- +1-315-215-1633

- sales@thebrainyinsights.com

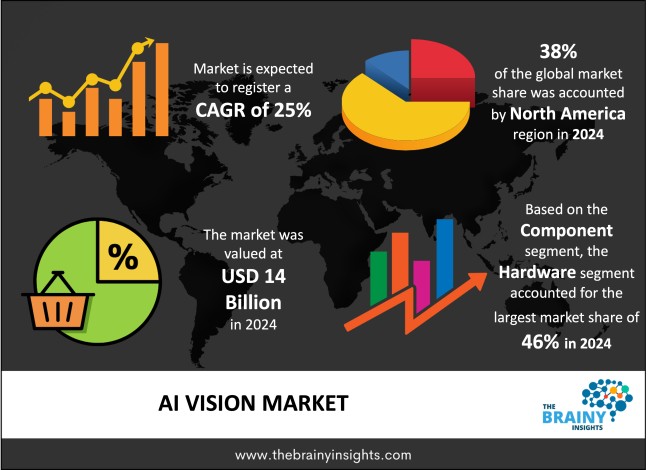

The global AI vision market was valued at USD 14 billion in 2024 and grew at a CAGR of 25% from 2025 to 2034. The market is expected to reach USD 130.38 billion by 2034. The rapidly advancing AI technologies will drive the growth of the global AI vision market.

AI vision functions as computer vision to provide artificial intelligence with capabilities which help computers understand visual world data through processing similar to human image perception. The combination of machine learning and deep learning with neural networks enables machinery to analyse visual information such as images and videos which leads to detection of patterns while identifying objects and image classification and production of intelligent decisions. The AV technology utilizes image recognition together with object detection and facial recognition and scene understanding methods to serve diverse industrial needs. AI vision helps medical imaging diagnostics through the detection of diseases in X-rays and MRIs and CT scans. Automotive autonomous vehicles depend heavily on AI vision because it performs continuous detection of objects and recognizes lanes and tracks pedestrians. Security applications use AI vision to track people and spots suspicious actions as well as managing entry points through facial recognition functions. AI vision capabilities achieve faster processing and real-time operations through combined utilization of edge computing technology and cloud infrastructure.

Get an overview of this study by requesting a free sample

Samsung Vision AI will be introducing personal AI-powered screens to improve your daily life at the CES 2025 First Look event. Along with significant improvements to its Lifestyle TVs and future display technologies, Samsung also revealed the newest flagship Neo QLED 8K QN990F. These announcements represent Samsung's aim to turn displays into intelligent, adaptable companions that enhance and simplify daily life.

The increasing automation of industries – Rising automation across industries is a key driver of AI vision adoption, as businesses increasingly seek to enhance efficiency, reduce costs, and improve accuracy. AI vision-powered automation is transforming sectors such as manufacturing, healthcare, retail, automotive, and logistics by enabling machines to perform complex visual tasks with minimal human intervention. In manufacturing, AI vision is revolutionizing quality control by detecting defects, ensuring precision in assembly lines, and monitoring production processes in real time. Robotics integrated with AI vision can identify, sort, and assemble components autonomously, reducing labour costs and increasing production speed. In healthcare, AI-driven automation aids in medical imaging analysis, helping radiologists detect anomalies in X-rays, MRIs, and CT scans with higher accuracy and efficiency. Retailers are leveraging AI vision for cashier-less checkout systems, shelf monitoring, and customer behaviour analysis, streamlining inventory management and improving the shopping experience. The automotive industry relies heavily on AI vision for autonomous vehicles and advanced driver-assistance systems (ADAS), enabling real-time lane detection, pedestrian tracking, and collision avoidance.

Substantial capital investments – Failure to adopt AI vision broadly stem from expensive deployment requirements which demand substantial financial investments to acquire computer hardware alongside software programs and supporting infrastructure. The implementation of AI vision becomes costly because it requires advanced computational resources that include high-performance GPUs along with specialized AI chips and edge computing devices that are both expensive to acquire. The process of training deep learning models for AI vision demands huge datasets together with cloud-based or on-premise computational power that expands operational expenses. The implementation costs of AI vision systems increase substantially by requiring high-quality cameras with LiDAR sensors and thermal imaging devices particularly in automated vehicle and industrial automation sectors. Businesses will need to spend funds on upgrading their current IT infrastructure which includes real-time data processing and cloud connectivity and cybersecurity maintenance thus increasing total expenses.

Advancements in AI technologies and other technological developments – The present advanced visual data processing capabilities, enabled by deep learning methods and AI algorithms, enhance AI vision capabilities which are much more accurate and efficient in delivering the output. Deep learning convolutional neural networks establish a new state-of-the-art for image recognition, as machines are now enabling the detection of patterns and objects, classifying images with crystal clarity. With Vision transformer and RNNs deep learning systems have advanced AI vision processing on multidimensional ordered data, which aids video analysis and real-time security activities. AI vision systems are getting more accurate thanks to continuous algorithm improvement, while specialized AI hardware and increasing computational capacity make the systems more accessible in all sectors. AI vision will keep being an engine for change as it improves interpretability since deep learning models have grown to be more systematic, and this advancement will diffuse their applications across global industries.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most significant global AI vision market, with a 38% market revenue share in 2024.

Leading AI vision companies based in the area create innovative deep learning algorithms and advanced AI hardware and software solutions at their facilities including Google, NVIDIA, Microsoft, Intel and IBM and Amazon. The region pioneer's AI vision technology because its companies maintain high levels of research and development operations. The U.S. automotive industry maintains dominant status due to the advancements Tesla, Waymo and General Motors implement for autonomous driving technology. The region excels in smart surveillance security through its widespread deployment of defence and law enforcement AI-powered systems that use facial recognition technology and video analytics and threat detection capabilities. Federal authorities across the region have established extensive AI regulations backed by increasing government support through the enactment of national initiatives such as the National AI Initiative Act in the U.S. The startup environment within North America exhibits considerable strength because venture capitalists and tech giants provide generous investments to AI vision startups.

North America Region AI Vision Market Share in 2024 - 38%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The component segment is divided into hardware, software and services. The hardware segment dominated the market, with a market share of around 46% in 2024. The AI vision market relies primarily on hardware because this component serves as an essential structure for analysing video and image data in real time for decision support. High-performance computer equipment including GPUs and FPGAs and TPUs functions as the core processing unit that enables deep learning model operation in AI vision applications that perform tasks such as facial recognition and object detection. The specialized type of processors handles enormous amounts of visual information to speed up AI inference operations while simultaneously boosting accuracy levels. More and more edge computing devices help AI vision systems operate locally with no dependence on cloud infrastructure to deliver enhanced security together with reduced latency. Asset cameras and sensors operate as crucial elements of AI vision hardware because they supply AI models with high-definition image and video data. Hardware serves as the main market growth driver since it needs powerful and specialized equipment to implement software and cloud-based AI vision deployment solutions.

The application segment is divided into object detection & recognition, facial recognition, image classification, video analytics and anomaly detection. The object detection & recognition segment dominated the market, with a market share of around 35% in 2024. The AI vision market leaders for object detection are current industry standards because these applications support diverse industries and help machines see objects accurately. The deep learning algorithms together with the real-time capabilities of AI-driven object detection provide identification and classification of objects through deep learning algorithms. Numerous applications depend on this functional capability that makes it the leading AI vision technology choice. Several AI-powered cameras and drones and robotics systems have been increasingly accepted into practice thus driving object detection and recognition to a stronger position.

The industry vertical segment is divided into automotive, healthcare, manufacturing, retail, and security & surveillance. The automotive segment dominated the market, with a market share of around 37% in 2024. Advanced visual perception technology needs have pushed the automotive industry to become the leading AI vision market sector. Autonomous vehicles operate with AI vision technology as a base element for both autonomous driving and advanced driver-assistance systems (ADAS) for detecting objects in real time and identifying traffic signs and tracking pedestrians along with performing lane detection. Manufacturers of cars and technology businesses dedicate substantial funds to AI-powered vision solutions to improve driving safety while lowering human mistakes and speeding up developments in autonomous vehicle technology. AI vision enables driver monitoring systems to identify cases of driver fatigue or distraction or drowsiness which guarantees heightened safety levels and meets regulatory requirements. Public authorities across the globe are establishing stronger road safety laws which in turn fuels the market need for AI-powered vision systems in vehicles.

The deployment mode segment is divided into edge-based AI vision and cloud-based AI vision. The edge-based AI vision segment dominated the market, with a share of around 58% in 2024. The market leader for AI vision solutions is edge-based technology since it delivers local data processing capabilities which minimizes cloud dependency and delivers speedy reliable security for decisions. The processing capabilities of edge-based AI vision operate independently on edge devices such as cameras, drones, robots and industrial sensors whereas cloud-based AI vision depends heavily on internet connectivity along with high bandwidth to transmit data. Its low latency performance suits applications requiring fast responses because it works efficiently for autonomous vehicles and smart surveillance as well as industrial automation systems. The main reason behind edge AI vision’s success in low-latency mission-critical applications stems from its high efficiency. New edge AI vision solutions protect privacy and data security by processing visual data at location instead of sending it to cloud storage thus satisfying requirements of GDPR and CCPA regulations. Edge-based AI vision establishes itself as the primary market deployment model due to rising customer requirements for time-sensitive yet economical and protected AI vision solutions.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2024 | USD 14 Billion |

| Market size value in 2034 | USD 130.38 Billion |

| CAGR (2025 to 2034) | 25% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Component, Application, Industry Vertical and Deployment Mode |

As per The Brainy Insights, the size of the global AI vision market was valued at USD 14 billion in 2024 to USD 130.38 billion by 2034.

Global AI vision market is growing at a CAGR of 25% during the forecast period 2025-2034.

The market's growth will be influenced by the increasing automation of industries.

Substantial capital investments could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global AI vision market based on below mentioned segments:

Global AI Vision Market by Component:

Global AI Vision Market by Application:

Global AI Vision Market by Industry Vertical:

Global AI Vision Market by Deployment Mode:

Global AI Vision Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date