- +1-315-215-1633

- sales@thebrainyinsights.com

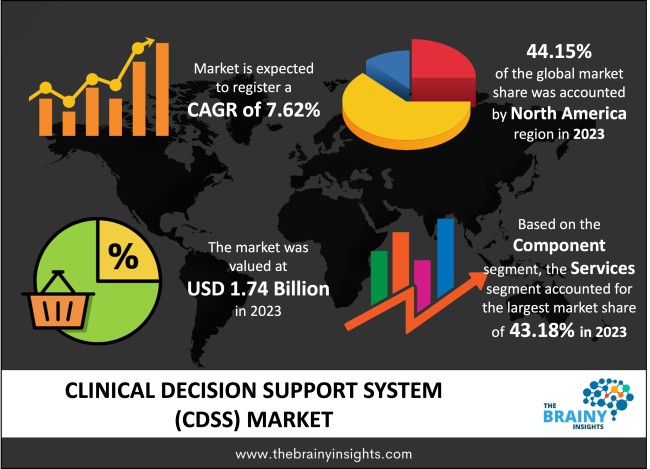

The global Clinical Decision Support System (CDSS) market generated USD 1.74 Billion revenue in 2023 and is projected to grow at a CAGR of 7.62% from 2024 to 2033. The market is expected to reach USD 3.63 Billion by 2033. Two major forces provide massive impetus for the market to expand: high rates of increase in healthcare expenditures and the shift towards cloud computing. In addition, innovations in the form of new products by many players in this industry are expected to create new prospects to boost market growth over the forecast years.

A Clinical Decision Support System (CDSS), therefore, refers to an application-oriented software devised to help health professionals make sensible clinical decisions when using it by availing credible clinical information. CDSSs utilize the patient's electronic health record data, clinical and medical literature and guidelines, and other sources to provide patient-specific decision support suggestions and alerts as and when the case arises. The basic form of operation of the CDSS relies on data about a particular patient, including medical history, laboratory tests, diagnostic results, and prescribed medications. It then matches it against a database of clinical workflow, protocols and decision-support reasoning to produce suggestions, prompts, or warnings for the healthcare giver. They can be concerned with general prevention services, timely adherence to treatment prescriptions, possible disease diagnoses, or further treatment tips for a condition already known to the patient. CDSSs can also have features like PA (predictive analytics) and ML algorithms that analyze patient data and recognize tendencies in unfavourable developments or treatment consequences. CDSSs offer a range of benefits, including improving the medical decision-making process due to timely supported suggestions of an optimal treatment(path) that complies with present medical most of the time. Implementing CDSS tools and supporting the clinicians' workflow enable them to make better decisions, decrease medical mistakes, and increase the value of patients' outcomes by providing the information right within the clinical practice context. Furthermore, CDSSs can help the workforce with patient care in primary and speciality settings and the rehospitalization process and assist emergency departments in managing patients. These resources can be tailored to offer solutions to unique patient cases, including prescription, test reporting, conditions management, and therapy planning. In summary, a Clinical Decision Support System (CDSS) is a tool that employs technology to help healthcare workers offer effective and patient-centered healthcare.

Get an overview of this study by requesting a free sample

Growing Priority on Superior Cares for Patients - Due to the rising emphasis on improving the quality of care, healthcare facilities are implementing the CDSS to support the decision-making system in caring for patients. CDSS can improve diagnosis, treatment decision-making, and patient prognosis and enhance the care-rendering processes.

An Enriched Need for Healthcare Cost-Cutting - Healthcare organizations are compelled to reduce costs and maintain the high quality of their services. Clinical decision support systems can reduce costs by optimizing resource utilization and, in the long run, reducing decision errors and additional procedures or tests.

Expansions in the Field of Healthcare IT - EHRs (electronic health records) and the integration of interoperability standards have provided a greater ability to incorporate CDSS seamlessly into the extant systems. The integration increases convenience for the product’s application by different categories of human resources in the healthcare sector, leading towards market adaptability.

Difficulties in Integration - Another major challenge hindering the deployment of CDSS is the architectural interoperability of these systems with other implementing technologies, such as EHRs and other systems in the healthcare setting. Some problems that can be observed include compatibility conflicts, data integration challenges, and disturbances in the work process.

Clarity and Standard of Records - For CDSS to deliver pertinent recommendations, high-quality and comparable clinical data must be fed into the algorithm. Yet healthcare data remain error-prone and incomplete and frequently need replicability and consistency when collected from various sources, which can hinder the accurate delivery of recommendations for decision-support algorithms or the provision of valuable assistance.

Application of CDSS for the Expansion of Personalized Medicine - Patient-specific information and data, genomic data, data analytics of patient response patterns to specific courses of treatment, and the knowledge derived from this information can help improve the prospects of personalized medicine. The increasing popularity of the individual addressing of patients provides a great chance for CDSS to help in the individual approach to diagnostics and treatment.

Telemedicine and Remote Patient Monitoring - Integrating telemedicine and remote patient monitoring techniques in the healthcare industry provides an understanding of the CDSS to improve virtual care. CDSS can offer immediate clinical decision support for distant clinicians to help them diagnose and treat patients. It allows clinicians to consult one another and intervene early in home/non-traditional care settings.

Clinical Work Distraction - Implementing a Clinical Decision Support System in the clinical setting may interfere with traditional working patterns and hence be met with some resistance from the workers. Many stakeholders report issues such as clinician workload, cognitive overload, and perception of reduced professional autonomy as barriers to the use of CDSSs, hence the need for specific consideration when addressing workflow integration, education and training, and organizational change management.

Evidence Based Content Update and Knowledge Management - Updating the mechanisms for managing knowledge-based information, guidelines, and protocols employed in CDSS can be time-consuming and require considerable effort. As the medical knowledge base grows and develops, and as clinical care guidelines are updated frequently, decision-support content becomes difficult to develop, maintain, and keep synchronized with all current practices across multiple healthcare settings.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most prominent global Clinical Decision Support System (CDSS) market, with a 44.15% market revenue share in 2023.

North America has one of the strongest and most developed health systems in the world, and it presents the comprehensive usage of EHRs, effective health-related information exchange networks, and digital health technologies. In this regard, the well-developed health system in the selected countries makes adopting and integrating CDSS in various pockets of the healthcare chain easier. Moreover, the USA's clean legislation and supportive programs (the HITECH Act or the Meaningful Use program) incentivized healthcare sectors to implement health information technologies, including CDSS. The essential legal framework and financial rewards shape healthcare experts' acceptance of the Clinical Decision Support System, leading to strong market growth in North America. Moreover, North America has a strong base of key stakeholders comprising healthcare technology companies, academic/research institutions, and budding startups that aim to create and deliver the latest innovative CDSS. With strong and well-developed R&D structures, available options for skilled human capital, and plenty of funding sources, the region encourages innovation and competition within the CDSS market space.

North America Region Clinical Decision Support System (CDSS) Market Share in 2023 - 44.15%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The component segment is divided into hardware, software and services. The services segment dominated the market, with a share of around 43.18% in 2023. CDSS solutions can be custom-made because several elements contribute to a healthcare body’s needs. Most service providers provide full-blown support for implementing various components such as the configuration, interfacing with other systems in an enterprise’s IT environment, and business reengineering to increase efficiency. This aspect enables the streamlined implementation and voluntary use of CDSS in healthcare organizations. Furthermore, services involve training and educational programs that strive to provide healthcare experts with critical information and experience that would enable them to embrace the implementation of CDSS in practice. These training programs, workshops and user support services are meant to assist clinicians in learning about CDSS and how to adopt the system in their clinical practices, understanding the outputs of the decision support tools and envisaging structures by which the CDSS can be incorporated into the clinical workflow. This way, they ensure that the possible solutions within the CDSS approach are used and have the highest possible effect on clinical practice. Also, services entail creating and sustaining clinical decision-support material, encompassing clinical protocols, clinical databases, and evidence-based decision algorithms. Most content development organizations rely on inputs and support from physicians, medical librarians, and clinical informatics experts in developing, updating, and validating decision-support information to ensure they are current, accurate, and evidence-based.

The product segment is classified into integrated CPOE with CDSS, integrated EHR with CDSS, integrated CDSS with CPOE & EHR, and standalone CDSS. The standalone CDSS segment dominated the market, with a share of around 32.16% in 2023. Several vendors sell separate and dedicated CDSS solutions. There is good portability and compatibility since CDSS can be integrated into several HIE (health information exchange) networks, EHR systems, and other components of healthcare IT. Standalone CDSS available for healthcare organizations does not tie them to any ECHR vendor or few platforms, hence allowing for flexibility in having a CDSS solution that best suits the organizations' clinical decision support needs. Furthermore, as discussed, most CDSS solutions may be deployed independently of electronic health record systems, allowing healthcare organizations to avoid vendor lock-in and proprietary ecosystems. Other goals of consumers reveal that dedicated CDSSs are prioritized for healthcare providers to choose depending on their wants, needs and the amount of money that they are willing to spend to acquire this medical technology depending on their need and capability and not by the problems that are elicited by the EHR vendor contract or the lack of functionality or additional feature in the EHR systems. Importantly, many standalone CDSS vendors offer expertise and focused experience in designing, improving, and implementing clinical decision support algorithms, knowledge databases, and user interfaces relevant to a particular clinical sub-speciality, disease type, or care delivery environment. This specialized focus and expertise allow standalone CDSS solutions to provide targeted and higher-quality Decision Support Systems that comprehensively meet the healthcare providers and care recipients' requirements and needs.

The delivery mode segment includes web-based systems, cloud-based systems and on-premise systems. The on-premise segment dominated the market, with a share of around 43.10% in 2023. While implementing CDSS solutions on-premise can still be beneficial, it gives an organization more direct control of its data and physical infrastructure to meet privacy, security, and compliance needs. Such CDSS systems, if hosted on-site, will meet set regulations such as HIPAA and have policies and procedures in place to contain and protect the patient data entrusted to them. In the same regard, CDSS solutions that are deployed on the premises afford those healthcare organizations a level of flexibility that the primary concern is the ability to configure the decision support solutions’ algorithms, workflow, and graphical user interface to conform precisely to the clinical requirements of the particular implementing healthcare organization. Identifying specific care paths or clinical decision-making patterns and protocols within individual organizations can be utilized to adapt and enhance the effectiveness and ease of use of the Clinical Decision Support System by healthcare providers. Furthermore, on-premise CDSS solutions are embedded with a feature that allows them to be reused from an existing EHR system, LIS, PACS, and other clinical IT frameworks. Interoperation capabilities enable timely and seamless sharing of data and other relevant content, as well as workflows, thus increasing the usability of CDSS within contexts of and as an integrated component of clinical practices.

The application segment is divided into clinical reminders, clinical guidelines, drug allergy alerts, drug dosing support and others. The drug allergy alerts segment dominated the market, with a share of around 26.21% in 2023. Drug allergy alerts serve as critical interventions because restricting ADRs and allergic reactions to medications are detrimental to patient welfare. Healthcare institutions aim to ensure the health and safety of their patients and therefore look to CDSS, which has efficient drug allergy alert functions that can help reduce medication-associated harm. Furthermore, drug allergy remains a frequent occurrence because more than one-third of patients are known to have some form of allergic reaction to drugs. Health care givers meet patients with drug allergies in their daily practice, proving that alert systems for drug allergies in CDSS are crucial to enable safe prescription and usage of medicines. Moreover, healthcare standards, including those spelt by the U. S. FDA and other similar bodies in other nations, require drug allergy alerts as part of a good medication administration process. Following the rules and guidelines while adopting and implementing CDSS solutions is obligatory, especially when the systems should incorporate powerful drug allergy alert features that protect patients and meet the requirements of healthcare laws and rules.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2023 | USD 1.74 Billion |

| Market size value in 2033 | USD 3.63 Billion |

| CAGR (2024 to 2033) | 7.62% |

| Historical data | 2020-2022 |

| Base Year | 2023 |

| Forecast | 2024-2033 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East & Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Component, Product, Delivery Mode, and Application |

As per The Brainy Insights, the size of the clinical decision support system (CDSS) market was valued at USD 1.74 billion in 2023 to USD 3.63 billion by 2033.

The global clinical decision support system (CDSS) market is growing at a CAGR of 7.62% during the forecast period 2024-2033.

North America became the largest market for clinical decision support system (CDSS).

Increasing demand for enhanced patient care and rising need for healthcare cost reduction drive the market's growth.

1. Introduction

1.1. Objectives of the Study

1.2. Market Definition

1.3. Research Scope

1.4. Currency

1.5. Key Target Audience

2. Research Methodology and Assumptions

3. Executive Summary

4. Premium Insights

4.1. Porter’s Five Forces Analysis

4.2. Value Chain Analysis

4.3. Top Investment Pockets

4.3.1. Market Attractiveness Analysis By Component

4.3.2. Market Attractiveness Analysis By Product

4.3.3. Market Attractiveness Analysis By Delivery Mode

4.3.4. Market Attractiveness Analysis By Application

4.3.5. Market Attractiveness Analysis by Region

4.4. Industry Trends

5. Market Dynamics

5.1. Market Evaluation

5.2. Drivers

5.2.1. Growing Priority on Superior Cares for Patients

5.2.2. An Enriched Need for Healthcare Cost-Cutting

5.3. Restraints

5.3.1. Difficulties in Integration

5.4. Opportunities

5.4.1. Application of CDSS for the Expansion of Personalized Medicine

5.5. Challenges

5.5.1. Clinical Work Distraction

6. Global Clinical Decision Support System (CDSS) Market Analysis and Forecast, By Component

6.1. Segment Overview

6.2. Hardware

6.3. Software

6.4. Services

7. Global Clinical Decision Support System (CDSS) Market Analysis and Forecast, By Product

7.1. Segment Overview

7.2. Integrated CPOE with CDSS

7.3. Integrated EHR with CDSS

7.4. Integrated CDSS with CPOE & EHR

7.5. Standalone CDSS

8. Global Clinical Decision Support System (CDSS) Market Analysis and Forecast, By Delivery Mode

8.1. Segment Overview

8.2. Web-based Systems

8.3. Cloud-based Systems

8.4. On-premise Systems

9. Global Clinical Decision Support System (CDSS) Market Analysis and Forecast, By Application

9.1. Segment Overview

9.2. Clinical Reminders

9.3. Clinical Guidelines

9.4. Drug Allergy Alerts

9.5. Drug Dosing Support

9.6. Others

10. Global Clinical Decision Support System (CDSS) Market Analysis and Forecast, By Regional Analysis

10.1. Segment Overview

10.2. North America

10.2.1. U.S.

10.2.2. Canada

10.2.3. Mexico

10.3. Europe

10.3.1. Germany

10.3.2. France

10.3.3. U.K.

10.3.4. Italy

10.3.5. Spain

10.4. Asia-Pacific

10.4.1. Japan

10.4.2. China

10.4.3. India

10.5. South America

10.5.1. Brazil

10.6. Middle East and Africa

10.6.1. UAE

10.6.2. South Africa

11. Global Clinical Decision Support System (CDSS) Market-Competitive Landscape

11.1. Overview

11.2. Market Share of Key Players in the Clinical Decision Support System (CDSS) Market

11.2.1. Global Company Market Share

11.2.2. North America Company Market Share

11.2.3. Europe Company Market Share

11.2.4. APAC Company Market Share

11.3. Competitive Situations and Trends

11.3.1. Product Launches and Developments

11.3.2. Partnerships, Collaborations, and Agreements

11.3.3. Mergers & Acquisitions

11.3.4. Expansions

12. Company Profiles

12.1. Allscripts Healthcare, LLC

12.1.1. Business Overview

12.1.2. Company Snapshot

12.1.3. Company Market Share Analysis

12.1.4. Company Product Portfolio

12.1.5. Recent Developments

12.1.6. SWOT Analysis

12.2. Athenahealth

12.2.1. Business Overview

12.2.2. Company Snapshot

12.2.3. Company Market Share Analysis

12.2.4. Company Product Portfolio

12.2.5. Recent Developments

12.2.6. SWOT Analysis

12.3. Agfa-Gevaert Group

12.3.1. Business Overview

12.3.2. Company Snapshot

12.3.3. Company Market Share Analysis

12.3.4. Company Product Portfolio

12.3.5. Recent Developments

12.3.6. SWOT Analysis

12.4. Cerner Corporation

12.4.1. Business Overview

12.4.2. Company Snapshot

12.4.3. Company Market Share Analysis

12.4.4. Company Product Portfolio

12.4.5. Recent Developments

12.4.6. SWOT Analysis

12.5. Epic Systems Corporation

12.5.1. Business Overview

12.5.2. Company Snapshot

12.5.3. Company Market Share Analysis

12.5.4. Company Product Portfolio

12.5.5. Recent Developments

12.5.6. SWOT Analysis

12.6. Elsevier B.V.

12.6.1. Business Overview

12.6.2. Company Snapshot

12.6.3. Company Market Share Analysis

12.6.4. Company Product Portfolio

12.6.5. Recent Developments

12.6.6. SWOT Analysis

12.7. IBM Corporation

12.7.1. Business Overview

12.7.2. Company Snapshot

12.7.3. Company Market Share Analysis

12.7.4. Company Product Portfolio

12.7.5. Recent Developments

12.7.6. SWOT Analysis

12.8. Koninklijke Philips N.V

12.8.1. Business Overview

12.8.2. Company Snapshot

12.8.3. Company Market Share Analysis

12.8.4. Company Product Portfolio

12.8.5. Recent Developments

12.8.6. SWOT Analysis

12.9. McKesson Corporation

12.9.1. Business Overview

12.9.2. Company Snapshot

12.9.3. Company Market Share Analysis

12.9.4. Company Product Portfolio

12.9.5. Recent Developments

12.9.6. SWOT Analysis

12.10. MEDITECH

12.10.1. Business Overview

12.10.2. Company Snapshot

12.10.3. Company Market Share Analysis

12.10.4. Company Product Portfolio

12.10.5. Recent Developments

12.10.6. SWOT Analysis

12.11. NextGen Healthcare Inc.

12.11.1. Business Overview

12.11.2. Company Snapshot

12.11.3. Company Market Share Analysis

12.11.4. Company Product Portfolio

12.11.5. Recent Developments

12.11.6. SWOT Analysis

12.12. Oracle (Cerner Corporation)

12.12.1. Business Overview

12.12.2. Company Snapshot

12.12.3. Company Market Share Analysis

12.12.4. Company Product Portfolio

12.12.5. Recent Developments

12.12.6. SWOT Analysis

12.13. Siemens Healthineers GmbH

12.13.1. Business Overview

12.13.2. Company Snapshot

12.13.3. Company Market Share Analysis

12.13.4. Company Product Portfolio

12.13.5. Recent Developments

12.13.6. SWOT Analysis

12.14. Wolters Kluwer N.V.

12.14.1. Business Overview

12.14.2. Company Snapshot

12.14.3. Company Market Share Analysis

12.14.4. Company Product Portfolio

12.14.5. Recent Developments

12.14.6. SWOT Analysis

12.15. Zynx Health

12.15.1. Business Overview

12.15.2. Company Snapshot

12.15.3. Company Market Share Analysis

12.15.4. Company Product Portfolio

12.15.5. Recent Developments

12.15.6. SWOT Analysis

List of Table

1. Global Clinical Decision Support System (CDSS) Market, By Component, 2020-2033 (USD Billion)

2. Global Hardware Clinical Decision Support System (CDSS) Market, By Region, 2020-2033 (USD Billion)

3. Global Software Clinical Decision Support System (CDSS) Market, By Region, 2020-2033 (USD Billion)

4. Global Services Clinical Decision Support System (CDSS) Market, By Region, 2020-2033 (USD Billion)

5. Global Clinical Decision Support System (CDSS) Market, By Product, 2020-2033 (USD Billion)

6. Global Integrated CPOE with CDSS, Clinical Decision Support System (CDSS) Market, By Region, 2020-2033 (USD Billion)

7. Global Integrated EHR with CDSS, Clinical Decision Support System (CDSS) Market, By Region, 2020-2033 (USD Billion)

8. Global Integrated CDSS with CPOE & HER, Clinical Decision Support System (CDSS) Market, By Region, 2020-2033 (USD Billion)

9. Global Standalone CDSS, Clinical Decision Support System (CDSS) Market, By Region, 2020-2033 (USD Billion)

10. Global Clinical Decision Support System (CDSS) Market, By Delivery Mode, 2020-2033 (USD Billion)

11. Global Web-based Systems, Clinical Decision Support System (CDSS) Market, By Region, 2020-2033 (USD Billion)

12. Global Cloud-based Systems, Clinical Decision Support System (CDSS) Market, By Region, 2020-2033 (USD Billion)

13. Global On-premise Systems, Clinical Decision Support System (CDSS) Market, By Region, 2020-2033 (USD Billion)

14. Global Clinical Decision Support System (CDSS) Market, By Application, 2020-2033 (USD Billion)

15. Global Clinical Reminders, Clinical Decision Support System (CDSS) Market, By Region, 2020-2033 (USD Billion)

16. Global Clinical Guidelines, Clinical Decision Support System (CDSS) Market, By Region, 2020-2033 (USD Billion)

17. Global Drug Allergy Alerts, Clinical Decision Support System (CDSS) Market, By Region, 2020-2033 (USD Billion)

18. Global Drug Dosing Support, Clinical Decision Support System (CDSS) Market, By Region, 2020-2033 (USD Billion)

19. Global Others, Clinical Decision Support System (CDSS) Market, By Region, 2020-2033 (USD Billion)

20. Global Clinical Decision Support System (CDSS) Market, By Region, 2020-2033 (USD Billion)

21. North America Clinical Decision Support System (CDSS) Market, By Component, 2020-2033 (USD Billion)

22. North America Clinical Decision Support System (CDSS) Market, By Product, 2020-2033 (USD Billion)

23. North America Clinical Decision Support System (CDSS) Market, By Delivery Mode, 2020-2033 (USD Billion)

24. North America Clinical Decision Support System (CDSS) Market, By Application, 2020-2033 (USD Billion)

25. U.S. Clinical Decision Support System (CDSS) Market, By Component, 2020-2033 (USD Billion)

26. U.S. Clinical Decision Support System (CDSS) Market, By Product, 2020-2033 (USD Billion)

27. U.S. Clinical Decision Support System (CDSS) Market, By Delivery Mode, 2020-2033 (USD Billion)

28. U.S. Clinical Decision Support System (CDSS) Market, By Application, 2020-2033 (USD Billion)

29. Canada Clinical Decision Support System (CDSS) Market, By Component, 2020-2033 (USD Billion)

30. Canada Clinical Decision Support System (CDSS) Market, By Product, 2020-2033 (USD Billion)

31. Canada Clinical Decision Support System (CDSS) Market, By Delivery Mode, 2020-2033 (USD Billion)

32. Canada Clinical Decision Support System (CDSS) Market, By Application, 2020-2033 (USD Billion)

33. Mexico Clinical Decision Support System (CDSS) Market, By Component, 2020-2033 (USD Billion)

34. Mexico Clinical Decision Support System (CDSS) Market, By Product, 2020-2033 (USD Billion)

35. Mexico Clinical Decision Support System (CDSS) Market, By Delivery Mode, 2020-2033 (USD Billion)

36. Mexico Clinical Decision Support System (CDSS) Market, By Application, 2020-2033 (USD Billion)

37. Europe Clinical Decision Support System (CDSS) Market, By Component, 2020-2033 (USD Billion)

38. Europe Clinical Decision Support System (CDSS) Market, By Product, 2020-2033 (USD Billion)

39. Europe Clinical Decision Support System (CDSS) Market, By Delivery Mode, 2020-2033 (USD Billion)

40. Europe Clinical Decision Support System (CDSS) Market, By Application, 2020-2033 (USD Billion)

41. Germany Clinical Decision Support System (CDSS) Market, By Component, 2020-2033 (USD Billion)

42. Germany Clinical Decision Support System (CDSS) Market, By Product, 2020-2033 (USD Billion)

43. Germany Clinical Decision Support System (CDSS) Market, By Delivery Mode, 2020-2033 (USD Billion)

44. Germany Clinical Decision Support System (CDSS) Market, By Application, 2020-2033 (USD Billion)

45. France Clinical Decision Support System (CDSS) Market, By Component, 2020-2033 (USD Billion)

46. France Clinical Decision Support System (CDSS) Market, By Product, 2020-2033 (USD Billion)

47. France Clinical Decision Support System (CDSS) Market, By Delivery Mode, 2020-2033 (USD Billion)

48. France Clinical Decision Support System (CDSS) Market, By Application, 2020-2033 (USD Billion)

49. U.K. Clinical Decision Support System (CDSS) Market, By Component, 2020-2033 (USD Billion)

50. U.K. Clinical Decision Support System (CDSS) Market, By Product, 2020-2033 (USD Billion)

51. U.K. Clinical Decision Support System (CDSS) Market, By Delivery Mode, 2020-2033 (USD Billion)

52. U.K. Clinical Decision Support System (CDSS) Market, By Application, 2020-2033 (USD Billion)

53. Italy Clinical Decision Support System (CDSS) Market, By Component, 2020-2033 (USD Billion)

54. Italy Clinical Decision Support System (CDSS) Market, By Product, 2020-2033 (USD Billion)

55. Italy Clinical Decision Support System (CDSS) Market, By Delivery Mode, 2020-2033 (USD Billion)

56. Italy Clinical Decision Support System (CDSS) Market, By Application, 2020-2033 (USD Billion)

57. Spain Clinical Decision Support System (CDSS) Market, By Component, 2020-2033 (USD Billion)

58. Spain Clinical Decision Support System (CDSS) Market, By Product, 2020-2033 (USD Billion)

59. Spain Clinical Decision Support System (CDSS) Market, By Delivery Mode, 2020-2033 (USD Billion)

60. Spain Clinical Decision Support System (CDSS) Market, By Application, 2020-2033 (USD Billion)

61. Asia Pacific Clinical Decision Support System (CDSS) Market, By Component, 2020-2033 (USD Billion)

62. Asia Pacific Clinical Decision Support System (CDSS) Market, By Product, 2020-2033 (USD Billion)

63. Asia Pacific Clinical Decision Support System (CDSS) Market, By Delivery Mode, 2020-2033 (USD Billion)

64. Asia Pacific Clinical Decision Support System (CDSS) Market, By Application, 2020-2033 (USD Billion)

65. Japan Clinical Decision Support System (CDSS) Market, By Component, 2020-2033 (USD Billion)

66. Japan Clinical Decision Support System (CDSS) Market, By Product, 2020-2033 (USD Billion)

67. Japan Clinical Decision Support System (CDSS) Market, By Delivery Mode, 2020-2033 (USD Billion)

68. Japan Clinical Decision Support System (CDSS) Market, By Application, 2020-2033 (USD Billion)

69. China Clinical Decision Support System (CDSS) Market, By Component, 2020-2033 (USD Billion)

70. China Clinical Decision Support System (CDSS) Market, By Product, 2020-2033 (USD Billion)

71. China Clinical Decision Support System (CDSS) Market, By Delivery Mode, 2020-2033 (USD Billion)

72. China Clinical Decision Support System (CDSS) Market, By Application, 2020-2033 (USD Billion)

73. India Clinical Decision Support System (CDSS) Market, By Component, 2020-2033 (USD Billion)

74. India Clinical Decision Support System (CDSS) Market, By Product, 2020-2033 (USD Billion)

75. India Clinical Decision Support System (CDSS) Market, By Delivery Mode, 2020-2033 (USD Billion)

76. India Clinical Decision Support System (CDSS) Market, By Application, 2020-2033 (USD Billion)

77. South America Clinical Decision Support System (CDSS) Market, By Component, 2020-2033 (USD Billion)

78. South America Clinical Decision Support System (CDSS) Market, By Product, 2020-2033 (USD Billion)

79. South America Clinical Decision Support System (CDSS) Market, By Delivery Mode, 2020-2033 (USD Billion)

80. South America Clinical Decision Support System (CDSS) Market, By Application, 2020-2033 (USD Billion)

81. Brazil Clinical Decision Support System (CDSS) Market, By Component, 2020-2033 (USD Billion)

82. Brazil Clinical Decision Support System (CDSS) Market, By Product, 2020-2033 (USD Billion)

83. Brazil Clinical Decision Support System (CDSS) Market, By Delivery Mode, 2020-2033 (USD Billion)

84. Brazil Clinical Decision Support System (CDSS) Market, By Application, 2020-2033 (USD Billion)

85. Middle East and Africa Clinical Decision Support System (CDSS) Market, By Component, 2020-2033 (USD Billion)

86. Middle East and Africa Clinical Decision Support System (CDSS) Market, By Product, 2020-2033 (USD Billion)

87. Middle East and Africa Clinical Decision Support System (CDSS) Market, By Delivery Mode, 2020-2033 (USD Billion)

88. Middle East and Africa Clinical Decision Support System (CDSS) Market, By Application, 2020-2033 (USD Billion)

89. UAE Clinical Decision Support System (CDSS) Market, By Component, 2020-2033 (USD Billion)

90. UAE Clinical Decision Support System (CDSS) Market, By Product, 2020-2033 (USD Billion)

91. UAE Clinical Decision Support System (CDSS) Market, By Delivery Mode, 2020-2033 (USD Billion)

92. UAE Clinical Decision Support System (CDSS) Market, By Application, 2020-2033 (USD Billion)

93. South Africa Clinical Decision Support System (CDSS) Market, By Component, 2020-2033 (USD Billion)

94. South Africa Clinical Decision Support System (CDSS) Market, By Product, 2020-2033 (USD Billion)

95. South Africa Clinical Decision Support System (CDSS) Market, By Delivery Mode, 2020-2033 (USD Billion)

96. South Africa Clinical Decision Support System (CDSS) Market, By Application, 2020-2033 (USD Billion)

List of Figures

1. Global Clinical Decision Support System (CDSS) Market Segmentation

2. Clinical Decision Support System (CDSS) Market: Research Methodology

3. Market Size Estimation Methodology: Bottom-Up Approach

4. Market Size Estimation Methodology: Top-Down Approach

5. Data Triangulation

6. Porter’s Five Forces Analysis

7. Value Chain Analysis

8. Global Clinical Decision Support System (CDSS) Market Attractiveness Analysis By Component

9. Global Clinical Decision Support System (CDSS) Market Attractiveness Analysis By Product

10. Global Clinical Decision Support System (CDSS) Market Attractiveness Analysis By Delivery Mode

11. Global Clinical Decision Support System (CDSS) Market Attractiveness Analysis By Application

12. Global Clinical Decision Support System (CDSS) Market Attractiveness Analysis by Region

13. Global Clinical Decision Support System (CDSS) Market: Dynamics

14. Global Clinical Decision Support System (CDSS) Market Share By Component (2024 & 2033)

15. Global Clinical Decision Support System (CDSS) Market Share By Product (2024 & 2033)

16. Global Clinical Decision Support System (CDSS) Market Share By Delivery Mode (2024 & 2033)

17. Global Clinical Decision Support System (CDSS) Market Share By Application (2024 & 2033)

18. Global Clinical Decision Support System (CDSS) Market Share by Regions (2024 & 2033)

19. Global Clinical Decision Support System (CDSS) Market Share by Company (2023)

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. The Brainy Insights has segmented the global Clinical Decision Support System (CDSS) market based on below-mentioned segments:

Global Clinical Decision Support System (CDSS) Market by Component:

Global Clinical Decision Support System (CDSS) Market by Product:

Global Clinical Decision Support System (CDSS) Market by Delivery Mode:

Global Clinical Decision Support System (CDSS) Market by Application:

Global Clinical Decision Support System (CDSS) Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date