- +1-315-215-1633

- sales@thebrainyinsights.com

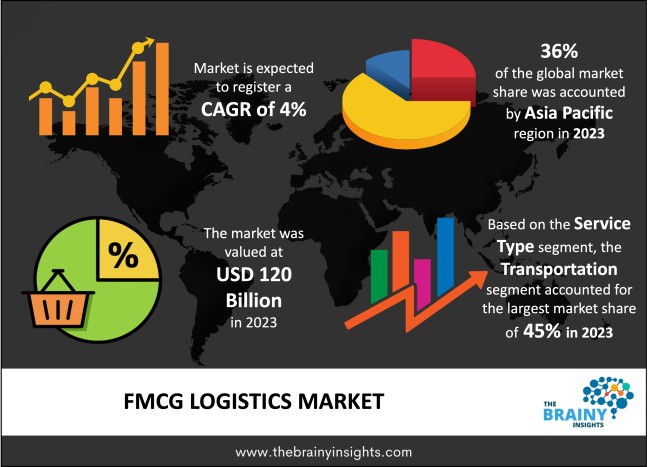

The global FMCG logistics market was valued at USD 120 billion in 2023 and grew at a CAGR of 4% from 2024 to 2033. The market is expected to reach USD 177.62 billion by 2033. The expanding e-commerce industry will drive the growth of the global FMCG logistics market.

FMCG logistics is the systematic movement and handling of fast-moving consumer goods (FMCG), the method of getting these products from the manufacturer to the end consumer. FMCGs are product that hold a fast turnover at a cheap cost, common examples include foods, beverages, toiletries, personal products, cleaning detergents, and OTC drugs. This means that speed and reliability are integral parts of FMCG logistics. Due to high turnover coupled with low shelf life, the delivery of FMCG products should be quick and efficient to prevent stockouts, spoilage of products, especially the perishable ones. This entails a coherent and effective coordinated network of manufacturers, suppliers, third party logistics providers, wholesalers and retailers. Optimal control of these processes is critically significant for the uninterrupted supply of products to the market. It also integrates and includes aspects such as supply chain inventory control, storage, and a distribution network. GPS, SCMS and other enabling technologies are regularly used to improve the routes for delivery to minimize lead times and increase the transparency of goods in the course of transit.

Get an overview of this study by requesting a free sample

The expanding e-commerce industry – The trend of e-commerce and online shopping is one of the prominent reasons fuelling the demand for FMCG logistics. While consumers are becoming more particular about the kind of products they want and when they want them, constant update of inventories becomes a requirement for retailers to meet this need, they are forced to devise and implement effective delivery methods to meet consumers’ demands. FMCG e-commerce distributors in particular, need complex logistics systems for the efficient delivery of a high number of small parcels. This has highlighted the need to have a faster last mile delivery channel, route optimization and real time tracking systems. Population growth and change in consumers’ preference also influences the demand of FMCG logistics in the market. The process of globalization, liberalization and rapid urbanization demand fast and efficient modes of distribution.

Rising transportation costs – Transportation costs have been identified as one of the biggest barriers to the FMCG logistics industry. This is one of the reasons because prices of fuel fluctuate due to change in oil production and this in turn impacts the transportation costs. Thirdly, transportation costs increase due to rising labour costs due to work force scarcity. Furthermore, lack of investment in transport infrastructure in some places worsens the disruptions and raises operating expenses. The sum total of these ever-increasing transportation costs exert pressure directly on the FMCG companies. Fluctuations in the global climate, social and political unrest and other disasters will occasionally result in supply chain disruptions which also hinder the market’s growth.

Technological advancements – Technology plays a major role in the growth of the FMCG logistics industry because it provides means and way to minimize cost and maximize customer experience. Technologies which include GPS tracking, real-time tracking, and use of automation were unheard of in supply chain management. GPS and tracking systems give real-time information about the position and condition of the shipments so that the route can be adjusted, inventory supply needed to be replenished can be deduced, and expected sales can be better projected. Additionally, human interference is being minimized with robotics used in sorting and packaging, AI in picking and packaging to listing of products. Also, AI and machine learning are used for demand forecasting, thus improving the supply chain by minimizing stock-out and over stock conditions. These technologies make the flow of products easier and accurate especially when it comes to logistics required for distribution of FMCG products since these products have short lifespan. There are normally strict rules on the movement, handling, and packing of consumer products, and especially foods, drugs, and other perishable commodities. These regulations also favour the growth and development of global FMCG logistics marker.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. Asia Pacific emerged as the most significant global FMCG logistics market, with a 36% market revenue share in 2023.

Asia-Pacific region has the largest and the fastest-growing customer base in FMCG logistics due to constant economic growth, and growing retail facilities. Some countries in the region include China, India, and Indonesia that are among the most populous nations in the world that have tremendous demand for FMCG products. Increased disposable income, increased population in urban areas, and changing lifestyle have greatly enhanced the sales of these FMCG products thus enhancing the need for stronger logistic management practices. Asia-Pacific has also benefited hugely from the developing of the organized retail and growing market of e-commerce. Furthermore, the region has superior manufacturing capacity which augments the regional market’s growth. Asia Pacific is a strategic hub for FMCG industry, where many companies have set up their production plants to take benefit of cheap labour and easy availability of resources. In addition to this, government initiatives in development of infrastructure add on the competency of the region’s logistics industry.

Asia Pacific Region FMCG Logistics Market Share in 2023 - 36%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The service type segment is divided into transportation, warehousing and value-added services. The transportation segment dominated the market, with a market share of around 45% in 2023. Transportation is the largest subsector within the FMCG logistics whereby it is responsible for the flow of FMCG products from manufacturers to warehouses, distribution centres, retailers etc. This results mainly from the characteristic of FMCG products, as they are fast moving and consumed regularly with possible short life spans. A particularly important aspect is the transport capabilities since Logistic means effective transportation that must deliver products to the final consumer in the best possible condition and in a timely manner. Technological improvements like GPS tracking, route optimization, and fleet management have boosted the reliability and efficacy of this segment. These innovations can facilitate real time tracking and better delivery schedule. In other words, the transportation segment is essential for the FMCG logistics market due to the speed, flexibility and coverage it offers.

The mode of transportation segment is divided into road, rail, air and sea. The road segment dominated the market, with a market share of around 38% in 2023. Road transport has remained the most preferred mode of transport in the FMCG logistics due to its flexibility, accessibility and cost-effectiveness. Road networks are unique in their ability to deliver products directly to a consumer’s doorstep, or to a store that is of direct value to the end consumer. This flexibility is paramount especially in last mile connectivity which is a major factor in FMCG supply chain. The role of road transport is further compounded by the fact that FMCG networks involve high frequency as well as small parcel delivery capacity. Consumption of FMCG goods such as foods and drinks normally demand replenishment on frequent bases, and road transport offers the flexibility required to undertake the restocking exercise with little interferences. Moreover, road transport is generally the cheapest mode of transport for short to medium haul trips. As a result, road transportation’s flexibility, broad access, and effectiveness strongly establish it as the leading mode of transportation for FMCG.

The product type segment is divided into food and beverages, personal care, household products and healthcare products. The food and beverages segment dominated the market, with a market share of around 37% in 2023. Food and beverages take the largest share of the FMCG logistics market as they are items of high consumption. These products are also part of the necessary human consumption necessities, which means they have stable and high consumer demand across geographies and generations and are responsible for a large part of the productions of the FMCG segment. Due to their fast turnover of stocks bought and utilized in modern retail outlets, adequate and dependable logistics are key to ensuring an uninterrupted supply in the outlets. This segment is also attributed to high degrees of perishability of food and beverage products requiring solutions such as cold chain storage. There are special requirements to preserve the quality and safety of perishable food products during transportation and storage when delivering them to the consumer, which remains a primary rationale for the effective use of logistics technologies in this segment. Moreover, the rise of online grocery has also steepened the supply chain of food and beverage logistics.

The end user segment is divided into retailers, wholesalers and e-commerce platforms. The retailers segment dominated the market, with a market share of around 35% in 2023. Retailers stand out as the most important logistics players in the FMCG sector because they are the main distribution link through which most of these products reach the final consumer. Supermarkets/hypermarkets as well as departmental stores and general stores and Kirana stores are the biggest distribution channel of FMCG products. This dominance comes in as a result of the fact that most FMCG companies gotten rid of middlemen and rely heavily on retailers in order to get their products to the end users. FMCG products involve products that are used frequently and needed regularly and therefore retailers typical experience a steady demand for these products.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2023 | USD 120 Billion |

| Market size value in 2033 | USD 177.62 Billion |

| CAGR (2024 to 2033) | 4% |

| Historical data | 2020-2022 |

| Base Year | 2023 |

| Forecast | 2024-2033 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Service Type, Mode of Transportation, Product Type and End User |

As per The Brainy Insights, the size of the global FMCG logistics market was valued at USD 120 billion in 2023 to USD 177.62 billion by 2033.

Global FMCG logistics market is growing at a CAGR of 4% during the forecast period 2024-2033.

The market's growth will be influenced by the expanding e-commerce industry.

Rising transportation costs could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. The Brainy Insights has segmented the global FMCG logistics market based on below mentioned segments:

Global FMCG Logistics Market by Service Type:

Global FMCG Logistics Market by Mode of Transportation:

Global FMCG Logistics Market by Product Type:

Global FMCG Logistics Market by End User:

Global FMCG Logistics Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date