- +1-315-215-1633

- sales@thebrainyinsights.com

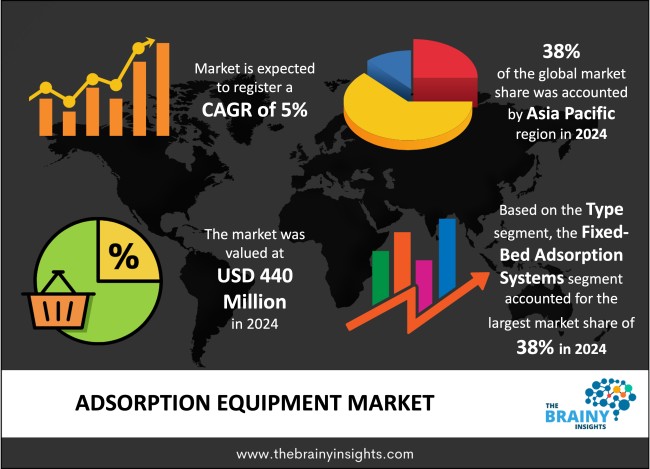

The global adsorption equipment market was valued at USD 440 million in 2024 and grew at a CAGR of 5% from 2025 to 2034. The market is expected to reach USD 716.71 million by 2034. The increasing demand for purification and sanitation across industries will drive the growth of the global adsorption equipment market.

Industrial adsorption systems utilize solid materials to bind unwanted components on their surfaces where the technique is known as adsorption. This equipment finds extensive application in chemical processing facilities as well as environmental protection operations. It also finds applications in pharmaceutical production sites, food manufacturing and water treatment facilities. The base process in adsorption depends on physical or chemical bond-making between the adsorbent substance and the material being eliminated. Industries require adsorption equipment to execute applications including air and gas purification alongside solvent recovery, odour control and water treatment processes. Physical adsorption operates by weak van der Waals forces while chemical adsorption develops strong chemical bonds between the adsorbate and adsorbent. Adsorption equipment works through two operational methods which include fixed-bed and moving-bed systems. Equipment selection for adsorption follows considerations that include contaminant type along with concentration level as well as operating conditions together with prerequisites for purification effectiveness. Advances in adsorption technology through increased usage of improved adsorbents combined with automated controls resulted in better efficiency and reduced costs. The adsorption-based carbon capture technology is presently emerging as industries work towards sustainable emission reduction.

Get an overview of this study by requesting a free sample

Technological advancements in adsorbent materials and equipment – The technological advancement of adsorbent materials and techniques has improved the operational efficiency of adsorption equipment. It has also enhanced the selectivity and cost-effectiveness of adsorption equipment for multiple industries. Metal-organic frameworks (MOFs) and zeolitic imidazolate frameworks (ZIFs) represent a crucial development in adsorbent materials. They offer exceptional high surface area and adjustable pore structures with superior adsorption capabilities compared to activated carbon and silica gel. The innovative materials demonstrate better capabilities to extract pollutants as well as gases and contaminants from water and air. Surface modification of activated carbons and zeolites strengthens their chemistry properties to improve the adsorbates selectivity thus increasing performance efficiency. Multiple components integrated into hybrid adsorbents have proven to boost absorption capacity regardless of environmental conditions. Lightweight graphene-based adsorbents together with carbon nanotubes show great promise in adsorption applications because they offer quick adsorption speed and efficient regeneration properties. Smart monitoring systems and AI-driven adsorption technologies create real-time monitoring abilities. They also enable predictive maintenance and process optimization through AI-powered methods that reduce operational downtime and enhance operational efficiency. The continuous development of adsorbent materials and related technologies encourages industry-wide adoption of adsorption equipment thereby establishing this solution as a vital tool for environmental sustainability as well as industrial purification and resource recovery.

High costs of adsorption equipment – Large financial expenses together with maintenance costs of adsorption equipment make its wider implementation challenging especially for small and medium-sized businesses. The initial investment requires substantial budget for equipment procurement together with infrastructure upgrades. The installation costs are also high. Advanced adsorption systems using state-of-the-art technologies, materials and procedures need elaborate designs with automated control systems which increases the initial investment cost. High-performance adsorbents cost significant amounts because their specialized formulations for particular applications require more expense. Operational costs exceed initial expenses because adsorbent regeneration remains costly and so does energy consumption. The thermal regeneration method in adsorption systems demands substantial energy usage because it results in elevated operational costs throughout the long term. The degradation process of adsorbents depletes their operational effectiveness until industry operators need to either replace or regenerate them to maintain system performance while increasing maintenance expenses. adsorption technology maintains high financial costs as a barrier even with new energy-effective regeneration methods and automated systems because of its effects on budget restrictions in small-scale and low-income production sectors

Stringent environmental regulations – Worldwide environmental regulations function as the main reason why industries use adsorption equipment at growing rates. Relevant authorities worldwide are implementing strong laws that regulate industrial emissions as well as wastewater disposal and air quality. these regulations require manufacturing industries to lower their release of hazardous air pollutants (HAPs) and volatile organic compounds (VOCs), thereby encouraging manufacturers to turn towards adsorption-based air purification solutions in increasing numbers. Industries are compelled to use adsorption-based filtration systems for wastewater treatment given the stringent regulations and guidelines. Industrial applications in the oil and gas sector now require desulfurization and carbon capture technologies which have prompted extensive utilization of adsorption systems for these purposes. Industries dealing with hazardous chemicals operate under strict environmental regulations with high penalties and other repercussions making it mandatory for them utilize adsorption equipment to minimize waste output. Net-zero emissions targets and sustainability commitment goals from across the world established new environmental regulations which push industries toward adopting improved adsorption technologies for regulatory compliance.

The regions analyzed for the market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. Asia Pacific emerged as the most significant global adsorption equipment market, with a 38% market revenue share in 2024.

The industries of chemical processing, petrochemicals, pharmaceuticals and electronics have established major manufacturing bases throughout China, India, Japan, and South Korea for their need of adsorption systems. Rising industrial growth in this region has generated increased emissions of VOCs combined with HAPs and greenhouse gases which need advanced adsorption technologies to meet market demand. China operates as the world’s largest industrial economy through environmental policies including the Blue-Sky Protection Plan that requires manufacturers and petrochemical operators to implement air pollution control systems. Increased customer demand for indoor air purifiers in commercial and residential settings because of population expansion and urban development combined with rising health priorities drives adsorption equipment sales growth. The market expands due to strong local manufacturer presence together with government support for sustainable technologies.

Asia Pacific Region Adsorption Equipment Market Share in 2024 - 38%

www.thebrainyinsights.com

Check the geographical analysis of this market by requesting a free sample

The type segment is divided into Fixed-bed Adsorption Systems, Moving-bed Adsorption Systems, Fluidized-bed Adsorption Systems, Pressure Swing Adsorption (PSA) Systems and Thermal Swing Adsorption (TSA) Systems. The Fixed-bed Adsorption Systems segment dominated the market, with a market share of around 38% in 2024. The system functions with an immobile bed containing activated carbon or zeolites to capture or adsorb contaminants that pass through the system. Processed materials can bond with the adsorbent surfaces to eliminate contaminants that exist in industrial emissions as well as wastewater and process streams. These units serve industries optimally because of their strong construction along with simple setup procedures which allow continuous reliable purification. The chemical manufacturing sector together with pharmaceutical industries and petrochemicals depend on fixed-bed systems to fulfil their obligations under strict environmental standards. These systems facilitate solvent recovery operations throughout industries so companies can recycle their valuable solvents which achieves cost reduction and emission minimization. The fixed-bed design outperforms other adsorption methods because it has minimal operational expenses and requires little maintenance since it does not contain complicated parts and avoids regular regeneration procedures. Industrial adoption of fixed-bed systems exceeds PSA and TSA systems because they integrate scalability and versatility for wide industrial applications despite their limitations in specific gas separation needs.

The adsorbent material segment is divided into activated carbon, zeolites, silica gel, polymeric adsorbents and metal-organic frameworks (MOFs). The activated carbon segment dominated the market, with a market share of around 37% in 2024. The global adsorption equipment market adopts activated carbon as its dominant material because it provides high surface area to volume ratio alongside exceptional adsorption capacity and cost-effective performance as well as its broad applicability. The removal of volatile organic compounds (VOCs) together with heavy metals and toxic gases and odours makes activated carbon an essential tool in various applications such as air purification and water treatment and solvent recovery and gas separation. Activated carbon maintains its dominance in the market through its effective adsorption processes at both low and high concentration levels because of its high porous structure. The chemical manufacturing sector together with pharmaceuticals and food & beverage operations and oil & gas plants select activated carbon because of its affordable regeneration costs and extended service capabilities when compared to zeolites and silica gel. Activated carbon functions as a premiere component in fixed-bed adsorption systems to eliminate VOC pollutants thus serving as an important tool in pollution control measures within air purification operations. The removal of organic contaminants along with chlorine and heavy metals in water treatment depends on activated carbon as the key method to meet stringent environmental regulations. Activated carbon shows proven performance and cost advantages as well as extensive availability across the market.

The application segment is divided into air purification, water & wastewater treatment, solvent recovery, gas separation & drying and chemical purification. The air purification segment dominated the market, with a market share of around 36% in 2024. Different industrial sectors face regulatory constraints to decrease their VOC emissions as well as hazardous air pollutants and toxic gases. Global environmental agencies have established strict air quality standards thereby forcing industries to select advanced air purification methods. Commercial structures and healthcare buildings together with residential spaces now require indoor air purification solutions because people fear about airborne pollutants along with allergens and microbial contaminants. The market demand for HVAC filtration systems as well as portable air purifiers with adsorption technology has strengthened the leading position of this segment. The largest segment of adsorption equipment usage exists in air purification due to its vital role in environmental protection, workplace safety and public health. The dominance of air purification in the adsorption equipment market derives from both mandatory regulatory standards and industrial requirements and increasing public health priorities.

The end-use industry segment is divided into chemical & petrochemical industry, food & beverage, pharmaceuticals, oil & gas, automotive and semiconductor & electronics. The chemical & petrochemical industry segment dominated the market, with a share of around 35% in 2024. The chemical and petrochemical industry controls the global adsorption equipment market because its operations greatly rely on adsorption technology for various applications including air purification, gas separation, solvent recovery and wastewater treatment. Advanced adsorption systems became essential in the industry which produces harmful organic compounds, hazardous air pollutants and toxic byproducts to meet environmental requirements. Hazardous air pollutants as well as toxic byproducts require strict environmental regulations enforced by relevant regulatory bodies which push companies to invest in adsorption-based pollution control solutions. Industrial demand for adsorption equipment has escalated with the fast-growing trends in petrochemical refineries as well as specialty chemical production operations and plastic manufacturing sectors. Market dominance in the industry is strengthened by its massive processing capabilities together with ongoing sustainability programs. The chemical and petrochemical sector leads as the primary end-user segment for adsorption technology due to its massive pollutant loads and regulatory requirements as well as economic advantages that traditional chemicals plants enjoy from applying this method.

| Attribute | Description |

|---|---|

| Market Size | Revenue (USD Million) |

| Market size value in 2024 | USD 440 Million |

| Market size value in 2034 | USD 716.71 Million |

| CAGR (2025 to 2034) | 5% |

| Historical data | 2021-2023 |

| Base Year | 2024 |

| Forecast | 2025-2034 |

| Region | The regions analyzed for the market are Asia Pacific, Europe, South America, North America, and Middle East and Africa. Furthermore, the regions are further analyzed at the country level. |

| Segments | Type, Adsorbent Material, Application and End-Use Industry |

As per The Brainy Insights, the size of the global adsorption equipment market was valued at USD 440 million in 2024 to USD 716.71 million by 2034.

Global adsorption equipment market is growing at a CAGR of 5% during the forecast period 2025-2034.

The market's growth will be influenced by technological advancements in adsorbent materials and equipment.

High costs of adsorption equipment could hamper the market growth.

This study forecasts revenue at global, regional, and country levels from 2021 to 2034. The Brainy Insights has segmented the global adsorption equipment market based on below mentioned segments:

Global Adsorption Equipment Market by Type:

Global Adsorption Equipment Market by Adsorbent Material:

Global Adsorption Equipment Market by Application:

Global Adsorption Equipment Market by End-Use Industry:

Global Adsorption Equipment Market by Region:

Research has its special purpose to undertake marketing efficiently. In this competitive scenario, businesses need information across all industry verticals; the information about customer wants, market demand, competition, industry trends, distribution channels etc. This information needs to be updated regularly because businesses operate in a dynamic environment. Our organization, The Brainy Insights incorporates scientific and systematic research procedures in order to get proper market insights and industry analysis for overall business success. The analysis consists of studying the market from a miniscule level wherein we implement statistical tools which helps us in examining the data with accuracy and precision.

Our research reports feature both; quantitative and qualitative aspects for any market. Qualitative information for any market research process are fundamental because they reveal the customer needs and wants, usage and consumption for any product/service related to a specific industry. This in turn aids the marketers/investors in knowing certain perceptions of the customers. Qualitative research can enlighten about the different product concepts and designs along with unique service offering that in turn, helps define marketing problems and generate opportunities. On the other hand, quantitative research engages with the data collection process through interviews, e-mail interactions, surveys and pilot studies. Quantitative aspects for the market research are useful to validate the hypotheses generated during qualitative research method, explore empirical patterns in the data with the help of statistical tools, and finally make the market estimations.

The Brainy Insights offers comprehensive research and analysis, based on a wide assortment of factual insights gained through interviews with CXOs and global experts and secondary data from reliable sources. Our analysts and industry specialist assume vital roles in building up statistical tools and analysis models, which are used to analyse the data and arrive at accurate insights with exceedingly informative research discoveries. The data provided by our organization have proven precious to a diverse range of companies, facilitating them to address issues such as determining which products/services are the most appealing, whether or not customers use the product in the manner anticipated, the purchasing intentions of the market and many others.

Our research methodology encompasses an idyllic combination of primary and secondary initiatives. Key phases involved in this process are listed below:

The phase involves the gathering and collecting of market data and its related information with the help of different sources & research procedures.

The data procurement stage involves in data gathering and collecting through various data sources.

This stage involves in extensive research. These data sources includes:

Purchased Database: Purchased databases play a crucial role in estimating the market sizes irrespective of the domain. Our purchased database includes:

Primary Research: The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. Primary research mainly involves in telephonic interviews, E-mail interactions and face-to-face interviews with the raw material providers, manufacturers/producers, distributors, & independent consultants. The interviews that we conduct provides valuable data on market size and industry growth trends prevailing in the market. Our organization also conducts surveys with the various industry experts in order to gain overall insights of the industry/market. For instance, in healthcare industry we conduct surveys with the pharmacists, doctors, surgeons and nurses in order to gain insights and key information of a medical product/device/equipment which the customers are going to usage. Surveys are conducted in the form of questionnaire designed by our own analyst team. Surveys plays an important role in primary research because surveys helps us to identify the key target audiences of the market. Additionally, surveys helps to identify the key target audience engaged with the market. Our survey team conducts the survey by targeting the key audience, thus gaining insights from them. Based on the perspectives of the customers, this information is utilized to formulate market strategies. Moreover, market surveys helps us to understand the current competitive situation of the industry. To be precise, our survey process typically involve with the 360 analysis of the market. This analytical process begins by identifying the prospective customers for a product or service related to the market/industry to obtain data on how a product/service could fit into customers’ lives.

Secondary Research: The secondary data sources includes information published by the on-profit organizations such as World bank, WHO, company fillings, investor presentations, annual reports, national government documents, statistical databases, blogs, articles, white papers and others. From the annual report, we analyse a company’s revenue to understand the key segment and market share of that organization in a particular region. We analyse the company websites and adopt the product mapping technique which is important for deriving the segment revenue. In the product mapping method, we select and categorize the products offered by the companies catering to domain specific market, deduce the product revenue for each of the companies so as to get overall estimation of the market size. We also source data and analyses trends based on information received from supply side and demand side intermediaries in the value chain. The supply side denotes the data gathered from supplier, distributor, wholesaler and the demand side illustrates the data gathered from the end customers for respective market domain.

The supply side for a domain specific market is analysed by:

The demand side for the market is estimated through:

In-house Library: Apart from these third-party sources, we have our in-house library of qualitative and quantitative information. Our in-house database includes market data for various industry and domains. These data are updated on regular basis as per the changing market scenario. Our library includes, historic databases, internal audit reports and archives.

Sometimes there are instances where there is no metadata or raw data available for any domain specific market. For those cases, we use our expertise to forecast and estimate the market size in order to generate comprehensive data sets. Our analyst team adopt a robust research technique in order to produce the estimates:

Data Synthesis: This stage involves the analysis & mapping of all the information obtained from the previous step. It also involves in scrutinizing the data for any discrepancy observed while data gathering related to the market. The data is collected with consideration to the heterogeneity of sources. Robust scientific techniques are in place for synthesizing disparate data sets and provide the essential contextual information that can orient market strategies. The Brainy Insights has extensive experience in data synthesis where the data passes through various stages:

Market Deduction & Formulation: The final stage comprises of assigning data points at appropriate market spaces so as to deduce feasible conclusions. Analyst perspective & subject matter expert based holistic form of market sizing coupled with industry analysis also plays a crucial role in this stage.

This stage involves in finalization of the market size and numbers that we have collected from data integration step. With data interpolation, it is made sure that there is no gap in the market data. Successful trend analysis is done by our analysts using extrapolation techniques, which provide the best possible forecasts for the market.

Data Validation & Market Feedback: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helps us finalize data-points to be used for final calculations.

The Brainy Insights interacts with leading companies and experts of the concerned domain to develop the analyst team’s market understanding and expertise. It improves and substantiates every single data presented in the market reports. The data validation interview and discussion panels are typically composed of the most experienced industry members. The participants include, however, are not limited to:

Moreover, we always validate our data and findings through primary respondents from all the major regions we are working on.

Free Customization

Fortune 500 Clients

Free Yearly Update On Purchase Of Multi/Corporate License

Companies Served Till Date