- +1-315-215-1633

- sales@thebrainyinsights.com

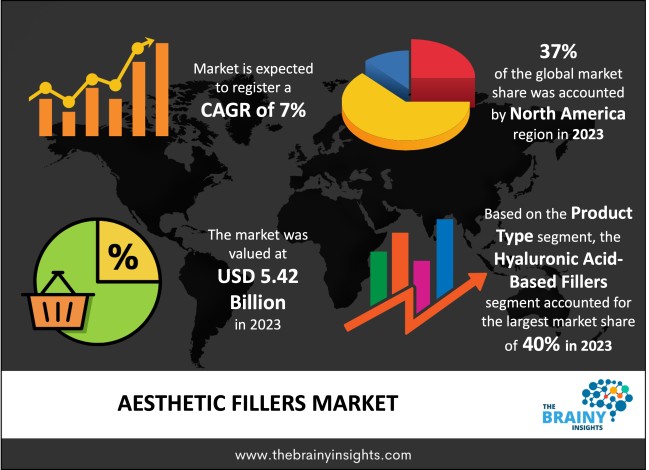

The global aesthetic fillers market was valued at USD 5.42 billion in 2023 and grew at a CAGR of 7% from 2024 to 2033. The market is expected to reach USD 10.66 billion by 2033. The increasing demand for cosmetic procedures due to the rising disposable income will drive the growth of the global aesthetic fillers market.

Aesthetic fillers are substances injected in dermatologic surgery. The main goal of which is the correction of line and wrinkles and volume replacement. These fillers are usually administered for facets of skin aging such as elasticity loss and presence of fine lines or deep wrinkles. The ultimate purpose of the aesthetic fillers is to offer clients an avenue to gain an aesthetic face lift without going through surgical procedures. The major classes of dermal fillers include hyaluronic acid filler, collagen fillers, calcium hydroxylapatite, poly-L-lactic acid and finally autologous fat fillers. Hyaluronic acid fillers, such as Juvederm and Restylane, are the most commonly used because of its natural feel, safety and the ease of reversal. Superficial and moderate lines are treated with calcium hydroxylapatite fillers. Autologous fat grafting means moving fat from a patient’s body and transplanting it to body areas requiring additional fullness. The mentioned fillers are usually administered to treat various regions for instance, cheeks, lips, under eye contours, and obligation furrows. The fillers can also be applied in jawline sculpting; chin enhancement and also the treatment of scars. The procedure takes little time, and it is done in a doctor’s office or clinic using local anaesthesia or a numbing cream. These effects are noticeable in the first few hours, but one may feel them in the first days only.

Get an overview of this study by requesting a free sample

The increasing awareness and acceptance of aesthetic fillers – With the increased adoption of social media, especially, Instagram, YouTube and TikTok, perception about cosmetic surgery has changed. Thanks to influencers, celebrities, and other people, admitting the battle with the bullying, the general population has changed the view on cosmetic procedures for the better. Cosmetic procedures were at one point frowned upon or were believed to be for the elites. Now they are acceptable. Social networks are making cosmetic surgeries socially acceptable. Therefore, more and more people are interested in non-surgical cosmetic treatment such as aesthetic fillers. Furthermore, these platforms give results in real-time together with customer success stories and transformations, all of which help increase the consumers’ trust and reliability of these treatments. Due to societal acceptance and conversations surrounding the aesthetically enhancing procedures, the value of service offerings are more clearly appreciated by consumers. The third factor influencing the popularity of the fillers is increase in gross income, especially in the developing countries. While consumers in developing nations are becoming more financially capable, due to growing economic growth, they are becoming more willing to spend on services that aren’t necessary.

Costs, risks and complications associated with aesthetic fillers – Variations in the cost of the aesthetic filler treatments themselves prove to be high, and a challenge that directly affects the consumer. Filler treatments cost involves factors such as the type of the filler used, the treatment area, and clinic location. Also, several treatments may be needed to sustain the results, which only drives up the general cost in the long run. Consequently, the people with lower incomes or those people who do not lay emphasis on the cosmetic treatments will not be willing to spend the cost incurred in such treatments. This financial factor narrows its market scope. Also, the potential side effects that may occur with aesthetic fillers can also discourage the use of those products. In any case, fillers are recognized as safe, but when utilizing them, they are tied to certain dangers, such as bruising, swelling, infection, or an allergic reaction. In some extreme situations, nonstandard methods of administering medication or using the service of low-skilled personnel results in adverse effects such as vascular occlusion, which compromises tissue integrity. Therefore, costs, risks and complications associated with aesthetic fillers will hamper the market’s growth.

Improvements in aesthetic filler materials and procedures – Increased innovation in the industry has clearly boosted aesthetic filler business through improving safety and effectiveness of the solutions in addition to the general feeling of the treatment procedures. In the course of time, the availability of natural looking and longer lasting aesthetic fillers has augmented the market’s growth. For instance, the creation of hyaluronic acid derivatives that are closer to the natural HA fillers is now a major groundbreaking advancement. These fillers have been praised for being all-natural and delivering the intended goal, which is to improve volumetric density close to the skin’s surface, thus preventing the formation of bumps and unevenness, which defined previous generation fillers. Furthermore, new cross-linking techniques employed in the preparation have enhanced the durability of fillers; some of them last for six months to two years, depending on the area treated and type of filler used. Therefore, advancements in materials and procedures will drive the market’s growth during the forecast period.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America emerged as the most significant global aesthetic fillers market, with a 37% market revenue share in 2023.

North America is the largest market for the aesthetic fillers, mainly attributed to the high customer demand for cosmetic procedures, well established and superior healthcare facilities, and income purchasing power parity. The population of people in the US is predominantly the aging population, which requires solutions for anti-aging, and secondly, more and more young people want to have fine facial features. Growth of the demand for non-surgical cosmetic procedures endorsed with the ubiquity of associated media coverage and celebrity endorsement has greatly enhanced the consumption of the aesthetic fillers in the region. North America owns globally prominent manufacturers and suppliers of the aesthetic fillers also owns well-trained personnel who are capable of producing diverse filler treatments. High levels of regulation in the region to guard the safety and quality of products used in aesthetic filler treatments have also bolstered the confidence in the products. Due to the increased acceptance of cosmetic treatments and higher income per-capita for the region, North America constitutes the largest market for aesthetic fillers.

North America Region Aesthetic Fillers Market Share in 2023 - 37%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The product type segment is divided into hyaluronic acid-based fillers, calcium hydroxylapatite-based fillers, poly-l-lactic acid-based fillers, collagen-based fillers, and autologous fat injections. The hyaluronic acid-based fillers dominated the market, with a market share of around 40% in 2023. Hyaluronic acid-based fillers are the most popular fillers for the treatment of facial wrinkles and other cosmetic concerns owing to their excellent safety profile and natural feel and versatility. They are fillers made of hyaluronic acid, which is a substance naturally occurring in the human body, so such fillers are appropriate for most clients. This natural composition greatly minimizes the predisposition towards allergic reactions or side effects of the filler, thus making Hyaluronic acid fillers the favourite amongst patients and practitioners. This makes hyaluronic acid highly effective in giving the skin natural-looking volume boost as well as hydration to remove wrinkles, improve facial outline and in general give the face a natural lift. Additionally, in the event of an unsatisfactory result or complications these fillers can be dissolved with enzyme hyaluronidase making the procedure a reversible one.

The application segment is divided into facial wrinkles and folds, lip enhancement, cheek augmentation, non-surgical nose job, and under-eye treatment. The facial wrinkles and folds segment dominated the market, with a market share of around 37% in 2023. The increasing geriatric or aging population along with the proliferation of staying young and beautiful beyond a certain age have contributed to the increasing application of aesthetic fillers for correcting facial wrinkles and folds. The body loses collagen elastin and facial fat with time leading to development of wrinkles, folding skin and deep creases around the nasolabial folds, marionette lines and forehead. All these signs are among the most conspicuous and widely considered as indicators of skin aging, hence, increasing the demand for correctly them through cosmetic procedures.

The end user segment is divided into cosmetic clinics, hospitals, and spas and salons. The cosmetic clinics segment dominated the market, with a market share of around 55% in 2023. Cosmetic clinics can be credited with having the greatest market share of the aesthetic fillers market since they are equipped with specialized equipment, devices, skilled personnel, and instruments required to offer cosmetic procedures of several kinds. Practitioners who are experienced make sure that patients get safe and effective filler treatments that need to be suited to individual patients for best outcomes without risks of complications. This level of safety and professionalism is one of the main reasons that many patients decide to undergo this process in cosmetic clinics and not in spas or salons where medical professionals are not always available. Another advantage is the versatility of the cosmetic clinics in a way that there are many kinds of filler products and techniques available, whereby the practitioners can select the most appropriate type of each for the individual patient.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Billion) |

| Market size value in 2023 | USD 5.42 Billion |

| Market size value in 2033 | USD 10.66 Billion |

| CAGR (2024 to 2033) | 7% |

| Historical data | 2020-2022 |

| Base Year | 2023 |

| Forecast | 2024-2033 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Product Type, Application and End User |

As per The Brainy Insights, the size of the global aesthetic fillers market was valued at USD 5.42 billion in 2023 to USD 10.66 billion by 2033.

Global aesthetic fillers market is growing at a CAGR of 7% during the forecast period 2024-2033.

The market's growth will be influenced by the increasing awareness and acceptance of aesthetic fillers.

Costs, risks and complications associated with aesthetic fillers could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. The Brainy Insights has segmented the global aesthetic fillers market based on below mentioned segments:

Global Aesthetic Fillers Market by Product Type:

Global Aesthetic Fillers Market by Application:

Global Aesthetic Fillers Market by End User:

Global Aesthetic Fillers Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date