- +1-315-215-1633

- sales@thebrainyinsights.com

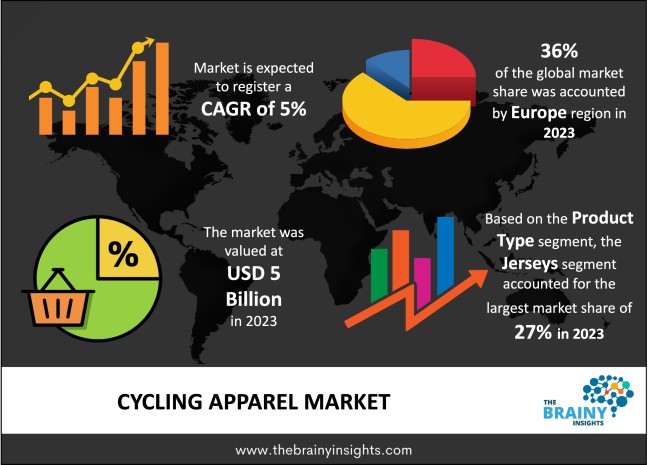

The global cycling apparel market was valued at USD 5 billion in 2023 and grew at a CAGR of 5% from 2024 to 2033. The market is expected to reach USD 8.14 billion by 2033. The rising popularity of cycling as a recreational and fitness activity will drive the growth of the global cycling apparel market.

Cycling apparel means the collection of clothing that is worn by the cyclists in order to improve their performance, comfort and safety throughout the cycling event. A type of clothing specifically designed for cycling is necessary due to the nature of the activity, which requires prolonged positioning of the body in a particular direction, repetitive movements and differing climatic conditions in which the cycling may be undertaken. Cycling garments are made of fine fabrics that are appropriate to cycling scenario, to ensure that they are dry and protected from the heat. The choice of cycling wear depends on the type of cycling – road biking, mountain biking, urban riding or leisure riding, as well as the location of the riding session. Jerseys, shorts or bib, jackets, gloves and base layers are important parts of cycling clothing. Cycling jerseys are form fitting and are manufactured from light weight synthetic fibres with a mesh construction to enhance both ventilation and drying time. Many of them have pockets at the back. Cycling shorts or bibs are designed to have a padded section on the crotch area to ensure that cyclist’s bottom is protected from forming sores that are as a result of rubbing with the bicycle seat when cycling for long distances. Bib shorts have shoulder straps and this way they provide better fit and comfort in comparison to the models without waistbands that put pressure on the waist. Similarly, other cycling apparel also aims to enhance safety, comfort and aesthetics during cycling.

Get an overview of this study by requesting a free sample

The rising popularity of cycling as a fitness activity – the number of cycling-related fitness activities has increased and this has also played a major role in driving the growth of cycling apparel market. In the recent past the number of cyclists has risen due to the fact that cycling is a form of cardiovascular exercise that has many benefits. Cycling is preferred over normal gym workouts as it is fun and effective for all ages and fitness levels which contributes to the increasing number of cyclists. Moreover, the interest towards activities that take place out in the open have also bolstered cycling. As opposed to the other indoor exercising routines, cycling enables the participants to appreciate the surroundings and physical environment since it exercises the mind too in the sense of sightseeing. Bike-sharing has also changed people’s habits and access to bikes by adapting the existing bike-sharing apps for its users, and cycling infrastructure in cities also encourages people to use bikes in their daily lives. Therefore, the rising popularity of cycling as a fitness activity will contribute to the global cycling apparel market’s growth.

The high costs of cycling apparel – cycling apparel is still quite expensive. Good quality cycling wear, which includes cycling jerseys, bib-shorts, cycling jackets and shoes, are made of superior fabrics that aim at providing comfort, durability and other performance enhancing attributes of apparel. Premium prices for high-performance fabrics, state-of-the-art, moisture-wicking, breathability, and aerodynamics in garments increases the price of cycling apparel. Furthermore, cycling apparels are branded and positioned as performance-enhancing product that remains relatively expensive investment which consumers may deem as luxury, unnecessary expenses. There are some areas where cycling is actually exercised as a pastime activity and not necessarily as a regular sport and user may not be willing to invest heavily because they are going to use in only occasionally. Therefore, the high costs of good quality cycling apparel will limit the market’s growth.

Advancements in fabrics and processing technologies – The improvements in fabric technology have been central to upgrading cycling apparel and the quality of the resultant material. Contemporary cycling wear is made from appropriate materials that incorporate features such as ventilation, and are water repellent and abrasion resistance to meet cyclists’ needs. One of the more radical developments is the adoption of the moisture management fabrics enabling the regulation of temperatures. Moreover, the use of Lycra and spandex in the production of cycling jerseys and shorts makes them stretchable, flexible and very tight in order to minimize air drag and achieve maximum results for aerodynamics. The use of improved materials including Gore-Tex that affords waterproof characteristics, but also retain the ability to let through perspiration has also been instrumental in responding to cyclists’ needs. Another new feature is an ultraviolet protection for fabric to shield cyclist from direct sun impact during outdoor rides. These developments also extend to making cycling apparel more comfortable and more long lasting. The advancements in fabrics and processing technologies will contribute to the market’s growth and development during the forecast period.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. Europe emerged as the most significant global cycling apparel market, with a 36% market revenue share in 2023.

The European market holds the largest share in the cycling apparel market due to robust bicycling tradition, cycling events and prominent players in the region. With people in the Netherlands, Germany, the United Kingdom, and Italy using cycling not only as a sport but as a means of transportation and unique lifestyle, the demand for cycling apparel is bound to increase. Responsible for professional cycle racing activities, the region boasts the forthcoming Tour de France, the Giro d’Italia, and the Vuelta a España; therefore, consumers are increasingly demanding cycling wear. In addition, the European market is supported by the continuously increasing trend of sustainability concerns within the apparel market. Most European clothing brands are actively using recycled fabrics and environmentally friendly production technologies. Furthermore, the European market benefits from its well-developed retail infrastructure – both online and offline.

Europe Region Cycling Apparel Market Share in 2023 - 36%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The product type segment is divided into jerseys, tops, bib shorts, tights, jackets and outerwear, gloves, footwear and accessories. The jerseys segment dominated the market, with a market share of around 27% in 2023. Jerseys are leading product category for cycling apparels because they are one of the most important clothing that determine the comfort of the cyclist as they move from one ride to another. Jerseys are the most frequently worn apparel. Cycling jerseys are also designed in regards to aerodynamic. Cycling jerseys tends to be tight-fitting in nature to minimize drag. This increases the demand among professional cyclists and others. The jersey also has rear pockets, which is one of the underrated and vital compartments that are most beneficial to cyclists. Furthermore, cycling jerseys come in a variety of different colours, graphics and variants.

The gender segment is divided into men, women and unisex. The men segment dominated the market, with a market share of around 52% in 2023. The market was dominated by men’s cycling apparels due to greater tendency of male users for cycling for sports and leisure. Cycling especially the competitive and professional cycling was for quite sometimes been dominated by men which has greatly influenced the market demand for male cycling apparel. Most of the professional cycling events and other cycling leagues and teams include only male participants, enhancing the opinion that most invested efforts are centred on crafting apparel suitable for male athletes. Furthermore, the more extensive male cycling fraternity continues to contribute enormously towards the increasing demand for cycling apparel. Brands have extended the range of men’s apparel.

The distribution channel segment is divided into online retail and offline retail. The online retail segment dominated the market, with a market share of around 55% in 2023. Online sales through the internet have emerged as the leading method of product distribution in the cycling apparels market mainly because of its convenience, broader range of products and reasonable prices. Online shopping offers cyclists a compelling offers and convenience of being able to view an array of cycling apparel from different manufacturers and prices, there are no restrictions on stock and variety unlike with conventional stores. Online stores have been preferred for home shopping convenience, doorstep delivery and easy returns. Furthermore, most online stores offer considerably lower prices than traditional shops. The online retailers have the competitive advantage of better prices, discounts, and promotions. Also, there are new or advanced cycling websites selling cycling related products and new marketplaces like Amazon or eBay offer an opportunity for cyclists from all over the globe to get products that might not be available in their home country. Continued transition of the consumer base to online channel for better value proposition results in online channel catering more than half of the cycling apparels market share.

The material type segment is divided into synthetic fabrics, natural fabrics and blended fabrics. The synthetic fabrics segment dominated the market, with a market share of around 51% in 2023. The cycling apparels mainly comprise synthetic fabrics because of the excellent performance characteristics that come with these fabrics and their functionality in meeting the cyclists’ needs. Polyester Lycra and spandexes are preferred as they provide the attributes like moisture management, permeability, and abrasion resistance, attributes that are useful for cycling wear. It also performs excellent by its ability to wick sweat away from the body making cyclists to stay dry even on long ride or high intensity training. Synthetic fabrics are lightweight, flexible, stretchable, and can be produced in fitted cut that increases their comfort and performance. Synthetic fabrics are less expensive than the natural fabrics.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2023 | USD 5 Billion |

| Market size value in 2033 | USD 8.14 Billion |

| CAGR (2024 to 2033) | 5% |

| Historical data | 2020-2022 |

| Base Year | 2023 |

| Forecast | 2024-2033 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Product Type, Gender, Distribution Channel and Material Type |

As per The Brainy Insights, the size of the global cycling apparel market was valued at USD 5 billion in 2023 to USD 8.14 billion by 2033.

Global cycling apparel market is growing at a CAGR of 5% during the forecast period 2024-2033.

The market's growth will be influenced by the rising popularity of cycling as a fitness activity.

The high costs of cycling apparel could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. The Brainy Insights has segmented the global cycling apparel market based on below mentioned segments:

Global Cycling Apparel Market by Product Type:

Global Cycling Apparel Market by Gender:

Global Cycling Apparel Market by Distribution Channel:

Global Cycling Apparel Market by Material Type:

Global Cycling Apparel Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date