- +1-315-215-1633

- sales@thebrainyinsights.com

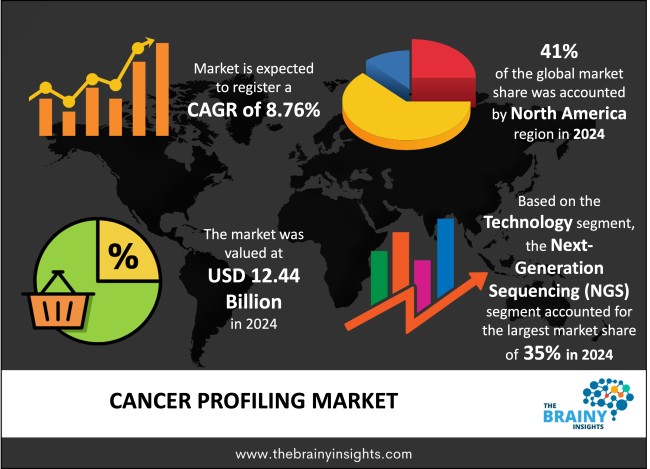

The global cancer profiling market was valued at USD 12.44 billion in 2024 and grew at a CAGR of 8.76% from 2025 to 2034. The market is expected to reach USD 28.80 billion by 2034. The increasing incidence and prevalence of cancer will drive the growth of the global cancer profiling market.

Tumour profiling or molecular profiling or cancer profiling represents a complete strategy that evaluates multiple tumours and their unique characteristics including genetic profiles alongside molecular and biochemical data. This approach reveals the particular mutations together with gene expressions and protein interactions responsible for cancer growth. Personalized medicine depends heavily on this test because it helps doctors prescribe individualized treatments by examining specific tumour characteristics instead of using standardized methods. Next-generation sequencing (NGS), polymerase chain reaction (PCR), immunohistochemistry (IHC), fluorescence in situ hybridization (FISH) and mass spectrometry serve as main cancer profiling techniques. they provide different insights into tumour biology. Physicians use this tool to forecast disease evolution together with the ability to evaluate progress of various treatments administered. The identification of suitable candidates for experimental drugs in clinical trials depends heavily on the results of cancer profiling. Cancer profiling enables physicians to make early cancer detection along with risk assessment in people showing genetic susceptibility for developing cancer. Modern oncology needs cancer profiling because increasing advances in artificial intelligence and machine learning as well as bioinformatics boost its accuracy and efficiency.

Get an overview of this study by requesting a free sample

The increasing incidence and prevalence of cancer – WHO statistics show cancer as one of the primary causes worldwide that results in many deaths and will continue to rise based on the increasing geriatric population, lifestyle changes, environmental hazards and inherited genetic risk factors. Cancer diagnostics and treatments require advanced methods because the increasing number of cancer patients require better detection and therapy solutions. Industrial development together with urbanization practices expose individuals to carcinogens while lifestyle choices including smoking habits as well as unhealthy diet, insufficient exercise and alcohol consumption are risk factors for cancer occurrence. Current improvements in cancer screenings and early diagnosis programs have resulted in more cases being diagnosed which creates an imperative need for accurate molecular profiling. The urgent requirement for individualized therapy emerges due to limited operational and safety aspects of conventional treatments including chemotherapy along with radiation. Through cancer profiling doctors can study tumour-based genetic mutations for personalized treatment programs. The rising number of difficult-to-treat and immune-resistant cancer cases reinforces the urgent need to use molecular diagnostic methods for therapy selection. Global cancer case increases indicate rising technological demand for cancer profiling that supports precision medicine development as well as superior cancer treatment strategies.

High costs of cancer profiling – The expensive nature of cancer profiling serves as the main obstacle for general implementation because it restricts availability to patients and healthcare systems worldwide. Next-Generation Sequencing (NGS) liquid biopsy and gene expression profiling need advanced technological equipment paired with costly reagents and specialized facilities with experts. A single comprehensive genomic profiling test costs anywhere from several hundred dollars to thousands of dollars so many patients and especially people from low- and middle-income countries cannot afford this service. These tests need trained professionals who specialize in genomics which drives up the total cost. Costs associated with data interpretation and analysis presentations also present substantial financial challenge. Genetic data output from cancer profiling needs specialized bioinformatics equipment with powerful computational capabilities as well as databases and skilled professionals to review the findings thus creating increased costs for software systems and staffing. Small hospitals and diagnostic centres avoid adopting cancer profiling technologies because they need to invest heavily in sequential facilities while meeting regulatory compliance requirements. Lack of sufficient insurance coverage and inadequate reimbursement policies from healthcare systems makes patients cover their molecular diagnostic costs on their own finances which hampers the market’s growth.

Increasing research and development expenditure – Public and governmental financial support leads the way toward increasing cancer profiling needs because it boosts research progress and develops precision oncology technology and accessibility. Public authorities across the globe dedicate major monetary resources for cancer studies as well as early detection screening and sophisticated diagnostic systems. The development of cancer profiling technologies receives support through national cancer research efforts combined with genomics projects which operate across Europe and Asia. Standard cancer care receives support for molecular diagnostic adoption through public health agencies together with regulatory bodies who provide financial backing for massive genomic sequencing projects and clinical trials. Cancer profiling receives substantial financial support from both private pharmaceutical companies and biotechnology firms along with venture capital groups at present. The pharmaceutical industry uses molecular diagnostic methods to understand genetic variations for creating new medicine treatments that lead to better treatment effects. The success of startups and research organizations dedicated to next-generation sequencing (NGS) and liquid biopsy together with artificial intelligence-based bioinformatics receives higher funding support for advancing cancer diagnostic methods. The market keeps growing as both sectors increase their financial backing of cancer profiling technology which has made these systems more sophisticated while improving accessibility and enhancing their role in individualized cancer therapy.

Limited insurance coverage.

Both limited insurance coverage and low awareness and adoption patterns among developing regions restrict the wide implementation of cancer profiling. A significant number of healthcare institutions which operate primarily in developing nations currently lack insurance coverage provisions for molecular diagnostic tests. Medical organizations in developed countries apply inconsistent reimbursement standards to cancer profiling services because insurers restrict payments only to tests linked to approved therapies. Standardized reimbursement policies that cover advanced genetic testing are missing which requires patients to bear out-of-pocket expenses too expensive for numerous patients. The lack of proper reimbursement policies deters medical providers along with diagnostic companies from funding cancer profiling thus reducing access opportunities for patients. Cancer profiling has limited adoption in developing regions because financial constraints intersect with insufficient infrastructure and insufficient training about the technology. Healthcare organizations in many areas do not have proper genomic testing infrastructure or trained personnel or support from regulatory bodies to perform molecular diagnostic analysis routinely in oncology practices. The standard cancer diagnostic methods based on biopsy and imaging techniques persist dominating healthcare settings because they have affordable prices and broad accessibility. Inadequate knowledge among medical personnel and patients about cancer profiling benefits decreases the market demand for sophisticated testing solutions.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most significant global cancer profiling market, with a 41% market revenue share in 2024.

The region has advanced healthcare systems which treat many cancer cases while prioritizing precise medicine methods. Cancer profiling solution markets are predominantly led by United States and Canada because both countries have fully developed systems for molecular diagnostics drug development and cancer research focused on biomarkers. The main reason behind North America’s leadership position in the global cancer profiling sector stems from its large number of individuals afflicted with cancer. New market growth stems from robust investments conducted by both public institutions and private corporations. Market adoption increases through regulatory approvals of NGS-based tests together with companion diagnostics. Medical innovation in personalized oncology advances rapidly through joint endeavours of research centres with pharmaceutical companies as well as healthcare institutions. The North American market maintains its leadership position in global cancer profiling because genomics technology continues advancing together with AI-driven diagnostic systems.

North America Region Cancer Profiling Market Share in 2024 - 41%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The technology segment is divided into Next-Generation Sequencing (NGS), Polymerase Chain Reaction (PCR), Immunohistochemistry (IHC), In Situ Hybridization (ISH), Microarrays and Others. The Next-Generation Sequencing (NGS) segment dominated the market, with a market share of around 35% in 2024. The cancer profiling market leads with Next-Generation Sequencing (NGS) due to its precise large-scale analysis of simultaneous gene evaluation. Personalized cancer care based on precision medicine becomes feasible through the genomic insights made possible by NGS instead of using obsolete sequencing approaches like Sanger sequencing and PCR. The extensive use of NGS technology mainly results from its ability to help choose targeted therapies. Large-sequence analysis with NGS proves cheaper than conventional techniques for sequencing programs. The technological progress in laboratory automation together with reduced sequencing expenses has driven clinical laboratories and research institutions to choose NGS for cancer profiling. The market penetration of NGS-based companion diagnostics intensified due to regulatory approvals by the FDA and EMA along with other authorities.

The cancer type segment is divided into breast cancer, lung cancer, colorectal cancer, prostate cancer, melanoma and others. The breast cancer segment dominated the market, with a market share of around 33% in 2024. The cancer profiling market is dominated by breast cancer patients because it has the highest worldwide incidence rates. Breast cancer stands as the WHO-recognized leading cancer form worldwide because thousands of individuals receive breast cancer diagnoses every year globally. The rising cancer incidence has made cancer profiling necessary because this approach provides essential support for timely detection and treatments. The introduction of breast cancer-targeted medications along with PARP inhibitors for patients with BRCA-mutations creates additional medical need for breast cancer profiling. The rise in breast cancer screening activities along with public awareness initiatives lead to increased adoption of molecular profiling. Breast cancer detection rates have increases elevated because government entities and healthcare institutions run routine screening programs that involve mammography and genetic evaluation.

The biomarker type segment is divided into genetic biomarkers, protein biomarkers, epigenetic biomarkers and others. The genetic biomarkers segment dominated the market, with a market share of around 40% in 2024. The cancer profiling market primarily uses genetic biomarkers because these biomarkers play essential roles in precision medicine, early detection and selecting specific therapeutic approaches. The specific and sensitive nature of genetic biomarkers makes them the selection preference for oncologists and researchers above protein and epigenetic biomarkers. Next-Generation Sequencing (NGS) and Polymerase Chain Reaction (PCR) with liquid biopsy technologies have expanded the success of genetic biomarkers through their ongoing technological improvements. The combination of these technical methods enables rapid cost-efficient genetic screening from blood as well as tissue samples which increases cancer diagnosis capabilities. The FDA along with EMA granted regulatory approval for NGS-based companion diagnostics which boosted the implementation of genetic biomarkers throughout medical practice. The profiling market for cancer will be led by genetic biomarkers because scientists continue their investigation of new oncogenic mutations.

The application segment is divided into diagnostics, prognostics, personalized medicine, drug development and others. The diagnostics segment dominated the market, with a share of around 42% in 2024. Cancer profiling functions as an essential tool for medical practitioners to determine genetic mutations along with biomarkers and molecular patterns which affect disease advancement and therapeutic selection processes. The rising global incidence of cancer together with an increased desire for sophisticated diagnostic instruments has led to substantial growth because early disease detection creates better outcomes for patients. Routine cancer screening together with diagnostic features has established molecular profiling as the dominant factor in medical diagnostics practice. The market has experienced expansion due to governmental programs together with biomarker-based cancer diagnostic approval processes. The FDA along with the EMA approved various diagnostic tests that can now be routinely used for standard care in oncology. The development of precision medicine will keep fuelling the growing market need for cancer profiling diagnostics so they become increasingly dominant across worldwide cancer diagnostics.

The end user segment is divided into hospitals & diagnostic laboratories, pharmaceutical & biotechnology companies and academic & research institutes. The hospitals & diagnostic laboratories segment dominated the market, with a share of around 43% in 2024. Hospitals and laboratories maintain their position as primary user facilities for cancer profiling solutions as they have access to advanced diagnostic technologies along with specialized oncologists who support their access to large numbers of cancer patients. Hospitals together with diagnostic laboratories gain access to governmental financial support along with payments from insurance providers and pharmaceutical company partnerships which contribute to precision oncology development. Many research hospitals work together with biotech firms to develop new biomarker-based tests for medical markets through validation processes and increase industry expansion. The combination of infrastructure capabilities and technical expertise coupled with advanced technological access keeps hospitals and diagnostic laboratories as the top players in the global cancer profiling market.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2024 | USD 12.44 Billion |

| Market size value in 2034 | USD 28.80 Billion |

| CAGR (2025 to 2034) | 8.76% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Technology, Cancer Type, Biomarker Type, Application and End User |

As per The Brainy Insights, the size of the global cancer profiling market was valued at USD 12.44 billion in 2024 to USD 28.80 billion by 2034.

Global cancer profiling market is growing at a CAGR of 8.76% during the forecast period 2025-2034.

The market's growth will be influenced by the increasing incidence and prevalence of cancer.

High costs of cancer profiling could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global cancer profiling market based on below mentioned segments:

Global Cancer profiling Market by Technology:

Global Cancer profiling Market by Cancer Type:

Global Cancer profiling Market by Biomarker Type:

Global Cancer profiling Market by Application:

Global Cancer profiling Market by End-User:

Global Cancer profiling Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date