consequently, manufacturers and distributors have capitalized on this trend by introducing specialty aftermarket filters tailored towards optimizing aged automobile performance. This has presented them with valuable growth prospects within the market sector. This factor is boosting the market growth and development.

Regulatory Complexities and Compliance Costs – Government regulations on vehicle emissions, environmental standards, and safety requirements have a significant impact on the heavy-duty road filtration aftermarket. These laws can drive demand for high-quality filtration products but also present challenges such as strict guidelines and increased costs. The stringent emission criteria in regions like North America, Europe, and Asia mean that aftermarket companies must produce filters that not only meet but exceed these expectations. Abiding by these regulations frequently requires considerable financial investments in research and development (R&D), sophisticated manufacturing techniques, and certification testing. These requirements then increase production costs incurred. Smaller companies operating within the aftermarket industry may find it challenging to bear such expenses, forcing them onto their customers through elevated product prices or reduced profit margins. Moreover, regulatory standards continue to change, leading to uncertainty amongst aftermarket manufacturers on long-term planning, who must adjust their products continually for compliance purposes, necessitating extra complexities. This factor is limiting the market growth.

Technological Advancements - The continuous advancement and innovation in filtration systems are major driving forces behind the global aftermarket for heavy-duty road filters. The automotive and industrial sectors' drive towards improved efficiency and durability has significantly increased demand for advanced filtration solutions. With modern heavy-duty vehicles operating in challenging environments where contaminants like dust, dirt, etc., are widespread, filtration technology has evolved significantly to provide enhanced protection against such harmful substances. In response to these challenges, high-performance materials have been developed, which have greatly impressed the industry by significantly enhancing filter efficiency while extending their service lives, consequently improving vehicle performance parameters and reducing operators' cost of replacing faulty/failing filters so often. In addition, incorporating intelligent technology into filtration systems is a major driving factor. The emergence of sensor and monitoring mechanisms that can instantly identify filter status has transformed the aftermarket industry. These advanced filters furnish automobile operators with important details regarding the condition of filtration systems, enabling them to perform timely upkeep and replacement measures. This factor is anticipated to provide lucrative growth opportunities over the years.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. Asia Pacific region emerged as the most prominent global heavy duty road filtration aftermarket market, with a 39.0% market revenue share in 2023. The rapid economic growth and industrialization in several countries of the Asia Pacific region are among the key factors driving its market share in heavy-duty road filtration aftermarket. Notably, China and India have seen substantial expansion over recent decades, resulting in a surge in construction, logistics, and other industry-related sectors that require heavy-duty automobiles. This development has stimulated the demand for reliable filtration systems to ensure optimal vehicle productivity, prompting an increase in aftermarket products' requirements to meet these expectations. The rise of heavy-duty vehicles in China and India can be largely attributed to the government's emphasis on infrastructure. This has led to a heightened demand for aftermarket filtration products, as vehicle operators aim to preserve the efficiency and sustainability of their fleets. India's rapid urbanization and industrial growth have further boosted its heavy-duty vehicle market, creating an even stronger demand for innovative air filters and other available options. The regional market players also engage in various market strategies such as product innovation, product differentiation, mergers, acquisitions, partnerships, and strategic alliances to maintain their competitive edge.

Asia Pacific Region Heavy duty road filtration aftermarket Market Share in 2023 - 39.0%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The type segment includes oil filter, air filter, cabin filter, fuel filter and others. The oil filter segment dominated, with a market share of around 38% in 2023. Oil filters cannot be overstated in heavy-duty vehicles, as they are integral to upholding engine health by eliminating contaminants from the oil. These essential components prevent damage to engine parts, enhance fuel efficiency, and promote longevity for road-worthy machines worldwide. Considering their critical role in safeguarding engines, oil filters dominate a considerable portion of the global market for filtration aftermarket products in heavy-duty transport due to frequent replacements that ensure vital protection is maintained at all times.

The application segment includes trucks & buses, construction, mining and agriculture. The trucks & buses segment dominated, with a market share of around 42% in 2023. From highways to busy city streets, trucks and buses encounter different environments that expose them to various pollutants. Dirt, dust particles, and exhaust fumes are just a few examples of what these vehicles come across daily. Installing reliable filtration systems is thus essential in ensuring optimal engine performance while safeguarding the vehicle's sensitive parts as well as passengers' comfort and safety from harmful airborne particles. Additionally, key filter components such as oil filters, air filters, and fuel flitters play critical roles in preserving the automobile's condition. Oil filters in trucks and buses eliminate impurities from engine oil. This aids in the lubrication of engine components, reducing wear and tear. Because these vehicles travel long distances with extended operational hours, their frequent replacement of oil filters significantly contributes to their market share within the aftermarket industry.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2023 | USD 3.5 Billion |

| Market size value in 2033 | USD 4.94 Billion |

| CAGR (2024 to 2033) | 3.7% |

| Historical data | 2020-2022 |

| Base Year | 2023 |

| Forecast | 2024-2033 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East & Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Type, Application |

As per The Brainy Insights, the size of the global heavy duty road filtration aftermarket market was valued at 3.5 billion in 2023 to USD 4.94 billion by 2033.

The global heavy duty road filtration aftermarket market is growing at a CAGR of 3.7% during the forecast period 2024-2033.

Asia Pacific region became the largest market for heavy duty road filtration aftermarket.

The rising construction activities across emerging nations is driving the market's growth.

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. The Brainy Insights has segmented the global heavy duty road filtration aftermarket market based on below-mentioned segments:

Global Heavy Duty Road Filtration Aftermarket Market by Type:

Global Heavy Duty Road Filtration Aftermarket Market by Application:

Global Heavy Duty Road Filtration Aftermarket Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date