- +1-315-215-1633

- sales@thebrainyinsights.com

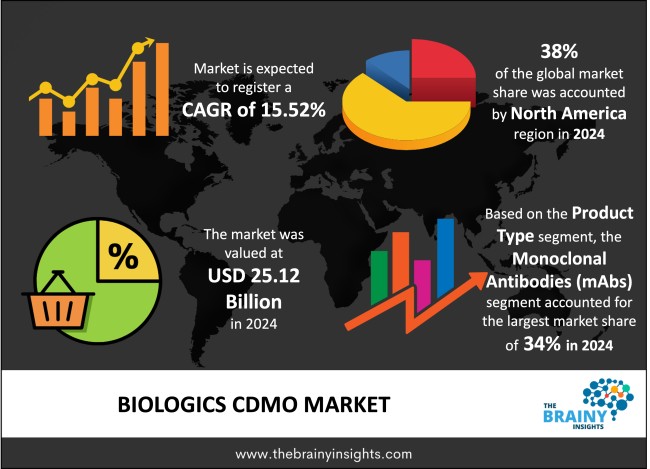

The global biologics CDMO market was valued at USD 25.12 billion in 2024 and grew at a CAGR of 15.52% from 2025 to 2034. The market is expected to reach USD 106.31 billion by 2034. The rising demand for biologics will drive the growth of the global biologics CDMO market.

CDMOs function as specialized providers who aid biotechnology and pharmaceutical businesses in developing and making biologic medications. The medical sector treats medical conditions such as cancer, autoimmune diseases and genetic disorders with complex drugs which originate from living organisms. Biologics CDMOs provide complete services from research development through clinical trial manufacturing to commercial production scale. Biologics CDMOs hold essential functions to create an essential link between pharmaceutical research and clinical product release. The organization supports pharmaceutical companies with specialized expertise for process optimization and regulatory requirements and large-scale manufacturing capabilities needed to address international market needs. Biologic products require specific advanced technology infrastructure including cell line development systems along with fermentation techniques and purification methods and formulation methods. CDMOs work with companies to handle their regulatory requirements which include compliance with FDA and EMA requirements and other health authority guidelines for maintaining high standards of biologic safety and quality and performance levels. Significant market expansion occurs in the biologics CDMO industry due to rising use of biologics therapies. Most biotechnology firms conduct research on new therapeutic solutions but partner with CDMOs for specialized support and expedited product delivery. Partnerships between companies and CDMOs enable businesses to concentrate on their main strengths including science development and sales activities while delegating complicated manufacturing operations to specialized providers.

Get an overview of this study by requesting a free sample

The increasing demand for biologics – Biological products consisting of monoclonal antibodies, vaccines, gene and cell-based therapeutic methods are revolutionizing the medical treatment of different complex diseases across cancer types and autoimmune disorders and rare genetic conditions. Biologics market adoption rises because these drugs create therapeutic solutions beyond traditional small-molecule drugs thus leading to the expansion of the biologics CDMO sector. The pharmaceutical sector needs biologics CDMOs to fulfil production requirements for newly developed therapies as well as existing products that serve patients from a growing elderly population and rising patient demographics. New trends toward biosimilar drugs and personalized medical solutions produce increased needs for biologics Contract Development and Manufacturing Organizations. Specific patient requirements for personalized medicine treatments need sophisticated patient-tailored manufacturing processes for biologic therapies but these therapeutic approaches continue to expand in the healthcare landscape. The growth of both biosimilars together with personalized medicine will increase the necessity for CDMOs who specialize in handling complex manufacturing methods which will consequently boost market demand for their biologic services.

High production costs of biologics – High production expenses for biologics present a key reason that limits the market need for biologics Contract Development and Manufacturing Organizations (CDMOs). Complex large-molecule biologic drugs made from living organisms need complicated manufacturing processes that start with cell culture and fermentation followed by purification before formulation and they demand both long durations and substantial resource allocation. At the present time small-molecule drugs can be synthesized through chemical reactions while the production of biologics necessitates specialized biological processing that requires exceptionally advanced facilities alongside specialized technologies and skilled experts. Manufacturing these products demands substantial expenses while technical staff must repeatedly check the product throughout manufacturing for protection assurance and performance integrity. A substantial capital investment is needed to build everything required for biologics production such as bioreactors along with purification systems and temperature-controlled storage solutions. Biotherapeutic medications need to comply with strict regulatory criteria from the FDA and EMA that generate more expenses for quality control systems and documentation methods and adherence protocols. The cost of producing biologics increases due to the specialized requirements of raw materials that include cell lines alongside culture media products.

Increasing research and development expenditure – The rising investment in biotechnology functions as a main force that compels customers to require biologics CDMOs. The biotechnology sector received substantial funding from venture capitalists together with large pharmaceutical companies due to advances in gene editing and immunotherapy and regenerative medicine. The treatment era undergoes transformation due to groundbreaking innovations in biologic therapy development where biotech ventures urgently create new pharmaceutical agents. New biotechnology firms along with smaller organizations find it challenging to establish large-scale professional production facilities because they lack proper financial resources. CDMOs serve as providers of essential capabilities to these companies so their products get efficiently manufactured while fulfilling regulatory compliance standards necessary for commercial production volume. More companies follow the practice of handing over biologics manufacturing operations to external partners. Increasing numbers of biotech and pharmaceutical companies make strategic alliances with Contract Development and Manufacturing Organizations instead of building self-owned manufacturing sectors. The expanding biotechnology sector will escalate the need for Contract Development and Manufacturing Organizations thus driving market expansion.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most significant global biologics CDMO market, with a 38% market revenue share in 2024.

North America leads the biologics Contract Development and Manufacturing Organization (CDMO) market because of its premier biopharmaceutical sector together with excellent infrastructure and major research and development investments. The United States leads globally in biologic production because pharmaceutical giants including Pfizer together with Amgen and Moderna strongly support monoclonal antibodies and gene therapies and biosimilar research and development. Market growth in the region continues to expand because these companies maintain more development services and manufacturing contracts with CDMOs. The United States Food and Drug Administration (FDA) regulates the region with its established Biologics License Application (BLA) approval system serving as a major reason for North America's pharmaceutical leadership. Massive financial support from both government agencies and private organizations for biopharmaceutical research in North America drives sustained developments of novel biologics that need large-scale production systems.

North America Region Biologics CDMO Market Share in 2024 - 38%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The product type segment is divided into monoclonal antibodies (mAbs), vaccines, cell and gene therapies, recombinant proteins, biosimilars and other biologics. The monoclonal antibodies (mAbs) segment dominated the market, with a market share of around 34% in 2024. Monoclonal antibodies serve multiple disease conditions including cancers and autoimmune diseases and infectious pathogens. The pharmaceutical industry accepts monoclonal antibodies due to their capability to adjust immune responses and stop disease progression as well as supply specific therapeutic approaches. The escalating demand for biologic research and development of monoclonal antibodies drives pharmaceutical companies to seek out large-scale manufacturing services which Contract Development and Manufacturing Organisations (CDMOs) are perfectly positioned to deliver. Industry demand for mAbs increases because biotechnology advancement like recombinant DNA technology and hybridoma techniques enhance both production efficiency and therapeutic capability. Monoclonal antibodies will keep maintaining their position as the dominating sector in the biologics CDMO market because of sustained innovation and increasing international market demand.

The service type segment is divided into contract manufacturing, contract development, fill-finish services, and analytical & quality control services. The contract manufacturing segment dominated the market, with a market share of around 38% in 2024. The biologics CDMO market receives most of its business from contract manufacturing because manufacturing biologics poses significant challenges in terms of cost and complexity and regulatory requirements. The complex manufacturing procedures together with specialized production facilities as well as demanding quality control requirements make in-house production of biologics an expensive operation beyond the capabilities of many pharmaceutical and biotech companies. Many companies now choose CDMO outsourcing because it enables them to access specialized contract manufacturing facilities together with dedicated expertise in order to achieve superior business results. The dominance of contract manufacturing results mainly from increasing market requirements for biologic therapies that include monoclonal antibodies and vaccines and gene therapies. The worldwide increase of approved biologic drugs requires pharmaceutical companies to develop large-scale productive capabilities for global market distribution. CDMOs offer complete manufacturing solutions by handling product production and packaging operations through their fill-finish services and upstream and downstream processes to maintain GMP compliance for efficient operations.

The end user segment is divided into pharmaceutical & biotechnology companies and research organizations & institutes. The pharmaceutical & biotechnology companies segment dominated the market, with a market share of around 58% in 2024. The dominant role in the biologics Contract Development and Manufacturing Organization (CDMO) market belongs to pharmaceutical and biotechnology companies since they require outsourced biologics development and production services extensively. The dominance of biotech sector is directly linked to the activities of small and mid-sized businesses who conduct drug research while lacking the capabilities to produce on larger manufacturing levels. CDMOs enable pharmaceutical clients to develop drugs more quickly by providing manufacturing services at lower costs thus reducing time to market with no need to build their own facilities. Pharmaceutical organizations are now turning to CDMOs regularly to develop their biologics product ranges while satisfying international market requirements since biologics manufacturing depends on modern production standards and increasing regulatory requirements.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2024 | USD 25.12 Billion |

| Market size value in 2034 | USD 106.31 Billion |

| CAGR (2025 to 2034) | 15.52% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Product Type, Service Type and End User |

As per The Brainy Insights, the size of the global biologics CDMO market was valued at USD 25.12 billion in 2024 to USD 106.31 billion by 2034.

Global biologics CDMO market is growing at a CAGR of 15.52% during the forecast period 2025-2034.

The market's growth will be influenced by the increasing demand for biologics.

High production costs of biologics could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global biologics CDMO market based on below mentioned segments:

Global Biologics CDMO Market by Product Type:

Global Biologics CDMO Market by Service Type:

Global Biologics CDMO Market by End User:

Global Biologics CDMO Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date